Global Market News

Global equities unchanged

Global equities were relatively unchanged on the week, dropping only slightly. The S&P 500 and Dow Jones closed down 0.10% and 0.23%, respectively, while the Nasdaq declined 0.42%. The US 10-year Treasury yield rose a few basis points to end the week at 3.57%. The price of a barrel of West Texas Intermediate crude oil dropped more than 5% to end the week at $77.76. Volatility, as measured by the CBOE Volatility Index, continued to decline, closing Friday at 16.77.

China’s economy is recovering

China reported stronger-than-expected economic data this week, stating an economic growth rate of 4.5% for the first quarter of 2023. The growth rate puts the country on track to achieve its target of 5% or more for 2023. Despite China’s much delayed opening following the Covid-19 pandemic, consumption is strong, with retail sales rising 10% year-over-year. However, a sustained recovery will be dependent on propping up its failing real estate sector, addressing its unemployment rate, and restoring confidence in the private sector.

International Developments

Fighting breaks out in Sudan

Violence erupted in Sudan’s capital, Khartoum, between the country’s military and the revolting Rapid Support Forces. As of Friday afternoon, at least 330 people have been killed. The fighting has threatened yet another humanitarian crisis, forcing 20 hospitals to close and leaving thousands of wounded struggling to find healthcare. Around 10,000 to 20,000 refugees have fled to neighboring Chad in the past few days. The outbreak of conflict has drawn international attention, particularly given what happens politically in Sudan historically has had a ripple effect on the region.

India and Russia discuss free trade agreement

New Delhi and Moscow are discussing a free trade agreement (FTA) that would deepen the increasing commercial ties between the two countries since the outbreak of the Ukraine war. Russia, which is India’s largest supplier of military hardware, recently topped Iraq this year to become India’s largest supplier of crude oil. This is one of Moscow’s latest efforts to circumvent Western-led sanctions, while India continues to promote its “unaligned” status.

US Social & Political Developments

Speaker McCarthy discusses next steps for debt ceiling

In an address at the NYSE, Speaker McCarthy has called on Democrats to cut federal spending in exchange for raising the debt ceiling. The debt ceiling is the limit the federal government can borrow against and will need to be raised, or else a default will occur, causing significant harm to the US economy. The House Speaker is proposing a one-year extension on the debt ceiling in exchange for a discussion on spending cuts in the budget. McCarthy has said that Medicare and Social Security are off the table. Nonetheless, the White House has accused House Republican leadership of failing to detail budget request cuts and is pushing back on the proposed 1% cap on spending growth.

Biden hosts Colombian president

President Joe Biden hosted Colombian President Gustavo Petro on Thursday at the White House. The visit comes amidst a backdrop of widening disagreements over US drug and Venezuela policies. President Petro has recently come out sharply against US-led efforts to prohibit cocaine and called for US sanctions levied against the Maduro regime in Venezuela to be lifted. The talks included those topics, while affirming broader cooperation in areas of policy alignment, such as on climate change, migration, and energy.

Corporate/Sector News

Automakers scramble for battery materials

As American automakers prepare to forge ahead on electric vehicles, they will require a steady and reliable supply of the critical minerals needed to produce batteries. Ford confirmed its plans to invest $3.5 billion in a lithium iron phosphate battery plant with the support of Chinese battery giant CATL, and General Motors is seeking a partner for its latest battery factory. Meanwhile, the US just signed a deal with Japan for minerals necessary for EV batteries. The EV race is not only transforming the auto sector, but it is also reshaping the global minerals trade.

EU reaches deal on chip subsidies

The European parliament and member states have reached a deal on boosting the supply of semiconductors in Europe as European countries seek to reduce dependence on semiconductor production in Asia. Semiconductor production is currently dominated by Taiwan and China. The subsidies seek to stimulate local manufacturing of chips to enhance European competitiveness in the semiconductor market, which will need to quadruple production in order to meet its target production goal.

WHO launches vaccine hub in Cape Town

The World Health Organization (WHO) launched an mRNA vaccine technology hub in Cape Town on the 20th of April. The organization aims for the hub to encompass the entire vaccine supply chain, from research to manufacturing and licensing, and is poised to assist low- and middle-income countries end their reliance on the developed world for their vaccine needs. The hub seeks to offer equitable access to COVID-19, malaria, and HIV/AIDs vaccines. The initiative is a partnership between the public and private sectors, including Biovac, Afrigen, and the South African Medical Research Council (SAMRC).

Recommended Reads

Mariupol, a chronicle of martyrdom

Slovakia joins Poland and Hungary in halting Ukraine grain imports

The world’s deadliest war last year wasn’t in Ukraine

How to survive a superpower split

The electric grid is about to be transformed

This week from BlackSummit

Canceling the Noise, Not by Bread Alone: Part XXII

John E. Charalambakis

The BlackSummit Team

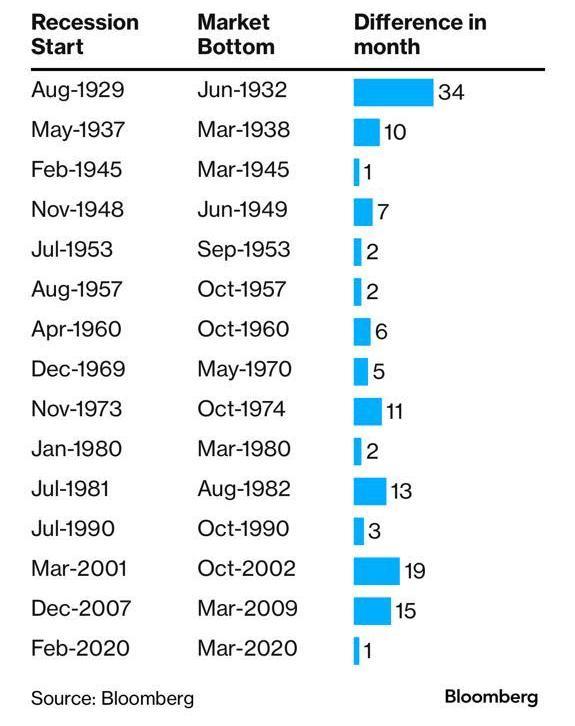

Image of the Week

Video of the Week

Europe and the US look to boost their lithium independence

Source: Financial Times