Global Market News

Global Equities Rebound

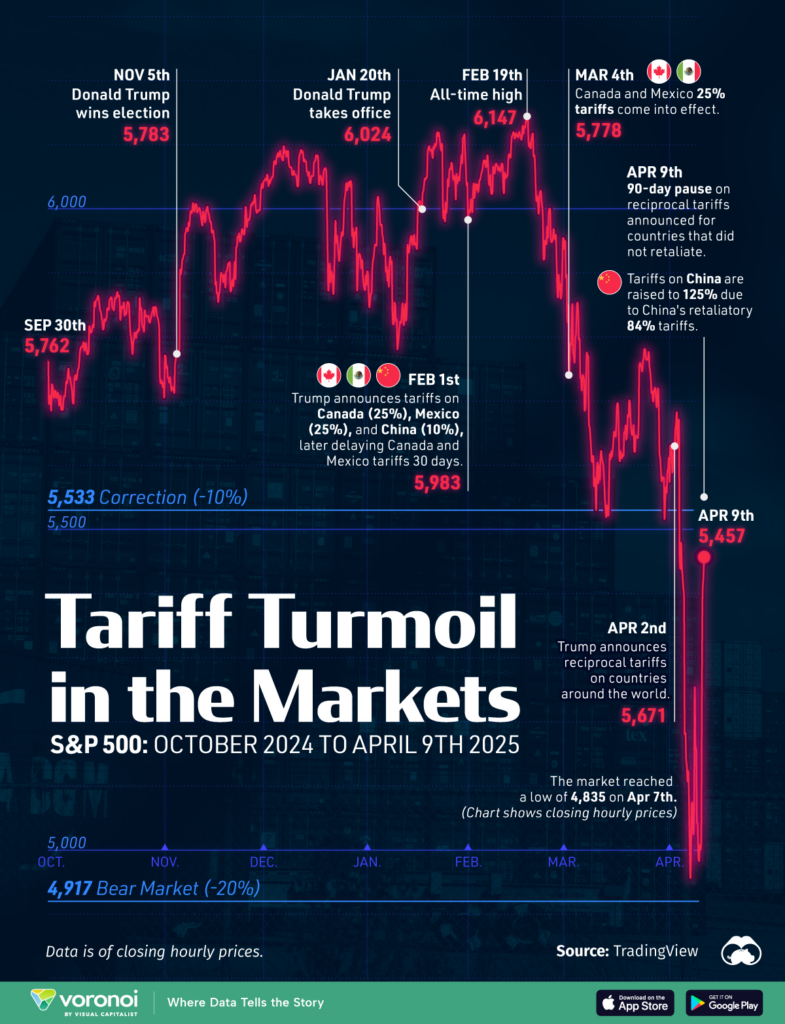

Global equities gained this week, attempting to recover some losses from last week’s correction. The S&P 500 and Nasdaq increased 5.70% and 7.29%, respectively, and the Dow Jones rose 4.95% on the week. The U.S. 10-year Treasury note soared, increasing more than 48 basis points to close the week at 4.48%. Meanwhile, pressure persisted on oil prices, with the price of a barrel of West Texas Intermediate crude oil dropping further to $61.55. Volatility, as measured by the CBOE Volatility Index, declined since last week but remained elevated at 37.56.

US Inflation Moderates But Concerns Persist

In March, consumer prices decreased by 0.1%, while core inflation rose slightly by 0.1%. Producer prices saw a sharper decline, falling 0.4% overall and 0.1% when excluding food and energy. Despite typically positive market reactions to such data, this week, investors were more concerned with the impacts of changing US trade policies and potential future inflation due to tariffs. The President of the Federal Reserve Bank of New York, stated on Friday that he expects inflation to increase to between 3.5% and 4% this year.

International Developments

Germany’s Merz Secures a Coalition Agreement, CDU Suffers a Loss in Support

Friedrich Merz secured a coalition agreement paving the way for his expected election as German chancellor in early May, following the February 23rd federal election. The deal includes a €1 trillion defense and infrastructure package, corporate and household tax cuts, tighter immigration and citizenship laws, and an 8% reduction in the federal government payroll, all aimed at revitalizing Germany’s economy and global role. However, Merz’s reversal on fiscal restraint has sparked backlash among conservative voters, contributing to the Christian Democratic Union (CDU)’s drop in support to 24%—surpassed for the first time by the far-right Alternative for Germany (AfD) at 25%, according to April 9th Ipsos and Forsa polls. As Germany braces for economic challenges, including a 20% U.S. tariff on EU goods, Merz must restore confidence amid fears of further electoral setbacks and declining trust in his leadership.

China Hikes Tariffs to 125%, Denounces Trump’s Trade Strategy

On Friday, China announced it would raise tariffs on all U.S. goods from 84% to 125% starting April 12th, in direct retaliation to President Trump’s latest tariff hikes on Chinese imports, which reached as high as 145%. China’s Ministry of Finance and Commerce condemned the U.S. actions as coercive and economically meaningless, while President Xi Jinping reaffirmed China’s resolve to resist “unjustified suppression.” The escalating trade war—affecting over $700 billion in annual bilateral trade—is now disrupting financial markets, curbing film imports, and prompting travel warnings from Beijing. Economists, including those at Goldman Sachs, have slashed China’s 2025 growth forecast to 4%, as both sides brace for economic and geopolitical fallout without clear signs of de-escalation.

