Global Market News

Global equities tumble

Global equities tumbled this week as inflation continues its rise. The S&P 500 and Dow Jones closed the week down 1.82% and 1.00% respectively, while the Nasdaq fell 2.18%. The yield on the US 10-year Treasury note settled at 1.91% after having risen several basis points earlier in the week. The price of a barrel of West Texas Intermediate crude oil rose yet again, ending the week at $93.89. Volatility, as measured by the CBOE Volatility Index, popped up to 28.5 in a choppy trading week.

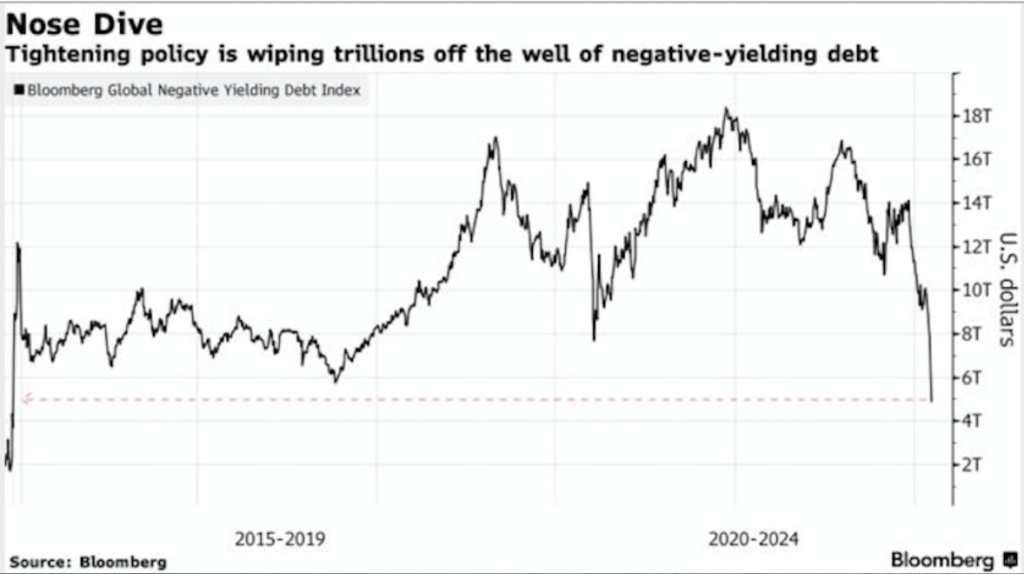

Inflation continues to surge, Traders anticipate rate hikes

Compared with a year ago, US consumer prices rose 7.5% in January, hitting a new 40-year high, yet again. At this point, the rise in inflation has moved well beyond global supply chain disruptions as price pressures are broader based. In reaction to the US Department of Labor’s inflation report, markets began pricing in additional Federal Reserve interest rate hikes. Futures traders have priced in a 50-basis point rate hike at the March Federal Open Market Committee (FOMC) meeting. Demonstrating the stress inflation is having on the bond market, the yield on the US 10-year Treasury note rose ten basis points to 2.03%

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 404,910,000 Global Covid-19 deaths: 5,780,000

US Confirmed Covid-19 cases: 76,600,000 US Covid-19 deaths: 906,000

*As of Friday evening

FDA delays vaccine decision for children under 5, J&J shuts down production

In a position reversal, the FDA has decided to wait for additional data from Pfizer-BioNTech’s Covid-19 vaccine before authorizing a vaccine for children under the age of five. Pfizer-BioNTech said their three-dose trial for young children was moving along quickly with results expected in early April. In other vaccine news, Johnson & Johnson has reportedly halted production of its Covid-19 vaccine at its only facility making usable batches of the jab. The company says that while it has millions of doses of its Covid-19 vaccine in inventory, it is using the facility to make an experimental but potentially more profitable vaccine for a different virus. The pause in J&J’s Covid-19 vaccines is supposedly temporary and the plant is expected to start producing the Covid-19 vaccine again after a few months. It is not clear if the pause has had an impact on supplies yet due to stockpiles.

