“It takes the character to sit with all that cash and to do nothing. I didn’t get to where I am by going after mediocre opportunities.” – Charlie Munger

Earnings season for the first quarter of 2021 has just begun and it promises to be one of the most interesting and thought-provoking quarters we’ve had in quite some time. The three following quarters will add additional chapters to the story that management teams start expressing over the coming weeks. 2020 was interesting to be sure (which might be an understatement) but it revolved around a singular topic in COVID-19 and understandably so. Commentary this year will feature a host of different ingredients and forces that feed upon each other or compete with another: the pace of reopening, consumer demand, inflationary pressures, shortages of labor and other inputs, stimulus effects, and more. It sets up for an interesting 2021 and 2022 in my opinion.

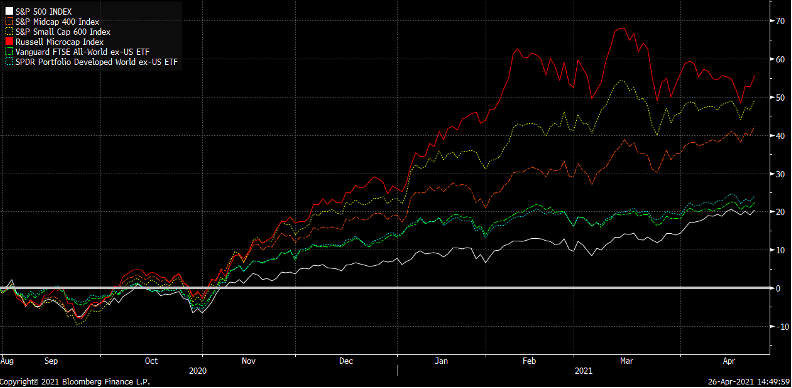

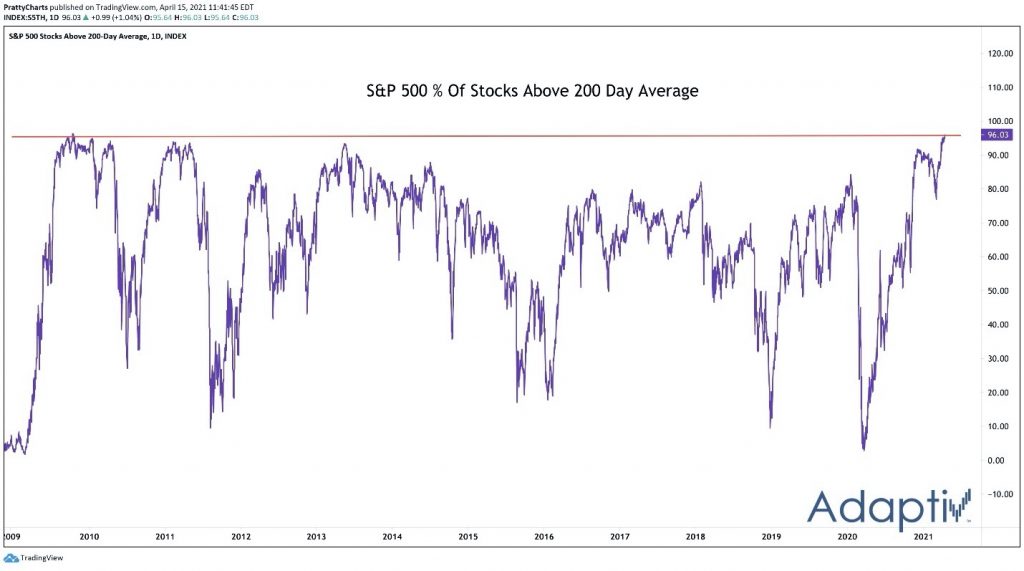

The bull market that began in 2020 to my, and many others, surprise has only strengthened both in terms of performance but also quality in 2021. What started as a market led by secular growers who had their fortunes brought forward multiple years and at better margins (cloud infrastructure, digital payments, omni-channel retailers, SaaS, among others) turned into a broader rally led by Financials, Industrials, Energy, and Materials (Figure 1). These sectors reclaimed their pre-COVID levels either late 2020 or earlier this year and are the current leaders whereas Tech recovered much more quickly, as early as last summer and have lagged the broader market since then. When the mix of sectors that take the leadership controls broadens out it spells for a healthy and sustainable market; the converse translates to elevated risks. If rotation is the lifeblood of a bull market, then we’re looking at a very healthy patient as the breadth in the current market is at the strongest levels in around a decade.

Figure 1: Tech Has Passed the Reins to Cyclical Sectors Since Last Fall

Just as those more cyclical sectors took the baton leadership also expanded up and down the various size profiles with Microcaps, Small caps, Mid caps all outperforming their larger peers. In addition, global markets excluding the US, both developed and total composite, have outperformed over the same time.

Figure 2: Smaller and ex-US Have Taken the Lead

Figure 3: Breadth is Healthier Than It’s Been in A Long Time

When the industry leadership mix leans cyclical, all capitalization types are participating, smaller companies lead, and the phenomenon is global, it’s not difficult to be excited, and many investors are. It’s also suggestive and consistent with historic patterns that would indicate we’re in the early stages of a multi-year market cycle.

