Global Market News

Global Equities Gain

Global equities made gains this week. The S&P 500 and Nasdaq increased 1.50% and 2.18%, respectively, and the Dow Jones rose 1.17% on the week. The U.S. 10-year Treasury note rose sharply on Friday to 4.51%, while the price of West Texas Intermediate crude oil also jumped significantly, closing Friday at $64.64 per barrel. Volatility, as measured by the CBOE Volatility Index, declined over the week, ending at 16.77.

ECB Cuts Rates, Fed Releases Beige Book

The European Central Bank (ECB) cut its deposit rate by 0.25% to 2%, signaling that the current easing cycle is nearing its end. ECB President Christine Lagarde struck an optimistic tone, highlighting that defense and infrastructure spending, along with a strong labor market and rising incomes, should support economic growth, though she acknowledged that tariffs and a stronger euro could weigh on exports. Meanwhile, the US Federal Reserve’s Beige Book, released ahead of the June 18th FOMC meeting, reported a slight decline in economic activity and a mildly pessimistic and uncertain outlook. The report noted moderate price increases, with businesses planning to pass on tariff-related costs within three months, while employment remained flat and wage growth modest amid hiring delays in several regions.

International Developments

Trump and Xi Hold Trade-Focused Call Amid Rare Earth Mineral Dispute

President Trump spoke with Chinese leader Xi Jinping on Thursday in a 90-minute call focused primarily on trade negotiations and rare-earth mineral exports. Trump described the conversation as productive and said both leaders agreed to meet soon, with Xi inviting him to China, though Beijing’s account struck a less conciliatory tone. The call addressed tensions over China’s alleged slow-walking of rare-earth mineral exports, which the U.S. claims violated their 90-day trade truce agreed to in mid-May. Upcoming negotiations will include Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and U.S. Trade Representative Jamieson Greer representing the American side.

Russia Retaliates with Massive Strike After Ukraine Hits Bomber Fleet

Russia launched a massive overnight missile-and-drone attack on Ukraine on June 6th, killing at least three people in Kyiv and injuring 49 across the country. The assault involved 407 strike drones and 45 missiles targeting sites nationwide, with Ukraine shooting down 368 drones and 36 missiles according to officials. Russia’s Defense Ministry called the attack retaliation for Ukraine’s “terrorist acts,” specifically referencing Ukraine’s daring drone operation on Sunday that damaged strategic bombers at sites deep inside Russia. The strikes occurred amid stalled peace talks between the two countries, with President Trump acknowledging that neither side appears ready to make peace.

South Korea Elects Liberal President Lee Jae-myung After Political Crisis

Lee Jae-myung of the Democratic Party won South Korea’s presidential election on Tuesday, taking 49.4% of the vote against conservative rival Kim Moon-soo’s 41.2%, and was inaugurated on Wednesday. The election follows six months of political turmoil after President Yoon Suk Yeol’s impeachment for declaring martial law in December. The 61-year-old former Seongnam mayor faces immediate economic challenges as President Trump doubles steel and aluminum tariffs to 50% starting Wednesday, while South Korea’s exports to both the U.S. and China fell 8% last month amid ongoing trade tensions. Lee promises to establish an emergency task force to address trade crises and has pledged to improve relations with China while maintaining the U.S.-South Korea security alliance.

US Social & Political Developments

Trump Implements Sweeping Travel Ban on 12 Countries Following Colorado Attack

President Trump announced a comprehensive travel ban on Wednesday, targeting citizens from 12 countries with full restrictions and 7 more with partial limits, following a terror attack in Boulder, CO by an Egyptian national who had overstayed his visa. The administration stated that the ban is aimed at countries with inadequate screening and vetting procedures, high visa overstay rates, and limited cooperation on deportations, which collectively pose a heightened risk to the U.S. The ban primarily affects African nations (Chad, Sudan, Libya, Eritrea, Republic of Congo, Somalia, Equatorial Guinea) and includes Afghanistan, Iran, Yemen, Haiti, Myanmar, and Laos, while imposing partial restrictions on Burundi, Cuba, Laos, Sierra Leone, Togo, Turkmenistan, and Venezuela. Egypt was notably excluded from the ban despite the Boulder incident, with Trump citing the country’s strong bilateral relationship and control over security matters.

Trump-Musk Feud Explodes into Public War of Words

President Trump and Elon Musk’s bitter feud erupted on Thursday with Trump threatening to terminate Musk’s billions in government contracts while Musk called for Trump’s impeachment and suggested, without evidence, that Trump appears in unreleased Jeffrey Epstein files. The conflict escalated during an Oval Office meeting with German Chancellor Friedrich Merz, causing Tesla stock to plunge 14% and prompting Musk to initially threaten decommissioning his Dragon spacecraft before backing down. The public warfare marks the end of their alliance after Musk’s 130-day tenure leading the Department of Government Efficiency concluded last week. Trump notably referred to their partnership in the past tense, telling reporters, “Elon and I had a great relationship.”

