Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : October 21, 2023

Global Market News

Global equities tumble

Global equities were lower on the week amid high Treasury yields and increasing concerns that the conflict between Israel and Hamas could expand into a wider regional conflict. The Dow Jones declined 1.61% on the week, while the S&P 500 tumbled 2.39%, and the Nasdaq dropped 3.16%. The US 10-year Treasury hit its highest level since 2006 this week, nearing 5% and settling Friday at 4.91%. Meanwhile, the price of a barrel of West Texas Intermediate crude continued to climb, closing Friday at $88.75. Volatility, as measured by the CBOE Volatility Index, closed the week at 21.71.

IMF warns China of “Japanization”

This week, the International Monetary Fund (IMF) warned China of the risks of “Japanization”, a term used that defines the prolonged deflation and economic stagnation experienced by Japan after the burst of an asset-inflated bubble in the late 1990s. The IMF says China is running the risk of bursting its property bubble which could lead to a period of low growth and deflation. Both the IMF and World Bank have identified China’s real estate crisis as among the biggest risks to global growth.

International Developments

Israel weighs ground invasion amid spiraling humanitarian crisis

Fighting between Hamas and Israel continued this week as Israel launched a full siege on Gaza, bombing the territory by land, air, and sea. The city’s 2.3 million residents have been cut off from power, food, and water, and the healthcare situation has become increasingly dire as thousands of civilians have been injured. After many days, negotiators finally came to an agreement on allowing humanitarian aid to pass through the Rafah crossing, an area between Gaza and Egypt. A 20-truck convoy with life-saving supplies made its through to Gaza today, but humanitarian officials are warning this will not be enough to address the crisis and urged for more support. Despite warnings from its US ally and other international actors, Israel continues to weigh a potential ground invasion into Gaza. Meanwhile, cross-border fire between Israeli forces and Iran-backed Hezbollah in Lebanon has been reported, sparking fears that the conflict will spread into a broader regional war.

US eases sanctions on Venezuela

The government of Venezuelan President Nicolas Maduro and primary opposition members signed an agreement this week committing to free and fair elections next year. The deal was a prerequisite to the ease of US sanctions on Venezuela. Following the announcement, the White House suspended sanctions on Venezuelan oil, gas, and gold production and also lifted some restrictions on bond trading. News of the sanctions relief eased oil prices as new supply is expected to come onto the market following the deal.

US Social & Political Developments

Biden addresses the nation to garner support for aid to Ukraine and Israel

President Biden addressed the nation Thursday night to call for the continued support of Ukraine and Israel as we reach an “inflection point in history.” In his speech, he urged Congress to support new military aid for Israel and Ukraine. On Friday, he asked Congress for $105 billion in an emergency government funding package that includes $10.6 billion to support Israel and $61.4 billion for Ukraine. The request also includes $9 billion in humanitarian assistance for Israel, Gaza, and Ukraine.

House remains without speaker

President Biden’s emergency funding request went to a still-leaderless House of Representatives. Rep. Jim Jordan’s bid for the position ended Friday after a third failed vote, making the speakership up for grabs once again. Without a speaker, the House remains at a standstill. The several failed attempts at voting for a speaker reveals the fractured Republican Party’s inability to unite. New potential candidates have until Sunday at noon to file if they want to be considered for the position.

Corporate/Sector News

Beijing restricts exports of graphite

Beijing announced new export restrictions on graphite, a key component of electric vehicle (EV) batteries. China is the world’s largest producer of natural and synthetic graphite. This latest move comes amid heightened tensions with both the US and Europe in the EV sector. Earlier this week, the US issued additional controls on exports of microchips to China.

Devon Energy eyes major acquisition targets

Devon Energy is eyeing major acquisition targets as it seeks to expand its role in the US shale industry. The company has held preliminary talks with Marathon Oil and is also interested in CrownRock, a Permian Basin producer that is looking at a potential $10 billion sale. The news from Devon Energy comes on the heels of Exxon Mobil’s announcement that it will buy Pioneer Natural Resources for $59.5, demonstrating a trend of consolidation in the US oil industry.

