Global Market News

Global Equities Decline

Global equities sank this week following US President Donald Trump’s implementation of harsher-than-expected tariffs against U.S. trading partners. The S&P 500 and Nasdaq lost 9.08% and 10.02%, respectively, and the Dow Jones fell 7.86% on the week. The U.S. 10-year Treasury note also dropped significantly, declining more than 26 basis points to close the week at 3.99%. Amidst the fears of a global recession as well as an OPEC+ output hike, the price of a barrel of West Texas Intermediate crude oil tumbled more than 10%, closing Friday at $61.99. Over the last five days, volatility, as measured by the CBOE Volatility Index, rose more than 88% to end the week at 45.31.

US Payrolls Jump, Fed Warns of Tariff Inflation Impacts

Amid the gloom in the markets, Friday’s job report brought some positive news, reporting that US nonfarm payrolls were stronger than expected. 228,000 jobs were added in March, surpassing expectations for a 140,000 gain. Despite signals that the labor market is doing well, the economic outlook has become cloudier following the tariffs announcement. On Friday, US Federal Reserve Chair Jerome Powell warned of a “highly uncertain outlook” and that the tariffs will have persistent impacts on inflation, with growth likely to slow. As recession fears grew, expectations of Fed rate cuts grew, with traders pricing in four rate cuts this year as of midday Friday.

International Developments

Global Leaders React to Trump´s Tariffs

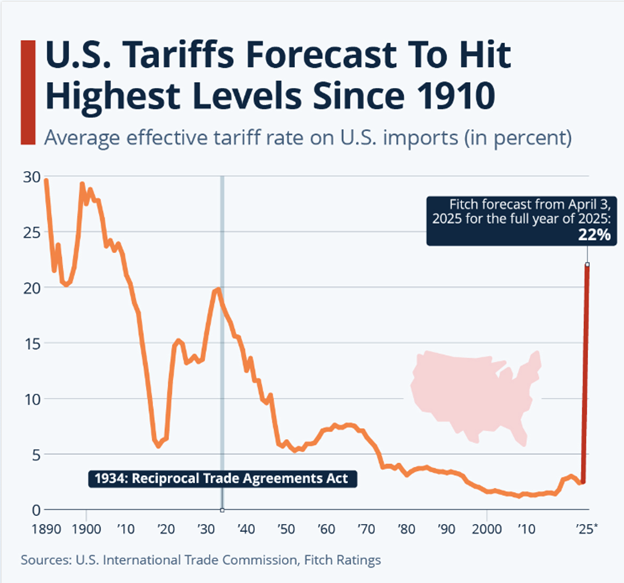

On April 2nd, U.S. President Donald Trump announced sweeping new trade measures, including a baseline 10% tariff on all U.S. imports, with elevated rates targeting specific countries—46% on Vietnam, 32% on Taiwan, and 20%+ on goods from the EU, Japan, and South Korea. The move sparked swift international backlash: Canadian Prime Minister Mark Carney responded with a 25% tariff on U.S. vehicle imports, while EU President Ursula von der Leyen and Spanish Prime Minister Pedro Sánchez pledged decisive countermeasures. Japan’s Prime Minister Shigeru Ishiba questioned the rationale of uniform tariffs. China’s Commerce Ministry declared it would “resolutely adopt countermeasures”, announcing on April 4th a 34% reciprocal tariff on U.S. goods. While allies like the U.K. and Switzerland urged restraint, others, including Australia, Ireland, and Italy, criticized the policy as protectionist and destabilizing to global trade norms.

Le Pen Convicted of Embezzling EU Funds, Barred from Elections

On March 31st, French far-right leader Marine Le Pen was found guilty of embezzling European Parliament funds and barred from holding public office for five years, a verdict that likely disqualifies her from the 2027 presidential race. U.S. President Donald Trump called the ruling “a very big deal” during a White House event, drawing parallels to legal challenges he faces and suggesting the decision undermines democratic participation. The U.S. State Department, via spokesperson Tammy Bruce, labeled political exclusion “concerning,” invoking Vice President JD Vance’s February remarks in Munich criticizing European suppression of dissent. Le Pen’s case has drawn support from right-wing leaders like Hungary’s Viktor Orbán and Italy’s Matteo Salvini, while she considers an appeal that could overturn a sentence of four years—two suspended and two under house arrest.

China Encircles Taiwan with ‘Strait Thunder’ Live-Fire Drills

On Wednesday, China’s People’s Liberation Army launched live-fire drills codenamed Strait Thunder, simulating strikes on Taiwan’s ports and energy infrastructure, following intensified rhetoric against President Lai Ching-te, whom Beijing labeled a “parasite” and “separatist.” The drills, held just days after China’s annual Boao Forum concluded on March 28th, marked a shift toward regularized military pressure on the self-governed island, with Chinese state media releasing propaganda videos likening the PLA to the mythical Monkey King. The U.S. State Department reaffirmed its “enduring commitment” to Taiwan, and Defense Secretary Pete Hegseth, during a regional visit, pledged “robust and credible deterrence” amid growing cross-strait tensions. While Taiwan’s presidential office strongly condemned the exercises, its military officials stated they are using the maneuvers to improve defense readiness against any potential blockade or invasion.

