Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : January 6, 2024

Global Market News

Global equities fall

Global equities fell in the first week of the year. The Dow Jones and S&P 500 declined 0.59% and 1.52% on the week, respectively, while the Nasdaq dropped 3.25%. The US 10-year Treasury note rose back up to over 4.00%, closing Friday at 4.05% amid heavy issuance of US investment-grade corporate debt and strong US employment data. Meanwhile, the price of a barrel of West Texas Intermediate crude rose more than 3% on the week to $73.91 amid continued turmoil in the Red Sea. Volatility, as measured by the CBOE Volatility Index, ended the week at 13.35.

US labor market ends 2023 robustly

In 2023, the US labor market exceeded expectations, adding nearly 2.7 million jobs to make it one of the strongest years in the last decade. Despite concerns about Federal Reserve interest rate hikes impacting the job market, the actual effect was limited. Excluding pandemic-related rebounds, 2023 marked the most robust year for job increases since 2015. Despite aggressive rate hikes, the unemployment rate remained nearly unchanged, ending the year at 3.7%, just above the March 2022 level of 3.6%. The average unemployment rate for the year matched 2022’s reading at 3.6%, the lowest since 1969.

International Developments

Risk of conflict widening in the Middle East weighs on the region

Several new developments in the Middle East have spurred new concerns about the outbreak of a broader regional conflict. First, an Israeli strike in a Hezbollah-controlled portion of Beirut, Lebanon, killed a prominent leader of Hamas, Saleh al-Arouri. At the same time, ISIS has claimed responsibility for two deadly explosions at the burial site of deceased Iranian military leader Qasem Soleimani that killed at least 84 and wounding nearly 300. In the time between the blasts and ISIS’ claim of responsibility, Iran had accused Israel of the blasts. Between these developments, as well as the still-ongoing Israeli invasion of Gaza, US Secretary of State Blinken is to visit the region for the fourth time since October, hoping to sort out disagreements between the US and Israel on the latter’s wartime conduct.

North Korea fires artillery near disputed South Korean territory

Over two hundred North Korean shells landed in disputed waters near remote South Korean islands this week. Seoul responded with live-fire exercises in the vicinity, urging North Korea to cease actions escalating tensions. Pyongyang attributed the drills to recent military actions by Seoul and threatened an “unprecedented strong response” if South Korea’s “military gangsters” continued to make provocative moves. China called for restraint and dialogue after the artillery exchange, while South Korea and the US intensified military cooperation in response to North Korea’s weapons buildup.

US Social & Political Developments

US national debt surpasses 34 trillion for first time

The United States has entered the new year with its national debt surpassing $34 trillion for the first time. As Congress anticipates another battle over federal spending, the country faces the possibility of a federal shutdown unless lawmakers reach an agreement on funding by Jan. 19th. Credit rating agencies, including Moody’s, have expressed concern, with Moody’s recently downgrading its credit outlook on the US to negative from stable due to increased downside risks to the country’s fiscal strength. Fitch had previously lowered America’s credit rating after last summer’s debt ceiling drama.

Trump’s businesses alleged to have profited off his presidency

During Donald Trump’s presidency, his businesses reportedly received over $7.8 million in payments from foreign governments and officials of 20 countries, including China, Saudi Arabia, and Qatar. Democrats on the House Oversight Committee released a report contending that these payments violated the Constitution’s foreign emoluments clause, which prohibits federal officials from accepting money or gifts from foreign governments without Congressional permission. The report argues that these payments occurred while the respective governments were pursuing specific foreign policy goals with the Trump administration and, at times, with Trump himself. The report comes amidst the Republicans’ impeachment inquiry into President Biden, which has sought to tie him to international business deals through his son Hunter Biden.

Corporate/Sector News

Houthi attacks on Red Sea disrupt global shipping

Repeated attacks on global shipping in the Red Sea by Houthi militias have led to a significant rerouting of freight around Africa, bypassing the Suez Canal. This redirection has caused delays and increased costs for transporting goods globally. The expense of transporting a standard 40-foot shipping container by sea has doubled to over $4,000, and shipments to the Mediterranean now cost as much as $6,000. Rerouting around the Cape of Good Hope adds an extra 7 to 20 days to the journey. The impact on US imports is notable, particularly on the East Coast, where over 30% of cargo typically transits through the Suez Canal.

