Global Market News

Global equities make gains

Global equities made gains this week as countries began lifting coronavirus lockdowns and vaccine developments hit the news. The yield on the US 10-year Treasury note rose 0.05% to 0.66% over the week while the price of a barrel of West Texas Intermediate crude oil also increased, reaching $33.42 by the end of the trading day on Friday. Volatility, as measured by the Cboe Volatility Index (VIX), dropped more than 5 points to 28.12.

Global economy begins to emerge

The global economy has begun emerging from its Covid-19 induced slumber. More countries have begun opening up, including the US where all 50 states have reopened to varying degrees. Oil prices rallied this week as road and air traffic increased and retailers and restaurants are expected to experience heightened activity over the holiday weekend. Adding to the good news and supporting the rally in the markets, Dr. Anthony Fauci of the White House coronavirus task force said the US government-backed effort to find a coronavirus vaccine is bearing fruit in early clinical trials. Hopes are riding on the belief that the worst of the economic crisis caused by the pandemic is now behind us and that a vaccine could come sooner than initially anticipated.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 5,170,000 Global Covid-19 deaths: 385,000

US Confirmed Covid-19 cases: 1,630,000 US Covid-19 deaths: 95,906 *As of Friday evening

Trump threatens the WHO

US President Donald Trump has given the World Health Organization (WHO) 30 days to commit to making “major substantive improvements” or else he will cut the US’ funding of the organization all together. During the World Health Assembly meeting on Tuesday, WHO member states adopted a European Union and Australian-led resolution without any objections. News of the resolution, which calls for of an independent and comprehensive evaluation of WHO’s handling of the pandemic, has been overshadowed by President Trump’s threat.

Geopolitics Spotlight

China’s latest move to squash Hong Kong

Mainland China is planning to enact a new national security law for Hong Kong that would allow Chinese national security forces to crack down on activities Beijing’s government views as seditious or secessionist. This is the latest in Beijing’s attempts to smother Hong Kong’s pro-democracy movement and limit the territory’s autonomy. The move has been condemned by several global leaders, including US Vice President Mike Pence who called China’s actions a “death knell” for the autonomy of Hong Kong.

Brexit is back A third round of trade talks between the United Kingdom and the European Union stalled last week. By the end of the June, each party will decide whether or not the current deadline for negotiating an agreement should be extended beyond December. Many are viewing the decisive June summit as the last hope for a breakthrough. Renewed concerns of a no-deal Brexit alongside rumors of negative interest rates have pushed the sterling pound to its lowest level since the March sell-off, making it the worst-performing currency this month.

Macron loses parliamentary majority French President Emmanuel Macron lost his parliamentary majority this week after 17 environmentalist and feminist ministers created a new political group in the National Assembly called the Ecologie Démocratie Solidarité (EDS). The new group’s proposals include a temporary wealth tax and universal income payments to every citizen over the age of 18 in order to help the country through the coronavirus crisis. Macron’s party, La République en Marche (LREM), is now one person short of the absolute majority. Though the move threatens the LREM’s power in the parliament, the dissidents are not establishing a formal political party. As they call it, “it’s a group of proposition, not of opposition.”

Recommended Reads

Brexit is back – and Covid has transformed negotiations

The Bureaucracy of the Absurd

Hong Kong’s Security Law: What China Is Planning, and Why Now

Argentina set for default as it wrangles with bondholders

COVID-19 Could Bring Down the Trading System

Are the Germans Edging Closer to True Fiscal Union?

Virus will push up to 60m into extreme poverty, World Bank warns

Poor Countries Borrowed Billions from China. They Can’t Pay It Back.

This Week from BlackSummit

Cash Is King: How P/E Ratios Obfuscate Value

Joel Charalambakis

Covid-19 and the Day After

Rachel Poole and Tyler Thompson

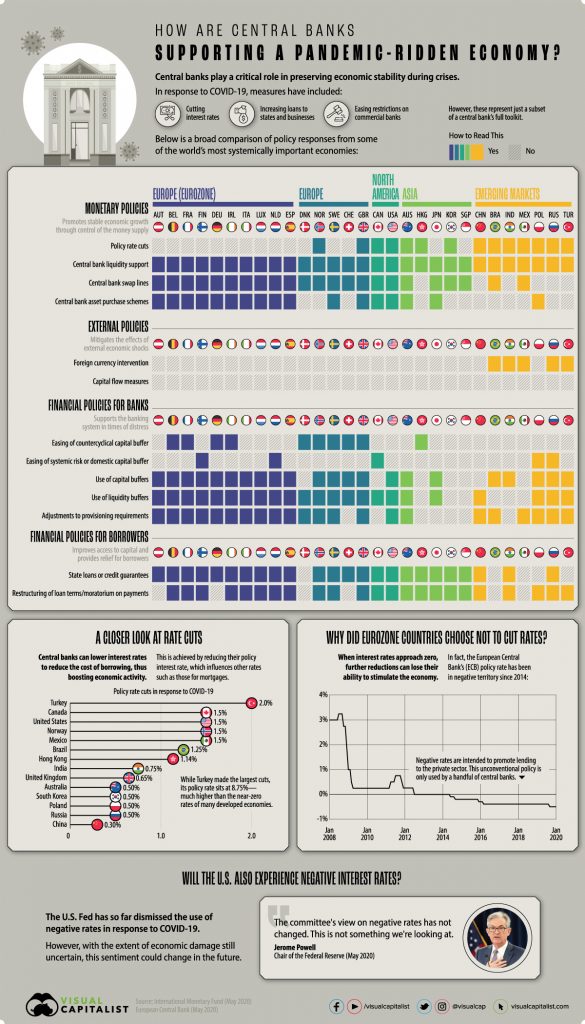

Image of the Week

How Global Central Banks are Responding to COVID-19

Video of the Week

Amazon deforestation surges in brazil

Source: DW News