Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : March 30, 2019

Market Action

Global equities rose on the week as interest rates rebounded from their recent lows in developed markets. The yield on the US 10-year Treasury note fell to 2.40% from 2.44% a week ago having fallen as low as 2.35% on Wednesday. The price of a barrel of West Texas Intermediate Crude oil rose $1.50 to $60 while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 14 from 16.8 a week ago.

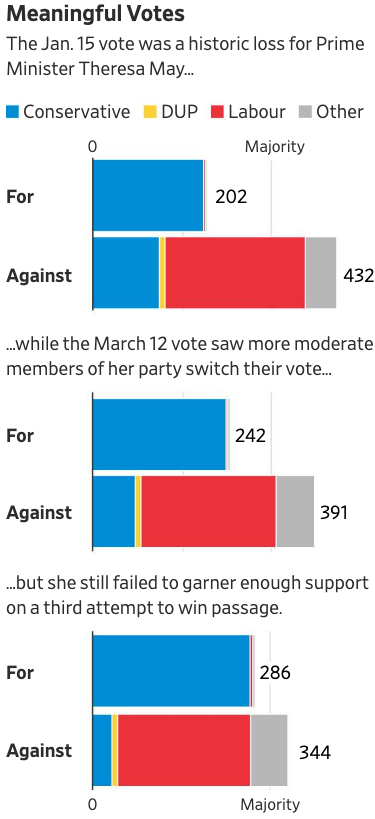

On the day long set for Britain to leave the European Union, Parliament on Friday rejected Prime Minister Theresa May’s Brexit deal for a third time, leaving the country no closer to an exit plan after more than two years of bitter wrangling. With Friday’s rejection of the deal Mrs. May negotiated with the EU for Britain’s orderly departure, Brexit outcomes that once seemed radical become more likely. These include another referendum to revoke the exit altogether, a general election or a sudden breakaway from the EU. As things stand, the UK will leave the bloc on April 12 without any agreement. It is also possible that the government may ask the EU to postpone Brexit again to avoid the expected widespread disruption arising from severing current trading arrangements with the UK’s closest trading partner. Against this unsettled backdrop, the EU announced earlier this week that it had completed preparations for a no-deal Brexit scenario.

US officials reported progress in all areas under discussion in trade talks with their Chinese counterparts this week in Beijing. Movement on forced technology transfer was termed “unprecedented,” but sticking points remain in the areas of intellectual property and enforcement. Separately, China’s premier, Li Keqiang, said the country will sharply expand market access for foreign banks, securities and insurance firms. Regarding tariffs, economic adviser Larry Kudlow said some but not all China levies may stay in place if a trade deal is struck as part of an enforcement mechanism. Another round of talks is scheduled for next week in Washington.

Venezuelan opposition leader Juan Guaido has been banned from holding public office for 15 years, the maximum punishment allowable by law, state comptroller Elvis Amoroso said on Thursday. Amoroso said Guaido, the head of the opposition-controlled National Assembly who invoked the constitution to assume an interim presidency in January, had inconsistencies in his personal financial disclosures and a spending record that did not match his level of income. Guaido has been recognized as Venezuela’s legitimate interim president by more than 50 countries, including the United States.

China’s industrial firms posted their worst slump in profits since late 2011 in the first two months of this year, falling 14% Y/Y to 708B yuan ($106B), according to the National Bureau of Statistics. Beijing has already propped up the manufacturing industry by cutting the value-added tax, increasing infrastructure spending and reducing direct government intervention, but more support measures may now be on the horizon.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

Ukrainians go to the polls this weekend to vote in a presidential election with the result far from certain. Russia will be keeping a close eye on the result to see how pro-western – or anti-Russian – Ukraine’s next leader might be. It is the first national vote since Russia annexed Crimea in early 2014 and subsequently supported an uprising by pro-Russian separatists in east Ukraine. In the closing days of campaigning before a first round of voting takes place on Sunday, actor and comedian Volodymyr Zelensky leads public opinion polls ahead of rivals Yulia Tymoshenko and incumbent Petro Poroshenko. If none of the candidates get more than 50% of the votes in the first round Sunday, then a runoff will be held on April 21.

Turkey’s voters head to the polls on Sunday amid new, widespread worries about their currency, and with much at stake for investors in the country. Investor fears have roiled Turkey’s lira over the past week in response to news that the Turkish Central Bank had burned through nearly a third of its foreign reserves in the first three weeks of March as it tried to prop up the currency and stifle short-sellers ahead of the vote. Many investors are recalling Turkey’s currency crash last summer, which triggered a sell-off in emerging markets. This Sunday’s election results could determine the fate of monetary policy and the stability of markets in Turkey and beyond.

The United States-Mexico-Canada Agreement, the trade pact negotiated last year to replace the North American Free Trade Agreement, is running into opposition on Capitol Hill, with Senate Finance Committee chairman Charles Grassley insisting that that the administration of President Donald Trump lift aluminum and steel tariffs imposed on Canada and Mexico as a precondition for the pact receiving a vote. US Trade Representative Robert Lighthizer has refused to lift the levies until Canada and Mexico accept quotas on their metals exports in an effort to keep Chinese steel from being re-exported to the US from the two countries, who also insist that the tariffs need to be lifted before the agreement can be ratified.

This Week from BlackSummit

Brexit and the Grim Picture Unfolding in the Midst of Rising Risks: The Berthe Morisot Dimension

John E. Charalambakis

Listen on the go! Subscribe to the podcast Market Commentary with BlackSummit on iTunes, Android, Google Play, Stitcher, Spotify or TuneIn.

Recommended Reads

How to Save the State Department

China’s Italian advance threatens EU unity – Nikkei Asian Review

Jair Bolsonaro’s Southern Strategy | The New Yorker

Venezuela’s Economic Collapse Explained in Nine Charts – WSJ

Why the United States Needs a New Containment Policy

Video of the Week

How China is rebuilding centuries-old trade routes into Italy