Global Market News

Global Equities Tumble

Global equities declined this week amid more tariff announcements from the Trump administration. The S&P 500 and Dow Jones tumbled 1.53% and 0.96%, respectively, while the Nasdaq decreased 2.59%. The US 10-year Treasury note rose to 4.25%. The price of a barrel of West Texas Intermediate crude oil rose slightly more than 1%, ending the week at $69.19. Volatility, as measured by the CBOE Volatility Index, jumped more than 14% over the last 5 days, closing Friday at 21.65.

US Core Inflation Rises, Moody’s Warns About U.S. Fiscal Outlook

The core personal consumption expenditures price index, the Federal Reserve’s key inflation measure, increased 0.4% in February, translating to a 2.8% annual rate. This is the largest monthly jump since January 2024 and came in alongside a lower-than-expected increase in consumer spending. Also this week, Moody’s credit rating agency warned the U.S.’ “fiscal strength is on course for a continued multiyear decline.” Though Moody’s report highlighted the resilience of the U.S. economy and the important roles that the US dollar and Treasury market play in the global financial system, it reported that tariffs could hamper the U.S.’ ability to cope with its growing debt and higher interest rates, causing more harm than good.

International Developments

Istanbul Mayor Arrested, Mass Protests Ensue

This week, Turkish authorities arrested Istanbul Mayor Ekrem Imamoglu, President Recep Tayyip Erdogan’s main political rival, on corruption and terrorism-related charges, triggering mass protests across the country. The opposition, accusing the government of undermining democracy, has responded with nightly demonstrations, a planned mass protest on Saturday, and a boycott of businesses linked to Erdogan’s administration. In response to the unrest, the government has cracked down by banning protests, restricting social media, and arresting over 1,300 people, including journalists. Amid international scrutiny, Erdogan dismissed the opposition as incompetent and accused them of destabilizing Turkey, while Istanbul’s City Council appointed Nuri Aslan as interim mayor.

Paris Hosts Summit on Ukraine

At a European leaders’ meeting in Paris this week, French President Emmanuel Macron reiterated support for Ukraine and proposed a “reassurance force” of European troops after the war, though details remain uncertain. While Britain and France back the idea, other countries like Italy and Poland are hesitant, and Russia has denounced the plan as military intervention. European leaders also pledged increased military aid and vowed to maintain sanctions on Russia despite Kremlin demands. With U.S. support unclear, Macron warned that Europe must prepare for the worst while Ukrainian President Volodymyr Zelensky urged faster progress on cease-fire and security guarantees.

Trump Issues Tariffs on Importers of Venezuelan Oil

President Trump issued an executive order imposing a 25% tariff on U.S. imports from any country that buys Venezuelan oil, arguing that Venezuela poses a national security threat. The measure, set to take effect on April 2nd, is an unconventional use of tariffs as a tool similar to financial sanctions. While China, India, and Spain import Venezuelan oil, analysts believe the tariffs may push them to seek alternatives. The administration also extended Chevron’s license to operate in Venezuela for two months but plans to revoke it. Critics question the feasibility of enforcing these “secondary tariffs,” while supporters argue they could be a strategic alternative to financial sanctions. Trump also plans to introduce broader “reciprocal tariffs” on April 2nd, aiming to match other countries’ trade barriers.

US Social & Political Developments

Trump Cabinet Discusses Military Operation in Yemen Over Signal, Concerns Abound

The controversy over a Signal group chat involving top Trump administration officials erupted on March 25th when it was revealed that discussions on sensitive military operations included Atlantic editor Jeffrey Goldberg. In response, President Trump and his advisers dismissed security concerns, attacking the credibility of the media and downplaying the incident, with Trump calling it a “witch hunt.” The White House confirmed that national security adviser Mike Waltz inadvertently invited Goldberg, while Secretary of State Marco Rubio expressed frustration over the use of the app for such discussions. As scrutiny mounted, Trump shifted focus by announcing 25% tariffs on global auto imports during a hastily scheduled event on March 26th (see below).