The early commentary from management teams supports the action over the last several months. A small sample from a variety of industries:

“Demand out there is absolutely phenomenal, across almost every sector. Very, very strong and it would appear to be there for the rest of this year going into next…So we see strong demand, tight supply, record low supply chain inventories across the space.” – Steel Dynamics (STLD) CEO Mark Millett

“to be honest, in all the years I’ve been doing the earnings call, this is probably the year that I’m most bullish about mid-and long-term consumer demand trends in North America. So I’m not worried about consumer demand.” …. “”What we’re seeing right now is the demand is a sustained and multiyear demand trend. It’s not a blip. It’s a strong upcycle.”- Whirlpool (WHR) CEO Marc Bitzer

“I think as you see the vaccine spread, this economic dam is really starting to burst and it’s going to be widespread in terms of an increase in activity and revenues across most businesses.” – The Blackstone Group (BX) COO Jon Gray

“…labor is in very high demand across all construction segments. And this continues to pressurize the industry keeping demand greater than supply, which we have seen for many years. Crews are working longer and the fair weather has helped expand capacity for the industry, but the labor market tightness is something that we continue to watch.” – Pool (POOL) CEO Peter Arvan

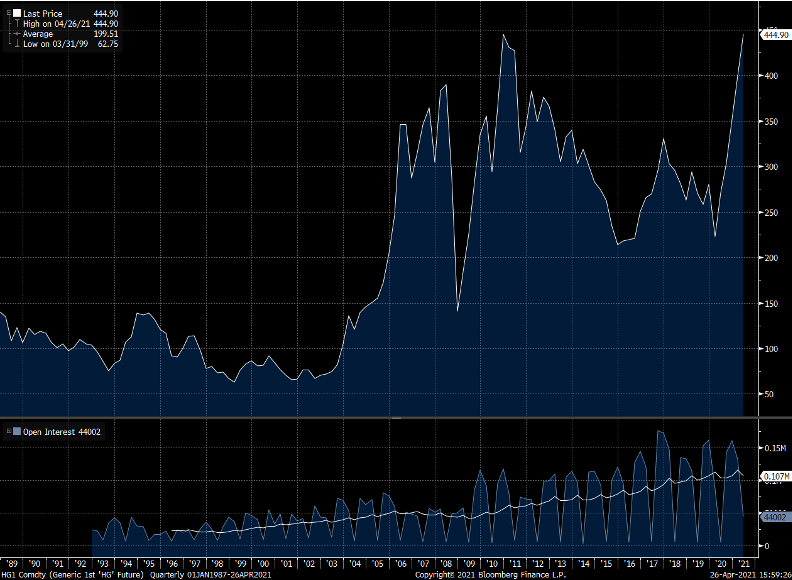

It’s no wonder then that things like copper are at all-time highs (Figure 4).

Figure 4: Copper

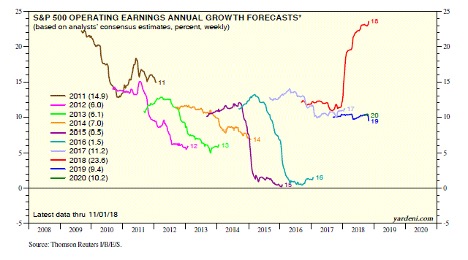

Expectations for earnings from sell-side analysts are slowly starting to catch up to what the market has been discounting since the Fall. Just about every other year estimates fall as earnings results come in (2018 was an exception due to Tax Reform).; 2021 is turning out to be an exception with estimates already having risen by about 10% since the start of the year to around $185 per share, well above pre-COVID levels and estimates for 2022 up around 9% as well. We hinted last September that corporate profits would see strong support via the fiscal measures passed at the time. Since then, two more bills of fiscal stimulus have been passed, together approximating $2.7T. It’s why Earnings are set to rise 29% in 2021, if not more, along with the reopening of the global economy. Quite frankly, barring something unforeseen between now and then, earnings for 2021 and 2022 should be extremely robust; the demand picture looks that strong and visible. The prices of risk assets however is another matter and less predictable.

Figure 5: Annual EPS Estimates Historically Fall Over Time. 2021 is Unlikely to Follow That Pattern