International Developments

US warns of “immediate” threat of Russian invasion of Ukraine

On Friday, National Security Advisor Jake Sullivan warned that a Russian invasion of Ukraine could happen at any time. There was an initial thought among US intelligence officials that Russian President Vladimir Putin could be waiting to launch a full-scale invasion until after the Winter Olympics in Beijing, but White House officials have moved the timeline up as Russia continues to build up its land, sea, and air forces on all three sides of Ukraine. US officials are urging Americans to leave Ukraine in the next 24-48 hours as diplomatic efforts have yielded little to no success.

Nuclear deal talks with Iran resume

Negotiators resumed talks in Vienna this week over a renewed nuclear deal with Iran. Both the US and Iran have reported good news this week, saying there has been significant progress and that a deal is in sight. In an act of good will, the US restored some sanctions waivers for Iran’s civilian nuclear activities, and while Iran expressed gratitude for the waivers, Iran’s foreign minister said it was “not enough.” The Biden administration continues to support nuclear talks with Iran despite the fact that even a new agreement would likely leave Iran capable of stockpiling enough materials for a nuclear bomb in less than a year. However, US lawmakers from both political parties have voiced opposition to restoring the pact. As talks enter their final stage, there is still much uncertainty surrounding an agreement.

US Social & Political Developments

“Freedom Convoy” blocks bridges on US-Canadian border

Three border crossings between the US and Canada were blocked by truckers this week as they built a “Freedom Convoy” to protest vaccine mandates and other Covid-19 restrictions. The demonstrations, which began in Canada, have grown over the last several days and things could get worse. The US Department of Homeland Security said it has received reports that truckers in the US are planning to “potentially block roads in major metropolitan cities”, including in Los Angeles around the Super Bowl. There are concerns that the convoy could reach Washington, DC by March in time for the State of the Union address. Demonstrations have already had a significant impact on North American trade as automakers like Ford, GM, Stellantis, Toyota, and Honda have all had to shut down production at plants near the convoy. Canadian and US officials are reportedly working together to dispel the demonstrations.

China doesn’t live up to phase one trade deal

A report published by the Peterson Institute for International Economics found that China did not fulfill its 2020 commitments under phase one of the trade agreement with the US. China had pledged to increase imports of certain US goods and services by $200 billion in 2020 and 2021 but it did not increase imports from the US at all, according to the report. Data reveals that China only purchased 57% of the US exports it had committed to which is less than the country purchased from the US before the trade war.

Corporate/Sector News

Apple launches “Tap to Pay” for small businesses

Apple has unveiled a new iPhone feature that will specifically aid small businesses. “Tap to Pay” will allow small businesses to take payments directly from their Apple devices by tapping phones together or via contactless credit cards. The feature will not require additional hardware. The move pushes Apple farther into the digital payment space, putting in direct competition with other fintech companies like PayPal, Block, and Verifone.

Meta falls below $600 billion market cap

Meta Platforms, formerly known as Facebook, fell below its $600 billion market cap this week as the company struggles to recuperate from its post-earnings slide. The $600 billion mark is significant as Congress prepares a series of bills targeting Big Tech. The draft legislation from the House of Representatives sets a threshold of only covering companies over $600 billion. If the legislation is passed, and Meta stays below this mark, the company could avoid additional antitrust hurdles that its peers like Amazon and Alphabet would face.

Disney surges following earnings report

Disney’s stock price surged as much as 10% this week following the company’s stellar earnings report. According to its earnings release, the company added another 11.8 million Disney+ subscribers in the fourth quarter to reach a total of 129.8 million paying users. To continue the momentum, company executives reaffirmed their plans to spend $33 billion on new Disney+ content this year. Disney also saw all-time-high revenues at its theme parks, experiences, and consumer products division, reaching $7.2 billion and exceeding pre-pandemic levels.

Recommended Reads

How are Gulf countries coming to terms with their history of slavery?

Russia’s Dark-Money Ties to the West Pose a Major Risk

The benefits of vaccinating the world are clear. The catch is the price tag.

The Dissenters Trying to Save Evangelicalism From Itself

US trade policy needs a radical redesign

Russia Thrived as It Integrated With the West—a New Cold War Is Unraveling That

This week from BlackSummit

The Wooden Nickel – The BlackSummit Team

Image of the Week

Video of the Week

The Cost of a Big Mac in Different Countries Overtime – Source: James Eagle