Global Market News

Global Equities Make Gains

Global equities made gains this week. The Dow Jones and S&P 500 rose 2.15% and 1.74%, respectively, while the Nasdaq gained 1.65%. The US 10-year Treasury note was relatively unchanged on the week, closing Friday at 4.62%. The price of a barrel of West Texas Intermediate crude dropped more than 4% to $74.66 in response to the expectation of an increase in US domestic oil production. Volatility, as measured by the CBOE Volatility Index, decreased over the week to 14.85.

PMIs Increase in Eurozone, UK, and Japan While US Declines

Preliminary purchasing managers’ indices (PMIs) for January showed an increase in the eurozone, United Kingdom, and Japan. However, in the US, the indices declined due to weaker services readings, despite an improvement in manufacturing. In Europe, the readings showed a modest return to growth to begin the year but the the recovery was uneven as Germany’s private sector activity stabilized in January, ending a six-month period of contraction, but France’s services industry continued to decline due to weak demand and political uncertainty. PMIs are considered leading indicators, often predicting broader economic trends and shifts before they become apparent in other economic data.

International Developments

Israeli Offensive in Jenin and Policy Shifts Under Trump

The Israeli military launched “Operation Iron Wall” on January 21st, targeting Jenin in the West Bank, killing at least seven people and marking a new offensive amid the third day of the Gaza ceasefire. This operation follows months of heightened violence, with over 800 Palestinians killed in West Bank raids since Hamas’ October 7, 2023 attacks. Meanwhile, US President Trump rescinded Biden-era sanctions targeting Israeli settlers, signaling support for Israel’s controversial settlement policies, despite international law deeming them illegal. Far-right Israeli leaders, including Finance Minister Bezalel Smotrich, anticipate US support for annexation plans, a move seen as undermining prospects for a two-state solution.

Trump Threatens Sanctions on Russia, Urges End to Ukraine War

US President Trump has called for an immediate end to the war in Ukraine, warning Vladimir Putin of severe tariffs and sanctions if negotiations are not initiated soon. Writing on Truth Social, Trump claimed he would push for a resolution, criticizing the ongoing conflict as “ridiculous” and suggesting the economic fallout for Russia would worsen without a deal. Ukrainian President Zelensky reiterated the need for US-backed peacekeepers, while skepticism about Trump’s impact persists among Ukrainians. Meanwhile, Kremlin spokesperson Dmitry Peskov expressed openness to dialogue but dismissed Trump’s threats as nothing new, as Russia faces mounting domestic debates

ICC Seeks Arrest of Taliban Leaders for Crimes Against Afghan Women

The International Criminal Court (ICC) prosecutor Karim Khan has announced plans to seek arrest warrants against Taliban leaders Haibatullah Akhundzada and Abdul Hakim Haqqani for crimes against humanity targeting Afghan women and girls. The charges focus on gender-based persecution since the Taliban’s return to power in August 2021, including systemic violations like bans on education, employment, and public life for women. The Taliban dismissed the accusations as politically motivated, while rights groups like Amnesty International welcomed the move as a step toward accountability. The ICC investigation faces challenges due to a lack of cooperation from the Taliban and fear among witnesses, but it has revived hope for justice among Afghan women and activists.

US Social & Political Developments

Trump’s Initial Executive Orders

President Trump’s second administration began with a flurry of executive orders impacting a wide range of issues, including immigration, trade, and civil rights. Within his first three days, Trump designated an “invasion” at the southern border, allowing military personnel to act as border enforcement, and redefined birthright citizenship. He also initiated a review of trade deficits, suspended the US participation in the Global Tax Deal, and withdrew from the Paris Climate Agreement. Additionally, Trump directed the elimination of diversity, equity, and inclusion programs, and created the Department of Government Efficiency led by Elon Musk to cut federal programs.

Trump’s Protectionist Agenda at Davos

In his virtual address to the World Economic Forum on Thursday, President Trump reiterated his “America First” stance, warning global companies they would face tariffs if they didn’t manufacture in the US. He criticized the European Union’s tariffs on American goods and urged OPEC to lower oil prices to pressure Russia over its invasion of Ukraine. Trump also expressed a desire for immediate peace talks with Russia, which has raised concerns among European allies about weakening support for Ukraine. The president’s protectionist rhetoric and threats of tariffs on friendly nations have alarmed allies, who fear the consequences of strained transatlantic relations and diminished US influence in global affairs.