US Social & Political Developments

Tariffs Shake Global Supply Chains as Trump Unleashes Broad Trade Offensive on “Liberation Day”

On Wednesday, the Trump administration imposed sweeping new tariffs—starting at 10% baseline and rising to 50% for certain states—on goods from the EU, Japan, Vietnam, and Cambodia, among others, and ending the $800 de minimis exemption for Chinese imports as of May 2nd. U.S. consumers now face price hikes on everything from Adidas sneakers to Modelo beer and luxury handbags, while Danish jeweler Pandora estimates DKr1.2bn ($177 million) in annual costs due to the new levies. A 25% tariff on foreign-assembled vehicles and car parts, effective May 3rd, could add $5,000–$20,000 to vehicle prices and cost U.S. buyers $30 billion in the first year, according to Anderson Economic Group. While pharma remains tariff-exempt for now, Trump hinted at future action, and global markets reacted with volatility, with shares in companies like H&M, Valeo, and Airbus falling amid mounting fears of a broader economic slowdown.

Trump Sends Migrants to El Salvador Amid Legal Challenges and Human Rights Concerns

On March 30th, the Trump administration transferred 17 alleged gang members—including 10 Salvadorans and 7 Venezuelans—from Guantánamo Bay to El Salvador aboard a U.S. Air Force C-17, labeling it a “counterterrorism operation” per Secretary of State Marco Rubio. This marked the second such transfer in two weeks, following flights that carried 261 migrants, despite a judge’s order to halt the operation. The migrants were delivered to El Salvador’s CECOT prison, a facility notorious for overcrowding and indefinite detention, prompting criticism from human rights advocates and a temporary emergency ruling by U.S. District Judge Brian E. Murphy requiring due process before deportations to third countries. Adding further controversy to the development, U.S. Immigration and Customs Enforcement (ICE) mistakenly deported Kilmar Armando Abrego Garcia—a 29-year-old Maryland resident with protected legal status—to El Salvador’s notorious CECOT prison on March 15, 2025, due to what officials described in a court filing on Monday as an “administrative error,” despite a 2019 immigration judge’s ruling barring his removal.

Corporate/Sector News

Trump’s 25% Auto Tariffs Spark Global Industry Shockwaves

President Trump imposed sweeping 25% import tariffs on vehicles and auto parts, along with reciprocal tariffs on key Asian electronic components and Indonesian nickel used in EV batteries. Analysts warn the tariffs could raise U.S. vehicle prices by $5,000 to $20,000 and significantly dampen demand. Stellantis responded by halting production at plants in Ontario and Mexico, affecting roughly 900 U.S. workers, while its stock fell 8.6%; Ford and GM shares also dropped by 4.6% and 3.7%, respectively. JPMorgan analysts estimate a 25% earnings hit for Stellantis and German automakers, as global automakers scramble to reassess supply chains and domestic production viability.

Volvo Truck Plant Investment in Mexico May Rise to $1 Billion Amid Trade Tensions

This week, Mexico’s Economy Minister Marcelo Ebrard announced that investment in Volvo’s new heavy-duty truck manufacturing plant in Monterrey would increase from $700 million to $1 billion, citing information from Volvo’s Swedish headquarters. However, Volvo clarified that its own investment remains unchanged and attributed the additional funding to local suppliers and partners. The Monterrey plant, announced in August 2024, aims to produce Volvo and Mack brand trucks for the North American market and is scheduled to begin operations in 2026. This development coincides with President Trump’s new 25% tariff on imported vehicles, which has already led Stellantis to pause production in Mexico and Canada.

OPEC+ Shocks Market with Major Supply Hike to Enforce Discipline and Lower Prices

OPEC+ announced a surprise oil supply increase of 411,000 barrels per day for May—three times the planned amount—in a move led by Saudi Energy Minister Prince Abdulaziz bin Salman to penalize overproducing members, especially Kazakhstan and Iraq. This shift marks a sharp departure from the group’s cautious policy, influenced in part by U.S. President Trump’s April 2nd call for lower oil prices and a renewed 25% tariff on vehicle imports. Crude prices fell to a two-year low, compounding market turmoil already triggered by oversupply forecasts and weaker Chinese demand. The move may also serve U.S. efforts to choke off Iranian oil exports as part of a broader “maximum pressure” campaign.

Corporate Profile

Thales Surges on Defense Boom, Eyes 8,000 Hires in 2025

Thales, Europe’s top defense electronics firm, plans to hire 8,000 people globally in 2025—half in France and the U.K.—to support rapid growth across its defense, aerospace, and cyber divisions, with 40% of roles in engineering. The company posted stronger-than-expected 2024 results with revenue rising 8.3% to €20.58 billion and adjusted operating income reaching €2.42 billion, driven by a 13% surge in defense earnings that outpaced weaker aerospace and cyber segments. With new orders up 6% to €25.29 billion and a 2025 sales forecast of €21.7–€21.9 billion, CEO Patrice Caine emphasized that ongoing geopolitical instability, particularly Russia’s war in Ukraine, is fueling record investments in defense capacity. Thales also saw its shares jump over 11% in early March and is engaged in potential talks with Airbus and Leonardo on consolidating Europe’s fragmented satellite operations to bolster long-term competitiveness.

Recommended Reads

Trump Tariffs Aim to Bring Down Curtain on Era of Globalization

Understanding tariffs and who pays for them

Can the world’s free-traders withstand Trump’s attack?

The Mission to Electrify Africa Might Finally Be Under Way

Image of the Week

Video of the Week