Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : October 28, 2023

Global Market News

Global equities tumble

Global equities tumbled this week amid mixed earnings news. The Dow Jones and S&P 500 lost 2.14% and 2.53%, respectively, while the Nasdaq dropped 2.62%. The US 10-year Treasury reached a 16-year high of 5.01% on Monday but ended the week at 4.83%. The price of a barrel of West Texas Intermediate crude receded to $85.21, down 3.99% on the week. Volatility, as measured by the CBOE Volatility Index, closed the week at 21.27.

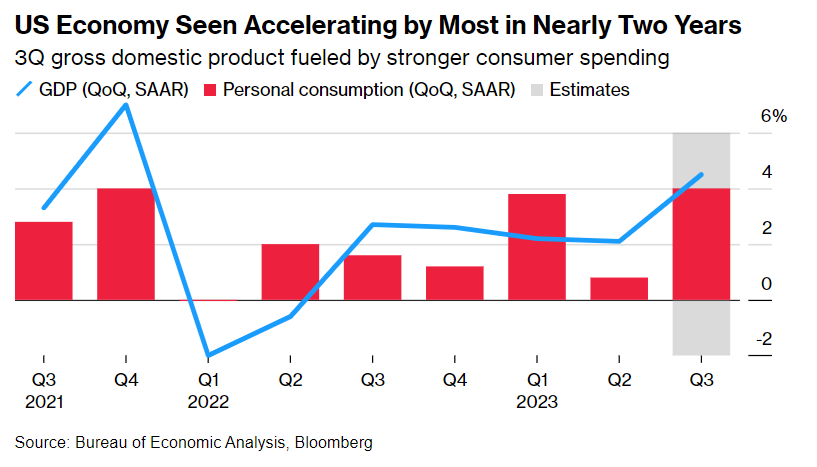

US GDP figures for Q3 surprise

US GDP grew at a 4.9% annualized rate in the third quarter, beating previous estimates of 4.7%. This was mainly due to continued strong consumer spending (which made up 68% of GDP in Q3), increased inventories, exports, residential investment, and government spending. The strong growth still frustrates the Federal Reserve, which is trying to clamp down on inflation above the 2% target, but traders are still pricing in no further interest rate hikes. Despite many economists having earlier predicted the economy being in a recession at this point, the strength of the American consumer has kept it chugging along smoothly. Experts still expect growth to slow in the coming months.

International Developments

Israel-Hamas Conflict Updates

The conflict between Israel and Hamas continues to escalate as Israel prepares to ratchet up a ground invasion, the US manages threats from Iranian-linked militia groups, and the humanitarian situation deteriorates. For Israel’s part, the country briefly entered Gaza in tanks, before returning its forces back into Israel. The country is reportedly preparing to expand its operations. As for the US, it has retaliated against Iranian-linked groups in eastern Syria by targeting two facilities in response to attacks that took place earlier this week against US military personnel. Finally, conditions for Palestinians on the ground in Gaza continue to worsen, while only limited supplies of food, water, and medicine have trickled into the embattled region. Diplomatic efforts for a ceasefire or humanitarian pause are ongoing, with no UN Security Council consensus having yet been achieved.

Surprise Peronist win in first round in Argentina shakes markets

Argentina’s Peronist candidate Sergio Massa (36.6%), the Economy Minister of the ruling Peronist coalition, narrowly won a plurality of votes in Argentina’s first round of voting for the presidency, setting up a head-to-head between him and the upstart “anarcho-capitalist” Javier Milei (30%) in the second round of voting for the presidency. The victory came as a surprise after the Paso elections saw Milei victories and has thrown the future of the country into greater uncertainty. Financial markets reacted negatively to the news, with financial stocks opening lower and trimming losses. Since her defeat, center-right Patricia Bullrich (23.8%) has endorsed Javier Milei.

US Social & Political Developments

Republican-led House elects its second Speaker

The House of Representatives has elected a new speaker, Representative Mike Johnson of Louisiana. Speaker Johnson is considered a Trump ally and a key figure in the 2020 efforts to overturn the results of the election of current President Joe Biden. Expectations are that Republican hardliners will give him additional leeway on supporting a resolution to keep the government funded. However, Johnson has already come out in support of separating funding for Ukraine and Israel amid concern over Republican support for Ukraine aid, while simultaneously signaling aid for an additional Ukraine package.

Chinese foreign minister headed to Washington

Chinese Foreign Minister Wang Yi arrived in Washington on Thursday for talks to stabilize the bilateral relationship. While there are currently no expectations that the talks will lead to a breakthrough of any sort, the fact that the meeting is taking place at all is being considered progress. Wang is expected to come with an agenda aimed at persuading the US to loosen restrictions on technology exports and roll back support for Taiwan. Meanwhile, the US seeks to bring China onside over the conflict in Israel and Gaza, while seeking Chinese support in pressing Iran to refrain from intervening in the conflict.

Corporate/Sector News

Chevron buys Hess, Roche buys Telavant from Roivant and Pfizer

Energy giant Chevron is buying Hess Corp. for $53 billion after over a year of mostly elevated oil prices from geopolitical shocks that have made big oil cash-flush. It is yet another example of consolidation in the oil industry, with the Exxon Mobil annoucnement to acquire Pioneer Natural Resources at $60 billion still being the largest deal so far this year. In other deal news, Swiss pharmaceutical firm Roche announced that it would buy Telavant Holdings from its owners, Roivant Sciences and Pfizer, for $7.1 billion. Telavant is currently developing a drug to treat inflammatory bowel disease, and was jointly formed by Roivant and Pfizer last year.

China launches probe into Foxconn

Chinese state media announced that state regulators are investigating Foxconn, a Taiwanese company that manufactures the majority of iPhones in factories in mainland China. Beijing claims that the probe is part of normal law enforcement, but hinted that firms operating out of Taiwan should promote “peaceful development of cross-strait ties,” a phrase which may refer to Foxconn’s founder Terry Gou, who resigned from the company’s board in September to campaign for Taiwan’s upcoming presidential election. Foxconn has said it will cooperate with authorities.

Tech earnings disappoint market

Big Tech reported their earnings this week, disappointing investors and kicking off a slide in market value that erased $386 billion from their collective market cap. The firms, which are also referred to as the ‘Magnificent Seven’ (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla), have outsized influence on the S&P 500, and the fall in these stocks has concerned traders. The hype around artificial intelligence (AI), which saw the Seven’s stock prices shoot up earlier this year, seems to have been somewhat offset by high-interest rates and conflict in the Middle East. The S&P 500 has fallen 9.8% since its 2023 peak.

Recommended Reads

Israel’s prime minister and its army are damagingly divided

Strongest US Economic Growth Since 2021 Puts Fed in Tough Spot

Net outflow of funds from China hits 7-year high in September

New Normal or No Normal? How Economists Got It Wrong for 3 Years.

Argentina’s economy minister Sergio Massa seeks broad coalition after first-round election win

This week from BlackSummit

The BlackSummit Team

The BlackSummit Team

Image of the Week

Video of the Week

How America’s EV Ambitions Could Affect the Future of the UAW

Source: Wall Street Journal