Global Market News

Global Equities Rebound

Global equities gained this week, with the S&P 500 and Nasdaq recouping April’s losses, but still remaining down for the year. The S&P 500 and Nasdaq rose 7.65% and 10.38%, respectively, while the Dow Jones increased 5.56%. The U.S. 10-year Treasury note was relatively unchanged on the week, closing Friday at 4.30% despite having dropped several basis points earlier in the week after the release of weak US GDP data. The price of a barrel of West Texas Intermediate crude oil declined nearly 5% to $58.60, posting its steepest monthly decline since 2021 amid a weaker demand outlook and signs from Saudi Arabia that it could handle low prices. Volatility, as measured by the CBOE Volatility Index, declined over the week to 22.68.

U.S. Q1 GDP Slumps, Labor Market Remains Resilient

Preliminary U.S. Q1 GDP data showed a 0.3% contraction due to a surge in imports ahead of tariffs. However, inventory growth lagged behind imports, hinting at possible upward revisions. Although consumer demand in Q1 was lower than at the end of 2024, it exceeded expectations, with personal consumption growing at a 1.8% annual rate. Meanwhile, in April, the U.S. labor market demonstrated resilience with nonfarm payrolls increasing by 177,000, surpassing forecasts despite downward revisions for the previous two months. The unemployment rate held steady at 4.2%, and the labor force participation rate edged up slightly.

International Developments

India-Pakistan Tensions Escalate After Recent Attack on Kashmir

Tensions between India and Pakistan have sharply escalated after a terrorist attack on April 22nd in Pahalgam, south Kashmir, killed 26 tourists, including one Nepalese national. India has blamed Pakistan for the assault, citing “cross-border linkages” while detaining hundreds in a sweeping security crackdown; Islamabad denies involvement and has offered a neutral investigation. The group Kashmir Resistance initially claimed responsibility but later retracted, and reports suggest possible links to the Pakistan-based Lashkar-e-Tayyaba. As India ramps up military readiness—exemplified by anti-ship missile tests on April 27th—and hints at potential cross-border retaliation, fears of conflict between the nuclear-armed rivals are intensifying.

Canada Election: A Liberal Comeback

This week, Canada’s federal election saw 59 of 343 seats (17%) change hands, more than double the turnover in 2021, amid a dramatic turnaround. Liberal gains included flipping Carleton, Ontario, and unseating Conservative leader Pierre Poilievre, as ex-central banker Mark Carney won his first seat and will continue as Canada’s Prime Minister. The New Democratic Party (NDP) collapsed, losing 17 of 24 seats—10 to Conservatives and 7 to Liberals—dropping below the 12-seat threshold for official party status and prompting leader Jagmeet Singh to resign. Three of five party leaders lost their ridings, underscoring a dramatic reshaping of Canada’s political landscape. Analysts speculate U.S. President Trump’s trade war tactics and repeated threats to annex Canada fueled a backlash against the Conservative Party, which had been leading in polls.

U.S.-Ukraine Minerals Pact Alarms Russia

On April 30th, U.S. Treasury Secretary Scott Bessent and Ukrainian Deputy PM Yulia Svyrydenko signed a U.S.-Ukraine minerals agreement in Washington, granting the U.S. preferential access to Ukrainian resources and creating a Reconstruction Investment Fund. Russian officials, including Alexei Pushkov and Alexei Chepa, condemned the deal as “colonization,” while Kremlin-linked analysts warned it could derail Moscow’s leverage in ceasefire talks. The pact follows strained Trump-Zelensky relations and marks a symbolic shift in U.S. policy, with tensions peaking ahead of Russia’s May 9th Victory Day celebration.

US Social & Political Developments

Rubio Takes Fourth Role, Replaces Waltz as National Security Adviser

On Thursday, President Trump appointed Marco Rubio as interim National Security Adviser, adding to his existing roles as Secretary of State, acting USAID administrator, and acting archivist—making him the first U.S. official to hold four top federal posts simultaneously. The appointment followed the sudden ousting of Michael Waltz, who had clashed with Trump loyalists and was reportedly outed after leaked Signal messages and internal National Security Council memos showed his resistance to Elon Musk’s restructuring proposals and growing influence over foreign policy. Waltz, along with his deputy Alex Wong, was removed and reassigned as Trump’s nominee to the United Nations, with insiders suggesting the move was engineered by Susie Wiles and Pete Marocco, key power players in Trump’s inner circle.

Trump’s Results at the 100-Day Mark

President Trump reached the 100-day mark of his second term on April 29th, signing a record-breaking 142 executive orders—surpassing FDR’s 1933 benchmark—and reversing over 100 of President Biden’s directives. He enacted just five laws, including the controversial Laken Riley Act, while also issuing mass pardons to over 1,500 January 6th defendants and initiating sweeping federal layoffs through Elon Musk’s Department of Government Efficiency. He has also accomplished an unprecedented 28% average tariff rate and mass deportations, reducing March border crossings to 7,180. Trump’s approval rating now sits at 42%, reflecting deep polarization and legal turbulence, with over 200 lawsuits already filed against his administration.

