Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : September 16, 2023

Global Market News

Global equities are mixed

Global equities had mixed results this week. The Dow Jones rose only 0.12%, while the S&P 500 fell 0.16%. The Nasdaq also fell 0.39% on the week. The US 10-year Treasury rose a few basis points to 4.33%. Meanwhile, the price of a barrel of West Texas Intermediate crude rose more than 4%, ending the week at $91.11. Volatility, as measured by the CBOE Volatility Index, rose to 13.95.

Inflation rises slightly before Fed meeting next week

The most recent inflation data showed that prices slightly increased, driven mostly by a spike in gasoline prices. Despite the uptick, markets predict no future rate hikes for next week’s Fed meeting, but analysts believe that the central bank will still leave the option on the table to keep downward pressure on inflation. Across the pond, the European Central Bank decided to raise interest rates by 0.25% to a record-high 4% as inflation remains stubborn.

International Developments

Natural disasters plague Libya and Morocco

Separate disasters in Libya and Morocco have caused significant devastation to both countries. In North Libya, flooding due to Mediterranean storm Daniel broke dams and submerged entire neighborhoods in multiple coastal towns. The greatest destruction is in the city of Derna, with the death toll rising to over 5,000 dead and 30,000 missing. Meanwhile, Morocco was hit with a magnitude 6.8 earthquake at a shallow depth, amplifying the destruction from the event. Almost 3,000 Moroccans have been killed and as many injured, with the Al Haouz province hit the hardest.

Flurry of activity, from EVs to expansion, from EU

European Commission President Ursula von der Leyen announced anti-subsidy investigations into Chinese electric vehicles, a move strongly supported by France. The decision follows a flood of cheaper Chinese electric vehicles into the European market, weakening European domestic manufacturers. The EC president is arguing that Chinese state subsidies for the electric vehicle manufacturing industry is keeping prices artificially low, causing European cars to become less competitive to produce. Beyond EVs, the EC president has called for additional EU expansion into Ukraine, Moldova, several Western Balkan nations, and Georgia.

US Social & Political Developments

McCarthy announces impeachment inquiry into President Biden

House Speaker Kevin McCarthy has announced the opening of an impeachment inquiry into President Biden over the president’s son Hunter Biden’s business dealings. Specifically, the inquiry is targeting bank records and other business-related documents and serves as a way for Speaker McCarthy to placate Republican hard-liners. The inquiry will be led by House Oversight Committee chairman James Comer, House Judiciary Committee chairman Jim Jordan, and House Ways and Means Committee chairman Jason Smith.

US Deepens Relations With Vietnam, Bahrain

The US has deepened relations with both Vietnam and Bahrain. With Vietnam, the US is to enter into a “comprehensive strategic partnership” with Vietnam. While the designation is symbolic, it marks the US as a partner of the highest order in Vietnam and puts the US into a category reserved until now for just four countries: China, Russia, India, and South Korea. Meanwhile in the Gulf, the US has entered into a security agreement with Bahrain to defend the country from attacks in a bid to counter Iranian influence in the region.

Corporate/Sector News

Google goes to trial in Washington

The Justice Department has taken Google to court, arguing that the company abused its monopoly in the search engine business in the government’s first major monopoly case to go to trial in decades. Google, under its parent company Alphabet, has 90% of the US search engine market. The company is claiming that consumers can easily choose another search engine and that Google’s dominance is because people prefer it over the competitors.

California passes bill requiring companies to disclose emissions data

A bill is headed to California Governor Gavin Newsom’s desk which would require large companies operating in the state to publicly release their greenhouse gas emissions. The bill is the first that would require firms to do so, and was heavily opposed by business interests in the state. The bill only affects firms with annual revenues exceeding $1 billion, and was praised by tech companies and environmental groups alike.

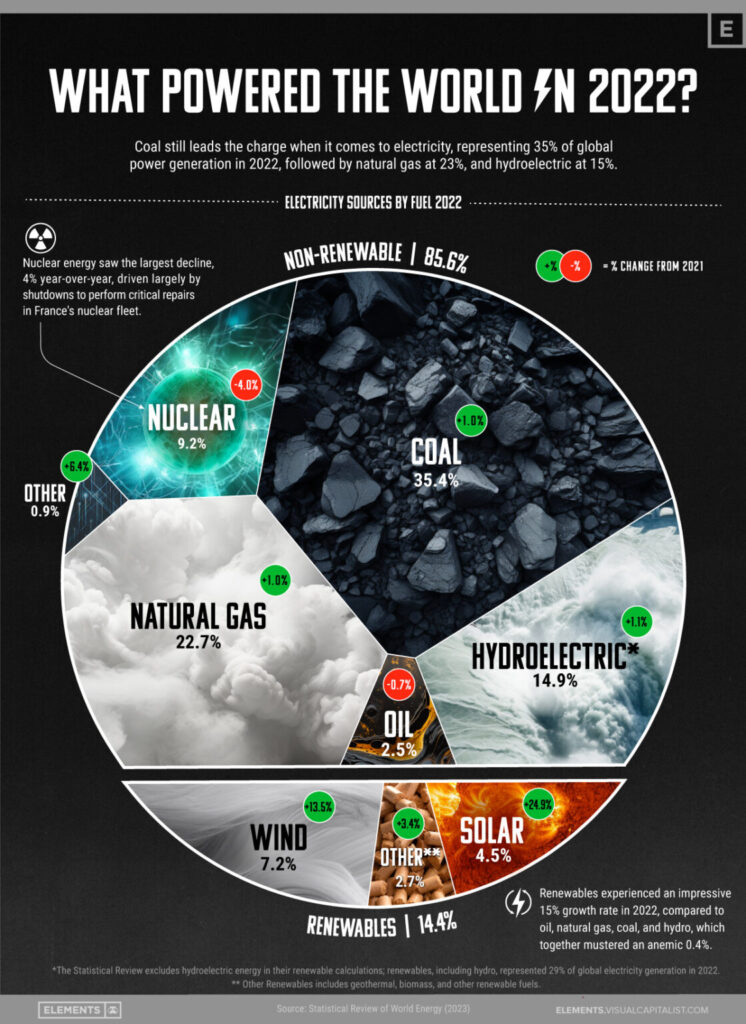

Demand for major fossil fuels to peak before 2030

The head of the International Energy Agency (IEA) forecasted that demand for all three major fossil fuel energy sources (oil, coal, and natural gas) will peak sometime before 2030. This is the first time that the IEA predicted a peak in demand for all three energy sources, and it was based on data from the agency’s annual report to be released next month. The IEA said that the recent flurry of climate policies as well as high energy prices will be the main factor in driving the transition away from fossil fuels in the near future.

Recommended Reads

What Ancient Greek Tragedies Can Teach Us About Grief

George W. Bush: Michael Gerson’s words make the case for saving PEPFAR

Meet Javier Milei, the front-runner to be Argentina’s next president

Earnings Estimates Are Rising, a Welcome Sign for 2023 Market Rally

How the U.S. Stumbled Into Using Chips as a Weapon Against China

This week from BlackSummit

The BlackSummit Team

The BlackSummit Team

Image of the Week

Video of the Week

How the Panama Canal’s Drought Is Threatening Global Supply Chains

Source: The Wall Street Journal