Corporate/Sector News

Saudi Arabia Continues to Push for Increased OPEC+ Oil Production

Saudi Arabia is pushing OPEC+ to continue accelerated oil supply increases of at least 411,000 barrels per day in August and potentially September 2025, marking a radical shift from defending prices to aggressively reclaiming market share. The kingdom wants to take advantage of peak summer demand in the northern hemisphere, despite opposition from Russia, Algeria, and Oman, who preferred to pause increases at recent meetings. This strategy has already driven oil prices to four-year lows under $60 per barrel in April, with futures now trading near $65 in London. The accelerated pace could complete OPEC+’s planned revival of 2.2 million barrels daily by September, a full year ahead of the original schedule.

Circle’s Stock Gains 170% on its Debut

Circle Internet Group (CRCL), a leading stablecoin company, made a spectacular stock market debut on Thursday, with shares soaring nearly 170% to close at $83.23 after opening at $69, well above the $31 IPO price. The New York Stock Exchange listing raised nearly $1.1 billion for the company and gave Circle a market capitalization of about $18.4 billion, with shares continuing to rise 14% to $94.38 in Friday premarket trading. Circle, led by CEO Jeremy Allaire and based in New York City, is the issuer of USDC stablecoin, which has a $61.5 billion market value compared to rival Tether’s USDT at $153.8 billion. The strong investor demand reflects renewed crypto enthusiasm following President Trump’s supportive regulatory stance, with analysts predicting Circle could increase its stablecoin market share from 28% to 40% if proposed congressional stablecoin regulations pass.

P&G Slashes 7,000 Jobs Amid Tariff Pressures and Restructuring

Procter & Gamble announced Thursday it will cut approximately 7,000 jobs (15% of its nonmanufacturing workforce) as part of a two-year restructuring program, with CFO Andre Schulten revealing the news at the Deutsche Bank Consumer Conference on June 5th. The Cincinnati-based consumer goods giant, which employs 108,000 people worldwide and owns brands like Pampers and Tide, faces slowing U.S. growth (just 1% organic sales rise in Q3) and expects a $600 million headwind from Trump’s tariffs in fiscal 2026. The company projects $1 billion to $1.6 billion in noncore restructuring costs and plans to exit certain brands and markets, with full details expected during its July earnings call. P&G shares fell over 1% on the announcement, reflecting investor concerns about the broader impact of trade tensions on the $407 billion market cap company.

Recommended Reads

Humanity According to Alasdair MacIntyre

How Ukraine carried out daring ‘Spider Web’ attack on Russian bombers

Toyota Industries accepts buyout bid by group companies

Financial giants are transforming Wall Street

This week from BlackSummit

BlackSummit Team

BlackSummit Team

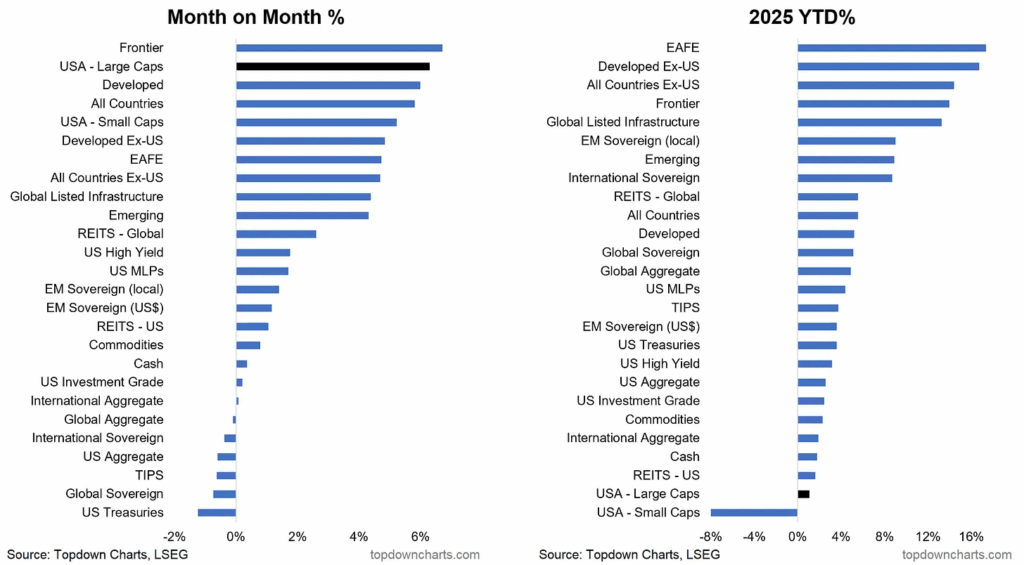

Image of the Week

Video of the Week

When Does the National debt Become Genuinely Bad

Source: Wall Street Journal