Weekly Market Update

Weekly Market Update

-

Author : Andy Quirk

Date : July 21, 2018

Market Action

US stock markets were relatively unchanged for the week despite continued fears of a trade war, with the Dow ending +0.2%. The S&P 500 rose by less than 0.1% and the Nasdaq declined by less than 0.1%. European stocks turned lower on Friday, as the DAX and the FTSE finished down for the day. Despite Friday’s losses, the FTSE 100 rose 0.2% for the week, posting its second straight weekly gain. Bond markets reported significant gains, with the 10-year Treasury note yield rising by 5 basis points to 2.895, the largest one-day yield rise since May 18. The 30-year bond yield climbed by 6.5 basis points on Friday, its highest climb since June 22. Investors are reacting to the President’s tweets that Federal Reserve monetary tightening was making it harder for the US to respond to currency manipulation by China and the EU.

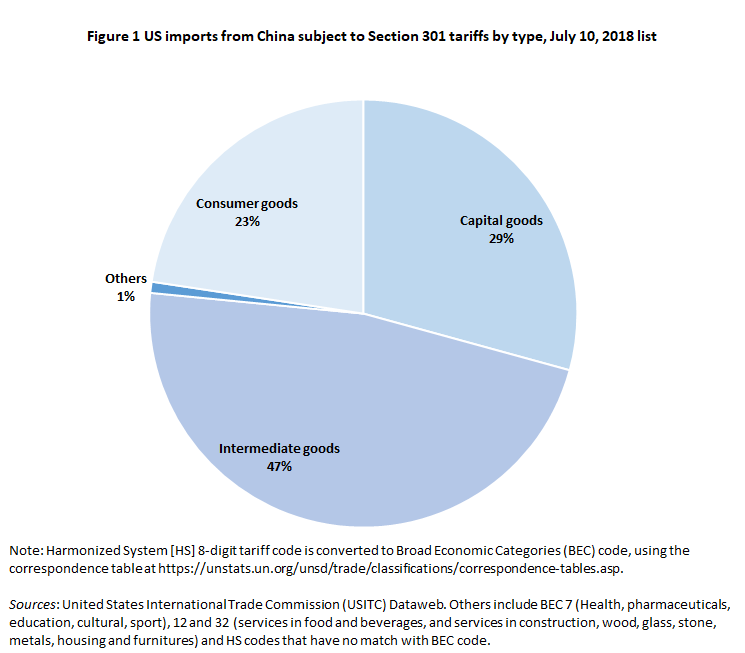

The IMF warned President Trump this week that a global trade war could cost the international economy $430bn, lowering global growth by 0.5% by 2020. The IMF’s warning came in response to President Trump’s proposal of 10% tariff on an additional $200bn of Chinese goods, on top of $34bn of tariffs already imposed in early July. President Trump told CNBC that he’d be willing to impose tariffs on every Chinese good imported to the US.

The US Congress rolled out new sanctions against the Nord Stream 2 pipeline in an effort to boost US energy exports to Europe. The sanctions on the $11bn natural gas pipeline from Russia to Germany could end the project, but it’s not clear whether US natural gas will fill the gap if sanctions are effective. The sanctions bill, if passed, would impose mandatory economic sanctions on companies building the pipeline.

Michel Barnier has said that the British Prime Minister’s plan for a future trade relationship with the EU could weaken the single market, after Theresa May urged the EU to “evolve” its position on Brexit. The Prime Minister has opposed the EU’s backstop proposal that could see a border return between Northern Ireland and the Republic of Ireland.

Hackers have stolen personal data of 1.5 million people in Singapore, equaling about a quarter of the population. The hackers broke into the government health database and stole data including names and addresses. The data of Singapore’s Prime Minister was implicated in the cyber attack. Singapore is one of many countries subject to cyber attacks over the past few years.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Emerging Markets Overview

Ken Reitz

Recommended Reads

Swiss Franc, Scandinavian Currencies Most Exposed to Trade War

Ellen Milligan

No End in Sight for Commodity Crash with Charts Sending Bear Signals

Luzzi-Ann Javier

Germany’s Savings Banks Are Uniquely Intertwined with Local Politics

Jonas Markgaf

The Trump First Doctrine

The Wall Street Journal

As inequality grows, so does the political influence of the rich

The Economist

Video of the Week

France produces the most World Cup players. Here’s why.