CELAC Summit Pushes Regional Diplomacy and UN Reform

On April 9th, leaders from 30 of the 33 member states of the Community of Latin American and Caribbean States (CELAC) convened in Tegucigalpa, Honduras, for their ninth summit, where they denounced U.S. trade coercion and advocated for regional unity. The summit’s declaration criticized former President Donald Trump’s tariffs and unilateral actions, with Argentina, Paraguay, and Nicaragua abstaining from the joint statement due to political divergences. Colombian President Gustavo Petro assumed the rotating CELAC presidency and announced plans for expanded dialogues with global blocs including the EU, AU, GCC, and China. The bloc also called for the next UN Secretary-General—due to be selected in 2026—to come from Latin America or the Caribbean, ideally a woman, with names like Mia Mottley, Michelle Bachelet, and Rebeca Grynspan in discussion.

US Social & Political Developments

Trump Imposes 90-Day Tariff Pause—China Exempt as Trade Tensions Escalate

On Wednesday, President Donald Trump announced a 90-day pause on all newly enacted “reciprocal” tariffs, reducing them to a universal 10% rate for all countries except China, whose tariff rate was sharply increased, as discussed above. The decision, reportedly finalized that morning following meetings with Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick at Mar-a-Lago, reversed Trump’s earlier hardline stance and came after significant stock market declines. The pause excludes Mexico and Canada from tariff reductions unless goods comply with the USMCA, while steel, aluminum, and auto tariffs remain at 25%, and further sector-specific levies are expected. Despite market rallies—including a 12.2% Nasdaq surge—experts like RSM US economist Joe Brusuelas warned that the pause may only delay an impending recession driven by mounting global trade shocks.

Trump-Backed Budget Bill Narrowly Passes in House Amid Deep Cuts and Political Tensions

The U.S. House of Representatives passed a Trump-endorsed budget bill by a narrow 216–214 vote, proposing $5 trillion in tax cuts and $1.5 trillion in spending reductions over the next decade. The measure, championed by House Speaker Mike Johnson and praised by Donald Trump as a “big, beautiful bill,” now faces reconciliation with a more modest Senate version, which was passed on April 5th and includes only $4 billion in spending cuts. The House version is projected to add $5.7 trillion to the national debt, which currently stands at $36 trillion, drawing criticism from both Republican hardliners and House Democrats, led by Hakeem Jeffries. Additional legislation will be required to enact Trump’s proposed tax breaks on tips, overtime, and Social Security benefits, while Treasury Secretary Scott Bessent expressed confidence that Congress will raise the debt ceiling later this year to accommodate the plan.

Corporate/Sector News

Panama Audit Threatens BlackRock’s Canal Port Deal Amid U.S.-China Tensions

Earlier this week, Panama’s Comptroller General Anel Flores revealed that CK Hutchison owes $300 million in unpaid fees and violated contract procedures related to its Panama Canal port operations, potentially derailing a $22.8 billion global port deal with BlackRock announced in March. The deal, which includes Hutchison’s ports at both ends of the canal, had been touted by former President Trump in his March 4th congressional address as a strategic move to counter China’s influence. The audit uncovered that Hutchison’s 2021 contract extension lacked proper clearances and used tax-exempt subcontractors to reduce payments to Panama, prompting Flores to initiate criminal referrals and regulatory briefings. As Beijing signals discontent and lines up alternative buyers, legal processes in Panama—expected to take 6 to 12 months—now pose a serious threat to BlackRock’s acquisition, further intensifying the U.S.-China geopolitical standoff.

China’s Tech Giants Rally to Shield Exporters Amid U.S. Tariff Hike

Yesterday, JD.com announced a $27.3 billion (200 billion yuan) initiative to buy export-bound goods and redirect them to China’s domestic market, in response to escalating U.S.-China trade tensions. The Beijing-based e-commerce giant made the announcement via WeChat, aligning with Beijing’s call to boost domestic consumption following new U.S. tariffs of up to 145% on Chinese goods. Alibaba’s Freshippo chain also responded by launching a 24-hour onboarding channel and a platform section for export-to-domestic products. These moves came the same day China retaliated with a 125% tariff on some U.S. imports, marking a significant policy shift and coordinated effort by Chinese tech firms to buffer domestic exporters.

Trump Signs Executive Order Designating Coal as a Critical Mineral

President Trump signed an executive order this week designating coal as a “critical mineral” for national security, which boosted stocks of coal producers like Peabody Energy (+12%) and Core Natural Resources (+11%), although they remain down 30% for the year. The U.S. coal industry has been in decline for over a decade, with 578 million short tons of coal produced in 2023, less than half the peak production of 1.1 billion tons in 2008. Despite the new support for coal, there is skepticism regarding its revival, with experts noting that coal-fired plants are expensive to run and environmentally harmful and keeping them operational could cost taxpayers $100 million per year in subsidies.

Recommended Reads

Dollar Emerges as Latest Victim of This Week’s Markets Mayhem

China hits back by slapping 125% tariffs on US goods

The U.S. Came Close to Financial Disaster This Week—and Could Come Close Again

Despite the pause, America’s tariffs are the worst ever trade shock

America’s financial system came close to the brink

This week from BlackSummit

BlackSummit Team

BlackSummit Team

BlackSummit Team

Image of the Week

Video of the Week

Why ageing offshore oil and gas infrastructure is a costly problem

Source: Financial Times