This Friday, March 29th, was supposed to be the day of Brexit. The earliest possible date for Brexit has now been pushed back to April 12th. Over the course of the next few days as many as seven options may be put to test in the British Parliament, namely:

– PM May’s deal

– The PM’s deal in addition to a customs union (free trade area with a common external tariff but without free movement of labor and/or capital) with the EU

The PM’s deal in addition to a customs union and a single market access where British firms will enjoy access to the EU’s internal market but under EU laws, rules, and regulatory regime

– Revoking Article 50 and thus cancelling Brexit

– Hard Brexit — i.e., exit from the EU without a deal

– Another referendum based on the deal/majority to emerge from the Parliamentary debates (see below)

– A free trade Agreement in the Norwegian or Canadian style a.k.a. EFTA (European Free Trade Association), originally envisioned by PM Harold Macmillan in 1959. Under the EFTA, nations such as Norway, Switzerland, and Iceland enjoy access to the single market but without access to a customs union or the decision-making process, and are still subject to EU laws/rules/regulations including the free movement of people (the latter two issues could be red flags for hard Brexiteers)

Brexiteers shot for the stars hoping to land on the moon. Once they won the Brexit vote, they understood that they lived in a fantasy world where they did not even have a rocket to get out of the stratosphere. They created a mess and have no idea how to resolve it. The contemplated amendments/scenarios outlined above (such as the ones involving a customs union with or without a single market access) could be rejected by the EU.

The unfolding picture has become grim and bleak. It reminds me of Berthe Morisot’s paintings. (An exhibition of her works is currently in Dallas.) Morisot is considered one of the leaders of French Impressionism but unfortunately her work is not as well-known as the works by Monet, Renoir, Degas and Manet (her brother-in-law), despite the fact that she was regarded as highly as them. In the midst of the Paris Siege (1870-71) – when Prussian bombing had reduced her studio to rubbles and Parisians ate squirrels in order to survive – Morisot’s paintings exemplified (and still do) life’s evanescence which fades along with its ephemeral, fleeing, and impermanent accomplishments. The triumph of the Brexit vote cannot be compared to the pain that millions could endure or to the permanency of the politics of incompetency that has been reverberating around the globe since the beginning of the century with very few exceptions.

What could happen to the hundreds of millions of derivative financial contracts? What would happen to contractual agreements and bonds under British law? How about the counter-party risks encapsulated into contractual obligations? What are the risks and uncertainties for EU banks and their US counterparties?

Here is a scenario of what may unfold or what should unfold in order to have as smooth of a landing as possible given the tumorous situation: In a series of debates over a number of amendments as outlined above, the MPs will test to see if a majority could be found for a different Brexit model. Once that majority is identified and the vote is in, a referendum could take place asking the people to back it as the best possible option for Brexit’s implementation, given that the first referendum failed miserably to capture the complexities of the Brexit vote. After all, in a democracy voters are entitled to change their minds, especially when the facts have changed. Doing otherwise may simply be treasonous, given that people may not desire the new relationship with the EU and would rather stay with the existing one.

As Congress contemplates the findings of the Mueller Report – at a time when other jurisdictions and the Congress may be preparing for new investigations and indictments – the rising tide of risks accumulate and we only hope that it won’t become a wave of uncertainty.

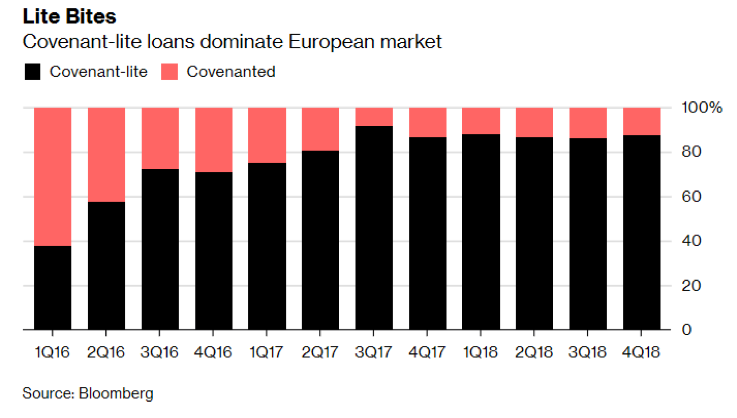

As we wrote in last week’s commentary, risky companies have too much debt on their books and the fact that more debt is extended to them makes them even more vulnerable to shocks. Financial stability is undermined by covenant-lite loans as shown below.

