Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : September 2, 2023

Global Market News

Global equities make gains

Global equities made gains this week. The Dow Jones and S&P 500 rose 1.43% and 2.50%, respectively, while the Nasdaq climbed 3.25% on the week. The US 10-year Treasury dropped a few basis points but remained high at 4.18%. On the other hand, the price of a barrel of West Texas Intermediate crude surged more than 7%, ending the week at $85.98. Volatility, as measured by the CBOE Volatility Index, declined to 13.09.

US unemployment rate gives hope for soft landing

The recent jobs report showed that US unemployment ticked up to 3.8% from 3.5%, showing that the labor market may be loosening. Additionally, the labor force participation rate rose to 62.8%, the highest since the Covid pandemic. Average hourly earnings went up 4.3% year over year in August, slower than July’s 4.4%. This is good news for the Fed, and markets have lowered their prediction of a further rate hike before the end of the year to 35%.

International Developments

Coup in Gabon rattles West Africa

Gabon has become the latest in a wave of military coups across Africa, with the military having deposed the recently elected president Ali Bongo Ondimba under allegations of election fraud and corruption. The power grab has been met with a swell of support within Gabon itself, while the African Union moved swiftly to suspend Gabon’s participation in the African Union and strongly condemned the coup. The move deposed the Bongo family’s political dynasty, whose rule has been ongoing since 1967. The military junta has put forth General Brice Oligui Nguema as transition leader, with details murky as to what government the putschists plan to transition to.

Libya rejects normalization with Israel

Libya on Thursday publicly rejected normalization with Israel following a secret meeting between the Israeli and Libyan foreign ministers. The meeting, which was revealed on Sunday by Israeli Foreign Minister Eli Cohen’s office, swiftly led to the suspension of Libyan foreign minister Najla Mangoush within hours as details became public. The decision ignited protests in several Libyan cities. Currently, it is illegal under Libyan law to normalize ties with Israel due to a law dating from 1957, which has remained on the books due to strong support for Palestine within the country. As Israel seeks to normalize with its neighbors through the Abraham Accords and other agreements, the Palestine issue continues to shape the politics of the region.

US Social & Political Developments

Student loans to begin accruing interest again

Interest on student loans is set to resume September 1st, as the three-year federal pause on payments finally sunsets. This comes one month ahead of the first round of student loan payments for American borrowers, which will be due October 1st. To facilitate a “soft landing” for borrowers, the Biden administration has instituted an “on ramp” whereby missed or partial payments will not be reported to credit bureaus or sent to collections agencies and loans will not default during the first 12 months.

FEMA restricts spending as disaster fund runs out

Natural disasters throughout the year, including dozens of storms and wildfires, have forced the Biden administration to restrict funding from the Federal Emergency Management Agency (FEMA) to help states rebuild from past disasters and instead use funds only for “life-saving measures” as the agency runs out of funding. The restrictions come on the backdrop of Hurricane Idalia, a category 3 hurricane that made landfall on the Florida Gulf Coast coastline this week. The administration is currently requesting an additional $4 billion in disaster relief to replenish the fund, which is expected to be taken up swiftly in the Senate.

Corporate/Sector News

Hollywood strike continues

The writers’ guild strike is entering its fifth month, while the actors’ strike begins its second, with negotiations with studios hitting a stalemate after the Writers Guild of America (WGA) claimed the studios’ counterproposal was vastly insufficient. Like the last strike in 2007-2008, the stoppages are costing money. This time, however, the damage is likely to be doubled; according to analysts, the 2007-2008 strike cost $2.5 billion. Today’s looks like it may cost upwards of $5 billion, as it has impacted restaurants, catering companies, trucking agencies, dry cleaning businesses, and others. Delayed films and lost wages make up much of the loss.