Barclays downgrades Apple

On Tuesday, Apple’s stock fell nearly 3.6% to a seven-week low after Barclays downgraded it due to concerns about weak demand for its devices in 2024. Despite a 50% rise in 2023, Apple has faced a demand slowdown since early last year, with holiday-quarter sales projected below Wall Street estimates. The stock decline erased over $100 billion of Apple’s market capitalization, leading Barclays to downgrade the stock to “underweight” and adjust its 12-month price target to $160.

Carrefour stops selling PepsiCo

Carrefour, the French grocery chain, has removed PepsiCo products such as potato chips, Quaker Oats, Lipton tea, and its namesake soda from its shelves in France due to what it deems “unacceptable price increases.” This action is in response to a new French law aimed at combating the rising cost of living, imposing fines on supermarkets that fail to reach pricing agreements with suppliers by the end of the month. PepsiCo expressed a commitment to ensuring its products remain available. The company has consistently increased prices, contributing to rising profits while impacting sales as consumers opt for more affordable brands.

Recommended Reads

Jacques Delors, who drove EU integration, dies at 98

What Is Happening to Our World?

Is America’s raging bull market exhausted, or taking a breath?

Banking Crisis Plays Out at America’s Smallest Lenders

Patients at Hundreds of Hospitals Have Cheaper Health Care Options Nearby. Why Don’t They Know?

This week from BlackSummit

John E. Charalambakis

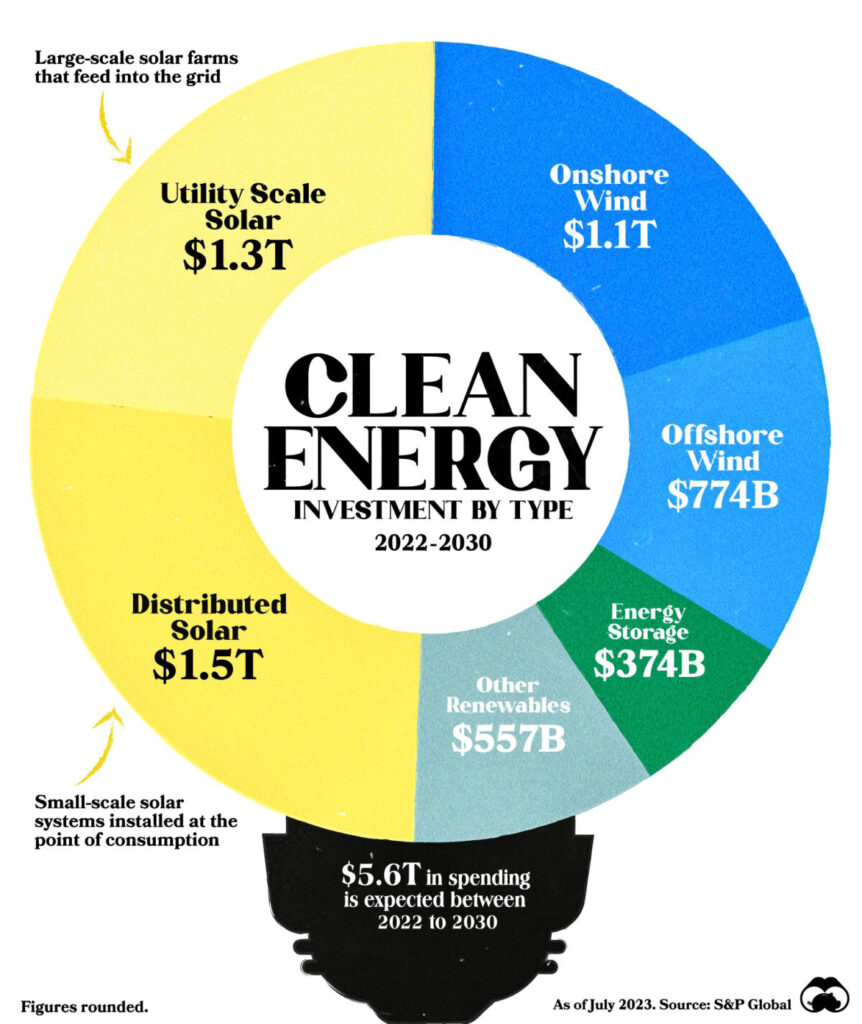

Image of the Week

Video of the Week

Fighting poverty in Europe: Meet the people who are making a difference

Source: France24