Corporate/Sector News

Tech Giants Commit $500B to Revolutionize AI Infrastructure

The Stargate Project, announced on January 21st, aims to invest $500 billion over four years to develop up to 20 cutting-edge AI data centers across the US, with SoftBank and OpenAI leading the initiative. Joined by Oracle, Arm, Microsoft, and Nvidia as partners, the project was unveiled at a White House event featuring President Donald Trump, who emphasized its role in strengthening American AI leadership and national security. Construction has already begun on a Texas data center, part of an initial $100 billion deployment, which promises to create hundreds of thousands of jobs and meet surging global data center demand. While the ambitious venture highlights AI’s transformative impact, experts caution that challenges, including power availability and extended timelines, could delay its implementation.

CNN Navigates Layoffs While Netflix Makes Record Gains

CNN is laying off 200 employees (6% of its workforce) as it shifts toward a $70 million digital expansion and prepares to launch a new streaming service, aiming to counter a 74% decline in prime-time viewers since 2020. Under CEO Mark Thompson, the network is revamping programming and emphasizing digital properties to adapt to audience changes despite legal and financial hurdles, including 2023 revenue of $1.8 billion, down from $2.2 billion in 2021. Meanwhile, Netflix reached an all-time stock high, briefly reaching $1,000 a share, following a record-breaking Q4. Last quarter the company added 18.9 million subscribers and achieved $10.25 billion in revenue, driven by live events and price increases. The streaming giant, now projecting 2025 revenue up to $44.5 billion, continues to dominate the market with innovative strategies and a $15 billion stock buyback.

Solar Power Leads EU Energy Revolution

In 2024, solar energy surpassed coal for the first time in the EU, providing 11% of electricity and contributing to renewables reaching a 47% share, up from 34% in 2019, according to climate think tank Ember. Coal’s contribution dropped to just 10%, while fossil-fueled power fell to a historic low of 29%, bolstered by the European Green Deal and the drive for energy independence following Russia’s invasion of Ukraine. Since 2019, the EU avoided nearly $61 billion (€58.6 billion) in fossil fuel imports, highlighting a rapid shift to cleaner, more affordable energy sources. This transition stands in sharp contrast to the US, where President Trump withdrew from the Paris Agreement in favor of an aggressive fossil fuel agenda.

Corporate Profile

KPMG Breaking Barriers with Potential US Legal Market Entry

KPMG is likely to become the first Big Four accounting firm to establish a U.S. law firm through Arizona’s 2021 program allowing nonlawyer ownership of legal practices, with final state approval anticipated this month. Already practicing law in over 80 countries, KPMG aims to streamline services like contract management and M&A legal support, leveraging AI tools to enhance efficiency while expanding its $8.7 billion global tax and legal division, which grew 10% in fiscal 2024. This move could trigger similar actions by rivals PwC, Deloitte, and EY, though traditional law firms dominate markets where accounting firms have previously entered. Critics raise ethical concerns about potential profit prioritization, but KPMG plans to collaborate with licensed attorneys in other states to navigate regulatory complexities.

Recommended Reads

Trump threatens to double tax rates for foreign nationals, companies

America’s departure from the WHO would harm everyone

China FDI trends point to world split by superpowers as Trump comes in

Why Did South Korea President Yoon Order Martial Law, and What is He Accused Of?

Europe Threatens to Trigger a Global Scramble for Natural Gas

This week from BlackSummit

The BlackSummit Team

The BlackSummit Team

CROSSROADS: Middle East, Asia, Latin America, Sub-Saharan Africa

The BlackSummit Team

CROSSROADS: US, Europe, China & India

The BlackSummit Team

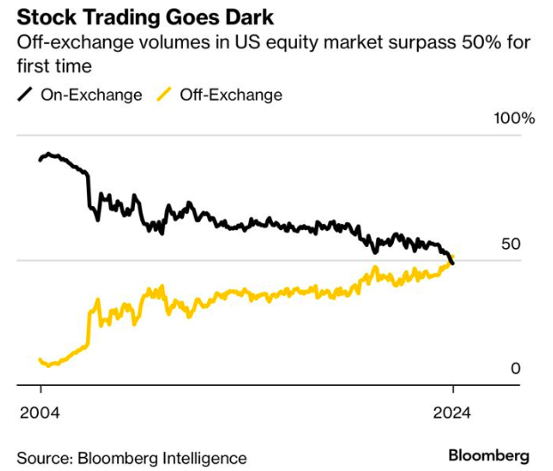

Image of the Week

Video of the Week

Uber’s Vision for the Future: EVs, AVs and On-Demand Logistics

Source: Wall Street Journal