The central banks’ fear of economic slowdown may increase the appetite for covenant-lite loans which already represent more than 80% of European leveraged loans from less than 40% just three years ago.

The central banks’ fear of economic slowdown may increase the appetite for covenant-lite loans which already represent more than 80% of European leveraged loans from less than 40% just three years ago.

We continue to encourage a more cautious approach to asset allocation. The markets may have started digesting that growth, and earnings (the fundamentals) may have the permanence lacking in the evanescence of temporal accomplishments. The view of Paris fades away from the Trocadero like in Morisot’s painting.

Brexit and the Grim Picture Unfolding in the Midst of Rising Risks: The Berthe Morisot Dimension

Author : John E. Charalambakis

Date : March 25, 2019

This Friday, March 29th, was supposed to be the day of Brexit. The earliest possible date for Brexit has now been pushed back to April 12th. Over the course of the next few days as many as seven options may be put to test in the British Parliament, namely:

– PM May’s deal

– The PM’s deal in addition to a customs union (free trade area with a common external tariff but without free movement of labor and/or capital) with the EU

The PM’s deal in addition to a customs union and a single market access where British firms will enjoy access to the EU’s internal market but under EU laws, rules, and regulatory regime

– Revoking Article 50 and thus cancelling Brexit

– Hard Brexit — i.e., exit from the EU without a deal

– Another referendum based on the deal/majority to emerge from the Parliamentary debates (see below)

– A free trade Agreement in the Norwegian or Canadian style a.k.a. EFTA (European Free Trade Association), originally envisioned by PM Harold Macmillan in 1959. Under the EFTA, nations such as Norway, Switzerland, and Iceland enjoy access to the single market but without access to a customs union or the decision-making process, and are still subject to EU laws/rules/regulations including the free movement of people (the latter two issues could be red flags for hard Brexiteers)

Brexiteers shot for the stars hoping to land on the moon. Once they won the Brexit vote, they understood that they lived in a fantasy world where they did not even have a rocket to get out of the stratosphere. They created a mess and have no idea how to resolve it. The contemplated amendments/scenarios outlined above (such as the ones involving a customs union with or without a single market access) could be rejected by the EU.

The unfolding picture has become grim and bleak. It reminds me of Berthe Morisot’s paintings. (An exhibition of her works is currently in Dallas.) Morisot is considered one of the leaders of French Impressionism but unfortunately her work is not as well-known as the works by Monet, Renoir, Degas and Manet (her brother-in-law), despite the fact that she was regarded as highly as them. In the midst of the Paris Siege (1870-71) – when Prussian bombing had reduced her studio to rubbles and Parisians ate squirrels in order to survive – Morisot’s paintings exemplified (and still do) life’s evanescence which fades along with its ephemeral, fleeing, and impermanent accomplishments. The triumph of the Brexit vote cannot be compared to the pain that millions could endure or to the permanency of the politics of incompetency that has been reverberating around the globe since the beginning of the century with very few exceptions.

What could happen to the hundreds of millions of derivative financial contracts? What would happen to contractual agreements and bonds under British law? How about the counter-party risks encapsulated into contractual obligations? What are the risks and uncertainties for EU banks and their US counterparties?

Here is a scenario of what may unfold or what should unfold in order to have as smooth of a landing as possible given the tumorous situation: In a series of debates over a number of amendments as outlined above, the MPs will test to see if a majority could be found for a different Brexit model. Once that majority is identified and the vote is in, a referendum could take place asking the people to back it as the best possible option for Brexit’s implementation, given that the first referendum failed miserably to capture the complexities of the Brexit vote. After all, in a democracy voters are entitled to change their minds, especially when the facts have changed. Doing otherwise may simply be treasonous, given that people may not desire the new relationship with the EU and would rather stay with the existing one.

As Congress contemplates the findings of the Mueller Report – at a time when other jurisdictions and the Congress may be preparing for new investigations and indictments – the rising tide of risks accumulate and we only hope that it won’t become a wave of uncertainty.

As we wrote in last week’s commentary, risky companies have too much debt on their books and the fact that more debt is extended to them makes them even more vulnerable to shocks. Financial stability is undermined by covenant-lite loans as shown below.

We continue to encourage a more cautious approach to asset allocation. The markets may have started digesting that growth, and earnings (the fundamentals) may have the permanence lacking in the evanescence of temporal accomplishments. The view of Paris fades away from the Trocadero like in Morisot’s painting.