Corporate/Sector News

Tariff Talk Surges Amid Growing Uncertainty on U.S. Earnings Calls

Mentions of “tariffs” on S&P 100 earnings calls spiked 132% in the past 90 days, with top CEOs including UPS’s Carol Tomé and Goldman Sachs’ David Solomon citing deep concerns following the Trump administration’s April 2nd tariff policy announcement. Companies like IBM, GM, and PepsiCo flagged disrupted investment plans, halted guidance, and potential earnings hits ranging from $0.20–$0.40 per share, while cost-cutting efforts like Hasbro’s $175–$225 million savings push intensified. Firms such as Boeing and GE Aerospace are lobbying the administration directly, balancing support for U.S. manufacturing with warnings about trade regime disruptions. Despite the uncertainty, companies like Netflix and NextEra Energy expressed confidence their sectors would see minimal impact from the new tariff landscape.

Trump Tariffs Trigger Supply Chain Retreat, Slash China-US Freight by 45%

A sharp 45% drop in container bookings from China to the U.S. by mid-April 2025 highlights the fallout from Donald Trump’s April 2nd announcement of 145% tariffs on Chinese imports. The Port of Los Angeles expects arrivals for the week of May 4th to fall by a third year-on-year, while airfreight volumes from China have dropped about 30%, according to U.S. and Hong Kong logistics firms. Major shippers like Hapag-Lloyd and TS Lines have seen mass cancellations, and the industry braces for further disruptions with the removal of the “de minimis” exemption on May 2nd. John Shea, CEO of Momentum Commerce, noted rising prices and a pullback in consumer spending signal a “double whammy” for the retail sector.

Trump Offers Temporary Auto Tariff Relief Amid Industry Pressure

This week, President Trump signed an executive order and proclamation providing partial relief to U.S. automakers, allowing reimbursements of up to 3.75% on cars produced domestically using imported parts, ahead of new 25% auto parts tariffs taking effect May 3rd. The policy, announced during a rally in Michigan marking Trump’s first 100 days of his second term, followed lobbying from auto CEOs and concerns that steep tariffs would disrupt U.S. production and hiring. Companies like General Motors, Ford, and Stellantis praised the move, though GM simultaneously withdrew its 2025 profit guidance, citing tariff-related uncertainty. The new rules also cap tariff stacking by limiting auto manufacturers to the highest applicable tariff, while fully exempting vehicles composed of at least 85% USMCA-compliant domestic parts.

Recommended Reads

An Age of Extinction Is Coming. Here’s How to Survive.

Which stockmarkets have benefited from the chaos on Wall Street?

Opinion: ‘Bond king’ Jeffrey Gundlach predicts our next financial hangover — and it’s sobering

The Mistake You’re Making in Today’s Stock Market—Without Even Knowing It

The Global Trading System Was Already Broken

This week from BlackSummit

BlackSummit Team

BlackSummit Team

BlackSummit Team

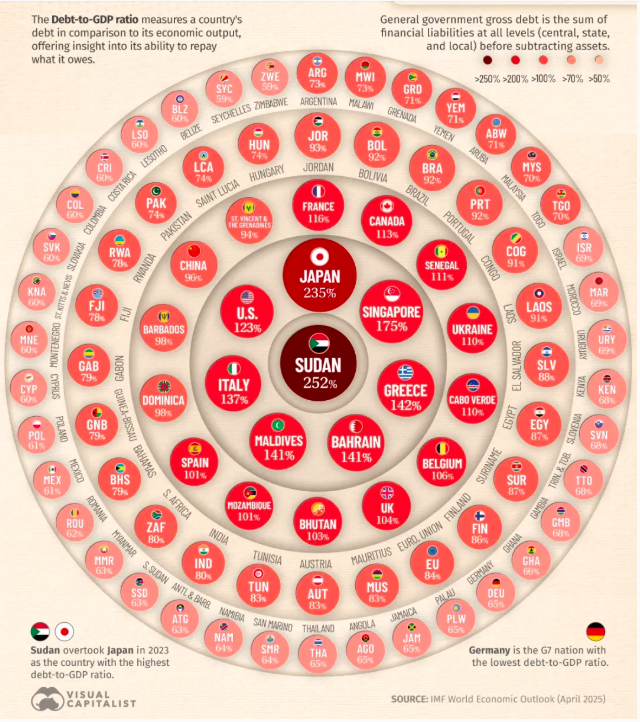

Image of the Week

Video of the Week

What Apple Earnings Reveal About Trump’s Trade War

Source: Wall Street Journal