Trump Issues Order to Change the Smithsonian

On March 28, 2025, President Donald Trump issued an executive order titled “Restoring Truth and Sanity to American History,” directing the Smithsonian Institution to promote “American greatness” and curb what he described as “revisionist” and “divisive” narratives. The order, which coincides with Trump’s broader push for “patriotic history” ahead of the U.S. semiquincentennial in 2026, calls on Vice President JD Vance, a Smithsonian board member, to work with Congress to restrict funding for exhibitions that “divide Americans by race” or “promote ideologies inconsistent with federal law.” The Smithsonian, which receives nearly two-thirds of its $1 billion budget from the federal government, was reportedly caught off guard, with officials expressing concerns over political interference in its research and exhibitions. Additionally, the order directs the Department of the Interior to review whether historical monuments and markers have been altered since 2020, ensuring that federal sites emphasize “the greatness of the achievements and progress of the American people.”

Corporate/Sector News

Trump Announces 25% tariff on all imported cars and key car parts

President Donald Trump announced a 25% tariff on all imported cars and key car parts, effective April 2nd, impacting automakers from Canada, Mexico, Europe, and Asia. The policy is expected to significantly affect manufacturers like General Motors and Ford, with UBS analysts warning that tariffs could erase their profits while cutting supplier profits by 30% to 40%. While the United Auto Workers (UAW) union supports the move as a way to revive domestic auto jobs, analysts such as Bernstein’s Daniel Roeska and Wedbush’s Dan Ives describe the tariffs as a major industry setback. Stocks reacted sharply, with GM falling 8.7%, Ford 4.4%, and foreign automakers like Hyundai and Volkswagen declining over 3%. The administration’s promise to make car-loan interest on U.S.-made vehicles tax-deductible may offset some price increases, though implementation remains uncertain. For investors, the tariffs create heightened volatility and downside risk for traditional automakers.

Dollar Tree Announces Sell of Family Dollar Business

Dollar Tree (DLTR) announced it would sell its Family Dollar business to private equity firms Brigade Capital Management and Macellum Capital Management for $1.007 billion, resulting in a 2.3% stock increase to $68.66 in premarket trading. The deal comes after Family Dollar’s underperformance, with Dollar Tree having acquired the chain for $9 billion in 2015. The company reported fourth-quarter adjusted earnings of $2.29 per share, surpassing analyst expectations of $2.20, and revenue of $8.3 billion, slightly above forecasts. Despite this, the sale will incur costs that may impact profitability, including an estimated 30-35 cent reduction in full-year earnings per share, with projected earnings of $5 to $5.50. Additionally, upcoming tariffs on Chinese imports and goods from Canada and Mexico could increase costs by $20 million per month, although mitigation efforts have reduced tariff impact by over 90%.

SAP Becomes Europe’s Biggest Stock

As of March 25th, SAP has surpassed Novo Nordisk to become Europe’s largest publicly listed company, with a market capitalization of approximately EUR 314 billion ($338.98 billion), compared to Novo’s EUR 310 billion ($334.66 billion). SAP’s 40% stock price increase over the past year reflects investor confidence in its successful transition to the cloud, with 80% of its legacy ERP customers committed to its cloud platform. In contrast, Novo’s stock has dropped nearly 50% since mid-2024 due to disappointing trial results for its CagriSema drug and rising competition in the obesity treatment market. Morningstar analysts have upgraded SAP’s economic moat rating and raised its fair value estimate by 76% to EUR 265 ($286) per share, while Novo’s fair value estimate was slightly increased due to a stronger outlook for its sales. SAP’s dominance has driven the outperformance of the Morningstar Germany Index in 2025, raising concerns about its potential move away from the German stock market.

Recommended Reads

Ignore the Boom in Oil That Isn’t Oil at Your Peril

Small Businesses Are Stalling, New Report Shows. It Could Be a Warning for the Economy.

Decades After the ‘End of History,’ Liberal Democracy Is In Retreat

A New ‘China Shock’ Is Destroying Jobs Around the World

What Went Wrong at Saudi Arabia’s Futuristic Metropolis in the Desert

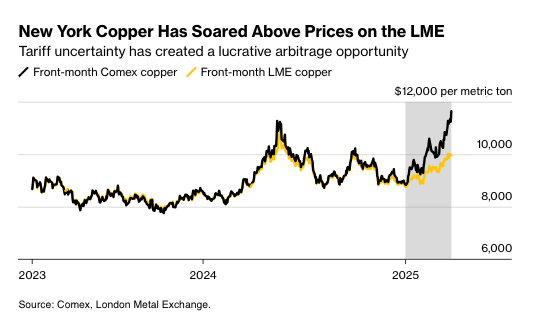

Image of the Week

Video of the Week