Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : September 30, 2023

Global Market News

Global equities decline

Global equities extended losses this week. The Dow Jones declined 1.34%, while the S&P 500 fell 0.74%. On the other hand, the Nasdaq was barely positive on the week, rising 0.06%. The US 10-year Treasury yield continued to rise, ending the week at 4.58%. Meanwhile, the price of a barrel of West Texas Intermediate crude ticked up slightly to $90.88. Volatility, as measured by the CBOE Volatility Index, closed Friday nearly unchanged on the week at 17.52.

China’s monetary policy and embattled developers

The People’s Bank of China said on Wednesday that it would be implementing monetary policy adjustments to support the country’s economy. The central bank claims that the recovery is improving with “increasing momentum” despite a slew of disappointing economic data over the last month that may say otherwise. Meanwhile, China’s property sector crisis intensified this week as developer Evergrande was forced to halt the restructuring of its $340 billion in debt while its billionaire chair is under investigation for suspicion of illegal crimes. The announcement prompted the trading of Evergrande shares to be suspended on Thursday.

International Developments

Leaders of Nagorno-Karabakh announce its dissolution

The president of the self-declared Nagorno-Karabakh Republic, Samvel Shahramanyan, has declared the dissolution of all state institutions of the breakaway republic by January 1, 2024. The region has ruled itself, in contravention of its recognition internationally as a part of Azerbaijan, since 1988 and been at the focal point of armed conflict between Azerbaijan and Armenia since. As a result, as many as 93,000 Armenians from Nagorno-Karabakh have fled the region, with expectations that all 120,000 Armenians may ultimately flee.

European leaders discuss migration amid rising migrant deaths

Leaders of nine Mediterranean and southern European countries met in Malta to discuss migration this week. The meeting comes on the heels of an announcement by the United Nations refugee organization that as many as 2,500 migrants had died or disappeared attempting to cross the Mediterranean so far this year. To remedy the issue, the European Union (EU) is poised to revamp its Pact on Migration and Asylum so as to relieve some of the pressure on frontline countries, like Greece and Italy, by relocating some arrivals to other countries. Paris and Rome are spearheading the initiative and reports indicate the disagreements among EU member states have been largely overcome.

US Social & Political Developments

A government shutdown expected Sunday

A government shutdown is swiftly approaching as House Republicans have to date proven unable to pass a funding package that will pass the Senate. A stopgap measure, such as the one being pulled together in the Senate, likewise seems dead on arrival, as House Republicans continue to balk at passing a stopgap funding bill. While the Republican House has passed some spending bills, they are not expected to survive the Senate. With the Saturday night deadline looming, it currently looks like a government shutdown is imminent. Meanwhile, tensions are mounting within the Republican caucus itself, and removing Kevin McCarthy from his role as House Speaker is becoming increasingly likely.

Republican presidential hopefuls debate

The second Republican presidential debate took place on Wednesday, which was again skipped by former president and Republican frontrunner Donald Trump. Viewership for the debate declined by 25%, down from around 13 million people tuned into the first to about 9.5 million during the second. While candidates such as DeSantis, Haley, and Ramaswamy had their moments, the debate is not expected to move the needle, with Republican voters broadly backing Donald Trump.

Corporate/Sector News

Low oil inventories cause worry

New data out of Cushing, Oklahoma, the US major oil storage hub, showed a drop in inventories. This news comes as worries about tight global supply are plaguing the market, sending WTI crude futures to $95 per barrel earlier this week, before settling back around $90. The depleting supply has exacerbated the production cuts from Saudi Arabia and Russia, which have recently been extended. Signs are pointing to an extended period of high oil prices.

FTC sues Amazon on antitrust grounds

The Federal Trade Commission, along with 17 states, has filed an antitrust lawsuit against Amazon, alleging that the company has enforced its monopoly on online shopping by putting pressure on merchants and favoring its own products, making it impossible for rivals to compete. The FTC’s effort is another in a growing list of actions against large tech companies, which includes the commission’s efforts to block Microsoft’s acquisition of Activision and its ongoing suit against Google.

Writer’s strike ends

The Writers Guild of America announced that its strike, which lasted for 148 days, would be ended after agreeing to a deal with the Alliance of Motion Picture and Television Producers. The strikes severely slowed production in the industry, and occurred due to writers fighting for streaming residuals and protections against artificial intelligence use in the film industry. The deal still needs to be ratified by union members in a vote lasting from October 2 to October 9.

Recommended Reads

U.S. Economy Could Withstand One Shock, but Four at Once?

Why Are Tech Stocks Down? Bond Yields Are Up

The US is on the brink of a new growth cycle

What Asia’s economic revolution means for the world

This week from BlackSummit

John E. Charalambakis

The BlackSummit Team

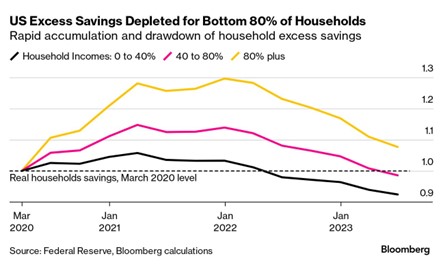

Image of the Week

Video of the Week

The Threat of an American Debt Crisis

Source: Bloomberg