Global Market News

Global equities make gains

Global equities made gains this week. The Dow Jones and S&P 500 increased 2.42% and 0.77%, respectively, while the Nasdaq rose 0.38%. The US 10-year Treasury continued its decline, closing the week at 4.21%. The price of a barrel of West Texas Intermediate crude also fell this week, coming down to $74.21. Volatility, as measured by the CBOE Volatility Index, decreased slightly to 12.63.

A strong November

Global equities rallied in November thanks to moderating inflation in the US and Eurozone, decelerating economic growth, and signs that the US might be in the midst of a soft landing. Germany’s DAX rose 13% on the month, while the S&P 500 gained more than 9%, and the Bloomberg US aggregate bond index had its best month since May 1985, rising just over 4.5%. Commodities were the only asset to lose ground last month, led by a decline in oil prices, with West Texas Intermediate crude falling 6%. Investors are pricing in multiple interest rate cuts from the Fed and the European Central Bank next year which has helped propel the rally of the last 6 weeks.

International Developments

Israel/Hamas truce ends, fighting Resumes

The weeklong ceasefire between Hamas and Israel has come to an end, with Israel’s military announcing a resumption of military action against Gaza. The truce saw a cessation of violence and negotiations for the release of 100 hostages in Gaza and 240 Palestinian prisoners. Israel’s military is prompting civilians to leave southern Gaza as the country plans to move further south. The US has urged the Israelis to do more to protect Palestinians, with an estimated 15,000 Palestinian civilians having been killed to date.

COP28 gets underway

The United Nations (UN) sponsored COP28 climate summit has begun in Dubai, United Arab Emirates (UAE). COP28 marks the 28th UN-hosted climate summit and has become all the more relevant as countries attempt to make true on their obligations under the 2015 Paris Climate Agreements. The summit has already achieved some success, as a deal has been struck for a fund that will assist poor countries hit by climate-driven storms and droughts, with the EU, UK, and US already pledging $400 million in aid for the fund.

US Social & Political Developments

George Santos is expelled

New York Representative George Santos has been expelled from the House of Representatives over concerns of serious ethics violations. The vote, which requires a two-thirds majority, passed 311 to 114, with slightly more Republicans voting to keep him than remove him. Santos has not been convicted of a crime; however, he has been charged with 23 counts of wire fraud, identity theft, falsification of records, and credit card fraud, among other charges. Santos’ expulsion is the sixth in the history of the House and the first in twenty years.

Henry Kissinger’s death

Former National Security Advisor and Secretary of State Henry Kissinger has died at 100 years old. Born in 1923, Kissinger advised 12 presidents, from John F. Kennedy Jr. to Joseph R Biden Jr. An academic by trade, he came into major prominence during the Nixon administration, where he served first as National Security Advisor and then as Secretary of State. Kissinger practiced a Machiavellian brand of realism and is credited for the diplomatic overtures that led to the Opening of China, engineered the US withdrawal from Vietnam, and engaged detente with the Soviet Union.

Corporate/Sector News

Sam Altman rehired to OpenAI

There was chaos and confusion in the tech world after Sam Altman, CEO of OpenAI, was fired and then rehired in a week. OpenAI’s board ousted him, putting out an opaque statement claiming that Altman had not been communicating clearly with the board. Quickly, the overwhelming majority of OpenAI’s employees threatened to quit if Altman wasn’t reinstated. Large corporate investors in OpenAI also sought Altman’s return. Altman’s comeback was celebrated by many inside and outside the company, and he announced that Microsoft (which owns 49% of the company) would be taking an official, non-voting observer position on OpenAI’s board.

Humana and Cigna eye merger

Cigna is reportedly in talks for a merger with fellow insurance giant, Humana in a deal that could reach over $60 billion. The merger, which could be finalized by the year’s end, would combine Cigna’s and Humana’s market values of $77 billion and $59 billion, respectively. The two companies have small business overlap, where Humana’s Medicare business is larger than Cigna’s while Cigna has a large presence on the pharmacy side of healthcare. Analysts predict that any deal between the two could face significant hurdles in terms of antitrust scrutiny.

Record holiday weekend shopping

American holiday shoppers over Thanksgiving, Black Friday, and Cyber Monday spent around $38 billion online, a 7.8% increase from last year, with a record 134.2 million people participating in the online shopping bonanza. According to analysts, consumers found better deals online where they can more easily compare prices. Clothing, toys, gift cards, books, video games, and beauty products were the winners of the spree. Analysts are watching holiday spending this year closely for signs that consumers may be scaling back their spending due to inflation and high interest rates, but a strong job market, wage growth, and savings have kept the American consumer resilient.

Recommended Reads

Now for Some Good News About Climate

Slicing and dicing historical equity returns

Gold prices hit 6-month high as investors bet on rate cuts

Jim Rogers warns that global ‘good times’ are nearing the end

Tyrant, liberator, warmonger, bureaucrat: the meaning of Napoleon

This week from BlackSummit

Oh My: Wild Market Moves and Geopolitical Hubris from Aeschylus to Shakespeare’s Coriolanus, Part II

John E. Charalambakis

The BlackSummit Team

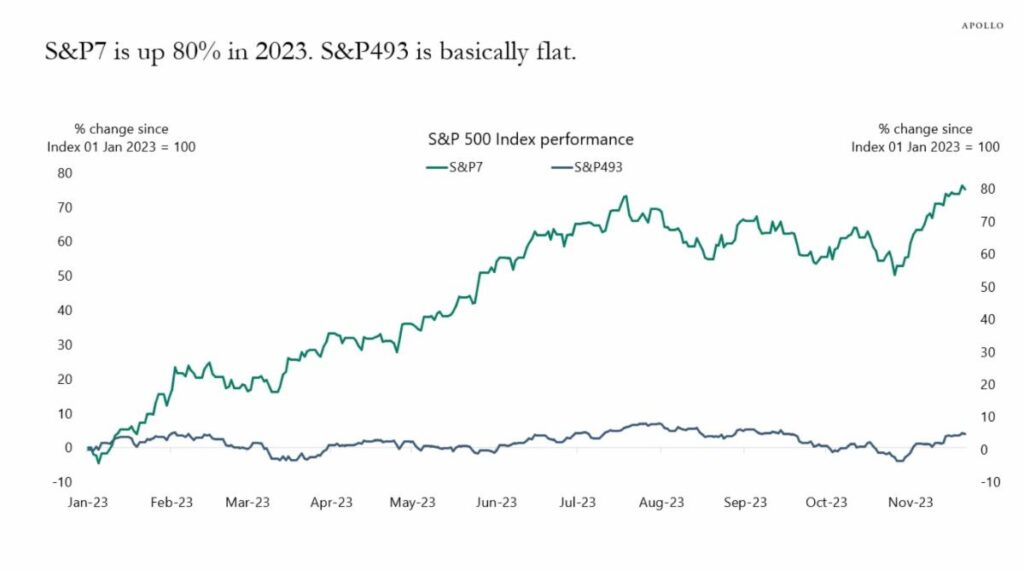

Image of the Week

Note: The S&P7 is the Magnificent 7: Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla.

Video of the Week

The race to improve weather forecasting

Source: The Economist