Market Action

Global equities climbed this week despite fluctuating sentiment about the prospects of a trade war between the US and China and heightened geopolitical tension over Syria. Oil prices rose to their highest levels since 2014.

News regarding trade frictions and ongoing trade negotiations were ubiquitous this week. The early focus was on apparently conciliatory comments from Chinese president Xi Jinping on steps his country will take to open markets to foreign competition. Chinese officials later stated that the speech was not a concession to the US and that China is prepared to retaliate.

Regarding NAFTA, it is unlikely a deal will be announced this weekend at the Summit of the Americas in Lima, Peru; negotiators now target early May.

A little over a year after withdrawing the US from the Trans-Pacific Partnership, President Trump asked his top economic advisers to study the possibility of re-entering the trade pact on terms more favorable than originally negotiated.

Minutes of the latest meeting of the Federal Open Market Committee show that the US Fed is increasingly confident it will reach its 2% core personal consumption expenditures goal. Soft inflation data a year ago will likely push year-over-year comparisons above target, but the minutes show that is unlikely to change the committee’s projected path of rate hikes.

Also released this week were the minutes of the European Central Bank’s most recent meeting. The ECB noted risks to the economic outlook from increasing trade tensions and a stronger euro.

A second round of talks aimed at forming a government led by Italian president Sergio Mattarella failed to reach a breakthrough more than a month after the 4 March general election. Prospects for a coalition being formed in the near-term appear dim. Italy is being governed by a caretaker government, and if a new coalition cannot be formed, that condition could persist for some time.

The Turkish lira fell to another low against the dollar in part because of concerns about Turkey’s push for growth at any cost. Inflation remains high at 10% and the current-account deficit has risen on an annual basis.

Saudi Arabia sold $11bn-worth of bonds without the customary roadshow. The kingdom may have been trying to get a jump on Qatar, which is in the process of seeking support for its own sale of government debt.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Sector Focus: Industrials

Ken Rietz and Dave Coulliette

Recommended Reads

Trump’s Next Crisis Could Be With His Asian Bankers

William Pesek

It Takes More Than Money to Make a Marshall Plan

Benn Steil and Benjamin Della Rocca

Comey’s Memoir Offers Visceral Details on a President ‘Untethered to Truth’

Michael D. Shear

The Iraq War: In the Beginning Was the Lie

Deuche Welle

Video of the Week

OPEC Near ‘Mission Accomplished’ as Oil Glut Vanishes, IEA Says

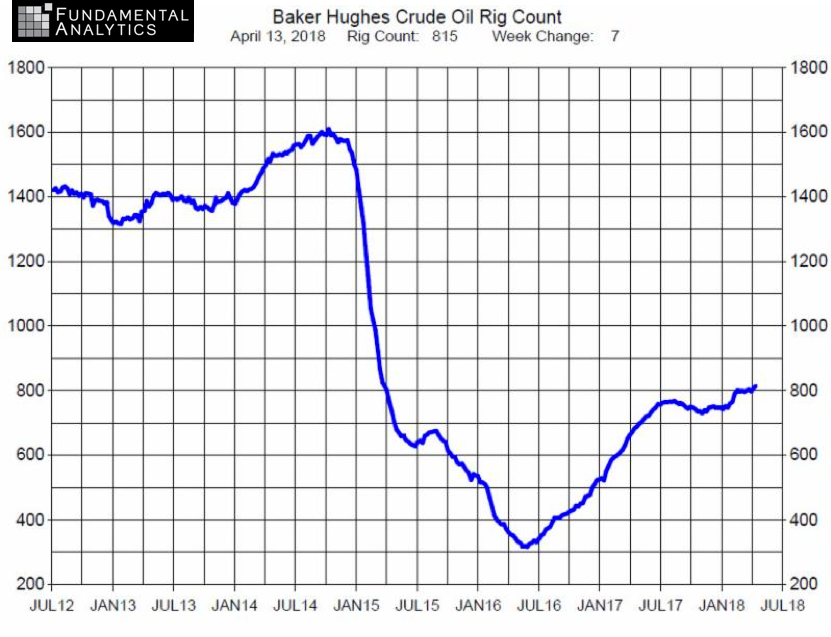

Image of the Week