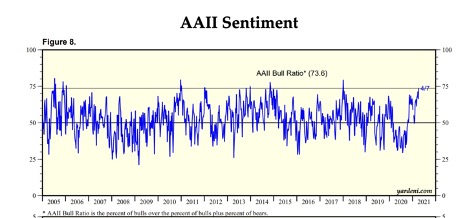

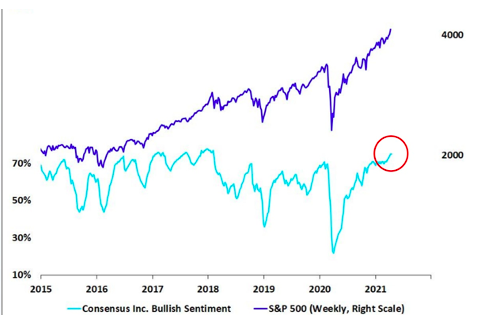

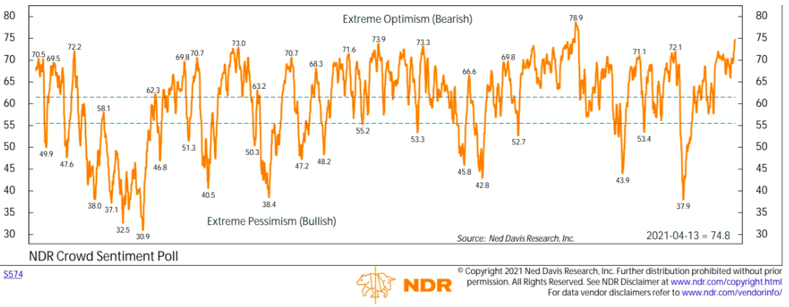

If there’s anything to cause hesitation among investors it’s that the story of a strong economy and booming corporate profits is well known. Looking at a variety of data that tracks investor sentiment and positioning it increasingly looks like investors are on the same side of the boat and at levels that historically is associated with elevated volatility.

Figure 6: Sentiment Seems To All Be on One Side (Yardeni, Ned Davis, Consensus Inc)

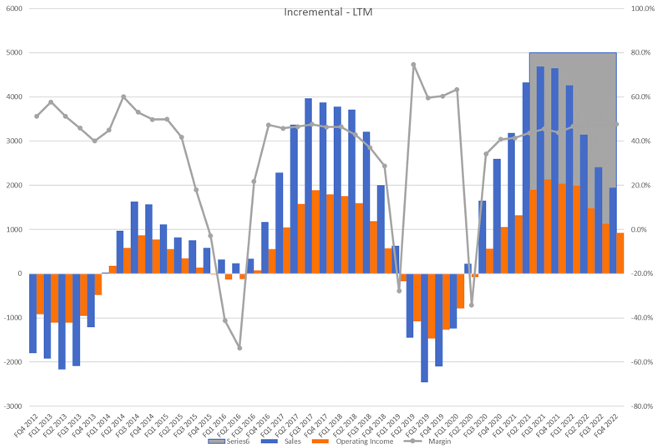

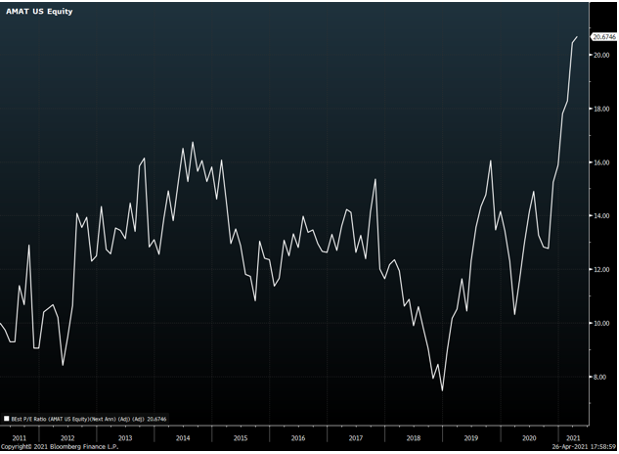

The sentiment data is evident in a number of names, particularly those that demonstrate classic cyclical characteristics in their operations and financials. Take Applied Materials, an equipment manufacturer and at the epicenter of the shortage in semiconductors (no advice pro or con the company, just observing). Its revenues and earnings follow a classic ebb and flow, as does the multiple investors assign to it.

Figure 7: Applied Materials Cyclical Pattern and Forecasts (shaded)

Late last year it was easy to see that estimates were too low given the news flow of demand for semiconductors and need for greater capacity at manufacturing facilities. Since the New Year, estimates for earnings have risen almost 20%. The multiple has also expanded. This is classic exuberant behavior on the part of investors in assigning a peak level multiple to peak earnings. Multiples, like investing in general, should discount the future and in businesses with these types of patterns to their sales and earnings investors should do the opposite of what they tend to do: assign peak (trough) multiples on trough (peak) earnings in order to accommodate for where we are in the cycle and capture the likely trajectory of sales and earnings. It’s classic animal spirits behavior whereby peak sentiment accompanies fundamentals that are ebullient.

Applied Materials is an excellent company. By no means am I intending to single the firm or industry out. But when I see this kind of underwriting combined with the sentiment data on the broad market, I can’t help but think that the balance of risk/reward is unfavorable at least in the short term. It’s not the equivalent of expecting a crash (I don’t) or thinking the market is running on fumes (I don’t given the breadth exhibited). But risk management should always be part of the investment process. When everyone is bullish, who is the incremental buyer? When it comes to deploying incremental capital I’d rather buy when sentiment is neutral or bearish, even if the price was a little higher. We had corrections in 2010, 2011, and 2012 for reasons not many, if anyone at all, remembers. They’re part of the cost of participating in the markets. We don’t need to see a catalyst up ahead to be prudent. By then, it’s often too late. Sell theses on markets based solely on valuation almost never work out, especially on a short timeframe. But that doesn’t mean you have to deploy additional capital. Sometimes it is ok to do nothing or feel neutral.