Apply reshuffles its supply chain

Apple has begun testing 3D printers in the manufacturing process of new Apple Watches, potentially making its supply chain more efficient and reduce its environmental impact. This report comes after Foxconn, Apple’s supplier, said it would begin manufacturing iPhones in India by April 2024, gradually moving out of China. Together, the two developments show that Apple is rethinking their supply chain with efficiency, environmentalism, and geopolitics in mind.

Dutch chipmaking export controls go into effect

The Netherlands began enforcing new export controls on advanced microchip production machines to China on Friday. The controls were part of a three-way deal between the US, the Netherlands, and Japan to restrict Chinese access to technology that the US fears would be used by the Chinese military. European critics of the export controls argue that the Dutch gave in to Washington’s pressure in its competition with Beijing.

Recommended Reads

Biden’s course for U.S. on trade breaks with Clinton and Obama

EV Boom Remakes Rural Towns in the American South

Why Tribalism Took Over Our Politics

Demography Is Destiny in Africa

The Manhattan Project to Wean the World Off Russian Uranium

Clogged Courts Worsen U.S. Immigration Crisis

This week from BlackSummit

The BlackSummit Team

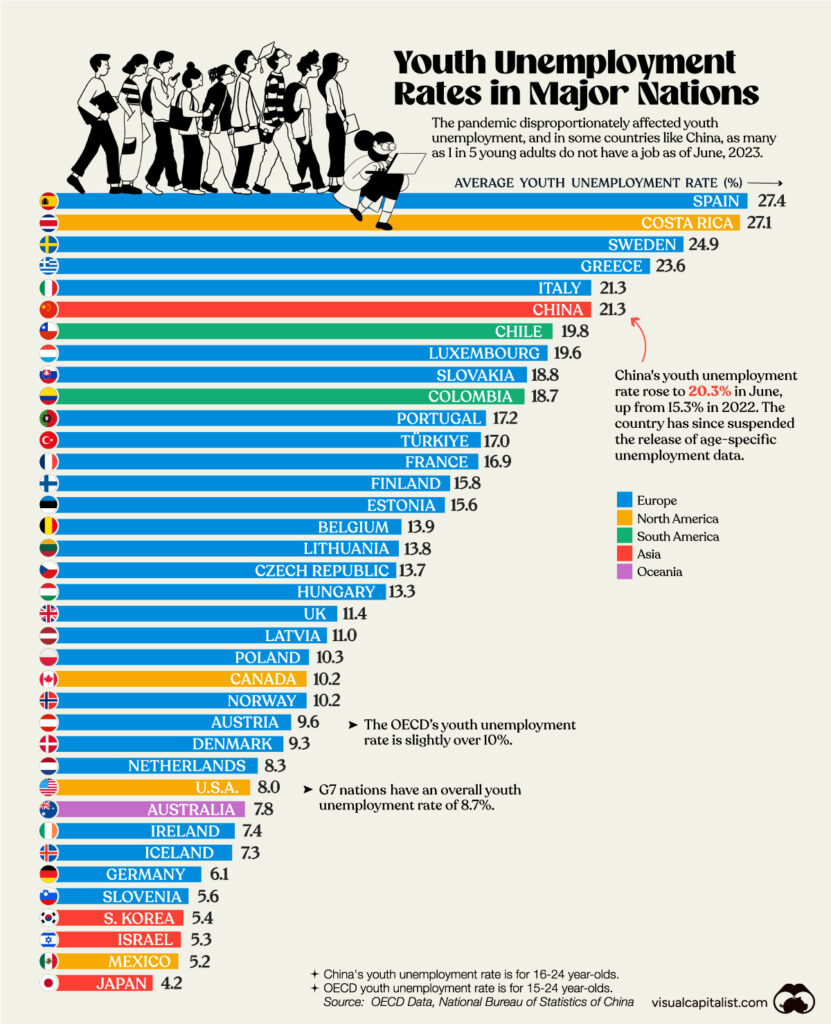

Image of the Week

Video of the Week

Source: Bloomberg Originals