US-EU steel deal stalls

So far, the US and European Union have failed to reach a deal on steel and aluminum preventing them from being able to announce a so-called Global Arrangement on Sustainable Steel and Aluminum at a summit in Washington on Friday. Negotiations will continue in an attempt to meet the year-end deadline. The dispute on the commodities arose when former President Donald Trump imposed tariffs on metals imports from Europe, citing national security risks. If officials do not reach an agreement by the end of the year, tariffs on $10 billion of exports between the US and EU would automatically come back into force in 2024.

Recommended Reads

10 maps to understand Gaza’s tumultuous history

China’s Economy Gets a Boost From Beijing, but Housing Woes Persist

Climbing Mortgage Rates Are Keeping Home Buyers Away. Brace for Another Hit.

These Companies Are Being Squeezed by Higher Rates

Automakers Have Big Hopes for EVs; Buyers Aren’t Cooperating

This week from BlackSummit

The BlackSummit Team

The BlackSummit Team

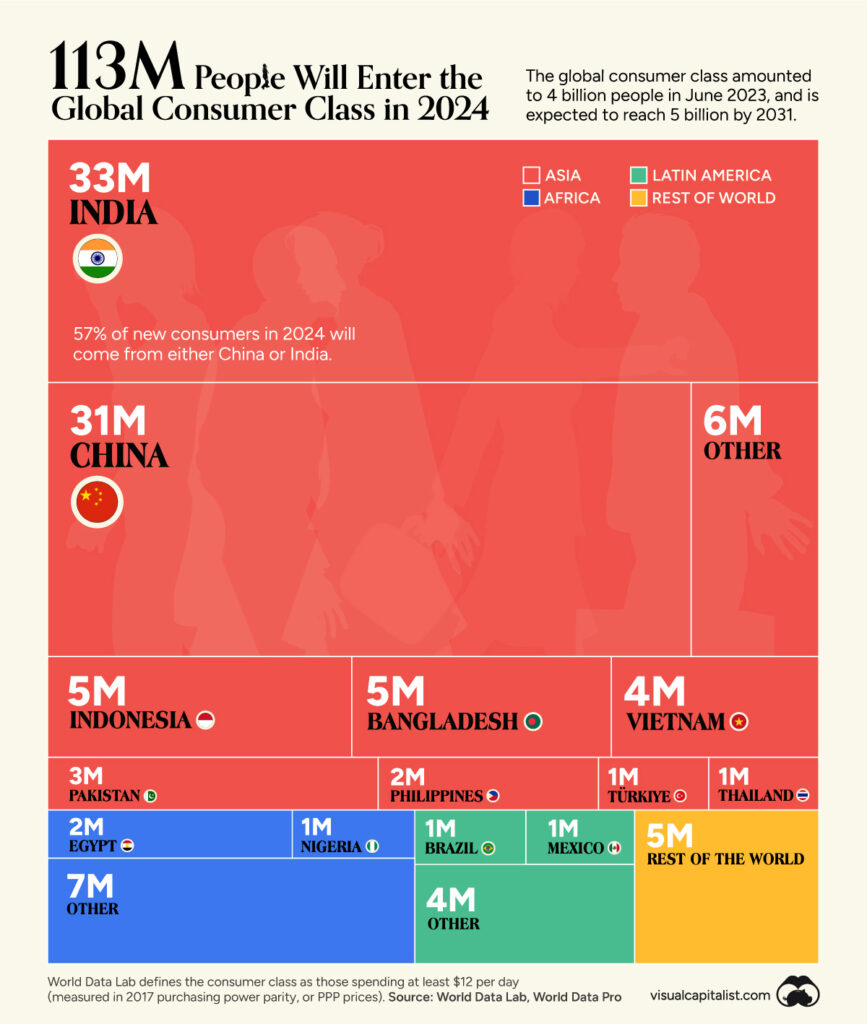

Image of the Week

Video of the Week

The Potential Fallout of a Widening Israel-Hamas War

Source: Bloomberg