Sector Focus: Industrials

Sector Focus: Industrials

-

Author : Ken Rietz

Date : April 12, 2018

This week we continue our review of the different sectors within the S&P and in the commentary below we discuss the industrial sector. Overall, the industrial sector globally is healthy and growing at a moderate pace. We will look at this a bit more closely, and then look at three separate topics that will have a major impact on the industrials and the market as a whole: tariffs and the possibility of trade wars; artificial intelligence as it applies to the industrials; the battle between president Trump and Jeff Bezos and its effects.

The global economy is expected to continue on its path slowly upward. While capital expenditures are expected to rise modestly, most indicators of growth are positive. For example, Purchasing Manufacturers’ Index (PMI) values have improved to the point that most of them point to expansion. Corporate balance sheets generally retain enough cash that purchases of more efficient equipment are reasonable. Central banks around the world, except for the Federal Reserve Bank of the US, are mostly stimulating their economies.

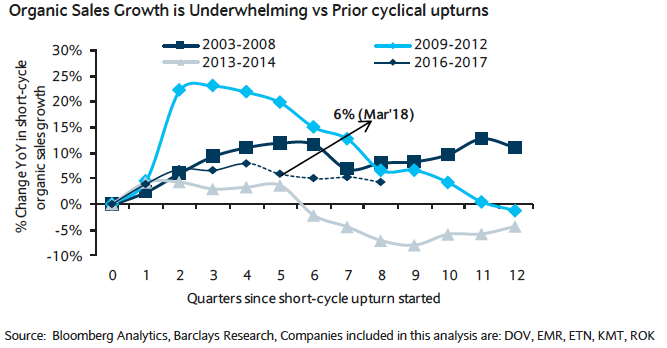

Focusing on our sector of interest, the US industrials are growing and accelerating as a whole. Companies are scrutinizing their expenditures more carefully, but not cutting back. Tax reform will benefit companies with a higher percentage of their revenues from inside the US. Strong sub-sectors will be energy exploration and production, oil services, small- and mid-cap companies, and semiconductor manufacturers, while weak sub-sectors include broadline distributors along with telecom and cable providers. The recent upturn in US sales needs to be compared to similar events in this century to be put into perspective, and it doesn’t fare too well, even though positive.

The Chinese report that their economy is strong and growing, but there is a growing sense that Chinese economic data is not always reliable. The Chinese PMI value is, as always, slightly into the expansion range. Industrial production grew 7.2% year-on-year during the first two months of this year, beating expectations of 6.1% and beating the 6.2% from December 2017. European industrials are expected to grow also, but to underperform the stock markets. European PMI values are strong but weakening. The last three months of data were 60.6, 58.6, and 56.6. Values above 50 indicate expansion. Unemployment in Europe is slowly decreasing, but still very uneven.

Here are our thoughts regarding industrial production, the tariffs, and potential trade wars. Predictions are nearly impossible because President Trump uses the threat of tariffs as a negotiating tool. For example, initially, all of the imported oil and gas pipelines would be subject to a 25% tariff. Now, about 75% of those pipelines are exempt from the tariff.

But the reality of a trade war, particularly between the US and China, the two countries with the largest economies, is looking more and more likely. The personality of President Trump and the culture of China set the stage for a likely conflict. Depending on the degree of global involvement, a likely model for the trade war suggests that the global GDP would decrease by -0.0% to -0.3%. The effects on the US and China would be much larger. In this kind of war, there are no winners, and a wide variety of opinions exist about which country would lose more.

Artificial intelligence is much more than the automation that has been well incorporated into various segments of industrial countries. There are three areas, out of many possible ones, that will spread quite soon over most of the industry: autonomous vehicles, materials handling, and image recognition.

Recent tragic, fatal accidents with self-driving cars will not stop the move to autonomous vehicles; the rewards are too great. But they may slow down development. The most likely outcome is the development of a set of standards that must be met by the computers that run the vehicle. They will resemble the kinds of rigorous testing that goes into the autopilots of airplanes. This will help the public accept self-driving cars and trucks.

Materials handling by artificial intelligence is more than just moving unwieldy objects from one place to another. Instead, it could automate entire Amazon warehouses, including loading shipping trucks with optimal efficiency. The ability of computer “hands” to grasp something without crushing it has only recently been developed and was a key step in being able to make handling of delicate objects possible.

Image recognition is useful in areas as varied as facial recognition and location of a specific tool only partially visible in a toolbox. Combining that with the materials handling capability means that an amazing amount of warehouse and assembly line work could be handed over to artificially intelligent machines.

The last topic is the conflict between President Trump and Jeff Bezos. The battle is too well-known to require a summary here, but the consequences of the battle are potentially significant to the market in general. Again, this is a battle that no one wins. Given that the president regularly takes pride in how well the stock market has performed, the pieces are falling into place for a modern reprise of King Lear; and even if Trump wins, he still loses at another level. Even Amazon is not big enough never to fail; Facebook proves that. The biggest loser, though, is the market.