Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : July 22, 2023

Global Market News

Global equities mixed

Global equities were mixed this week as several disappointing tech earnings reports came out. The S&P 500 and Dow Jones closed up 0.69% and 2.08%, respectively, while the Nasdaq closed down 0.57%. The US 10-year Treasury ticked up a few basis points to 3.83% while the price of a barrel of West Texas Intermediate crude oil increased about 2% to close Friday at $76.96. Volatility, as measured by the CBOE Volatility Index, was roughly unchanged on the week, closing at 13.80.

Fed to launch “FedNow” instant-payments system

The Federal Reserve has launched its “FedNow” instant-payments system, bringing the antiquated US banking system in line with several other countries, including Brazil, India, the European Union, and the United Kingdom, that have had similar payment platforms in place for years. FedNow is supported by 57 financial institutions including JPMorgan Chase, Bank of New York Mellon, and Wells Fargo, allowing consumers to instantaneously settle transactions directly via central bank accounts. The new system presents a new competitive challenge to closed peer-to-peer networks like PayPal and Venmo.

International Developments

Global wheat prices rise as Russia exits grain deal, attacks Ukrainian ports, and threatens shipping

Global wheat prices have continued to rise in the wake of Russia’s decision to decline to renew its participation in the grain deal that saw safe passage for vessels shipping wheat from Ukrainian ports. Further exacerbating the situation is (1) a statement released by the Russian Ministry of Defense seemingly threatening vessels going to port in Ukraine and (2) renewed Russian assaults against ports such as Odesa and Mykolaiv that have damaged infrastructure and incinerated some 60,000 tons of grain. Still, excellent harvests across a range of countries, including Russia, Austria, and Brazil are likely to fill the void, as prices remain below pre-war levels.

Thailand’s political turmoil continues

Thailand remains without a prime minister as the election-winning Move Forward party’s nominee, Pita Limjaroenrat, has been shot down for a second time by the military-backed Senate. While the lower house saw Move Forward and the runner-up populist party Pheu Thai trounce their conservative, military-backed rivals in elections on May 14, the Senate remains composed of members appointed by the royalist army after the 2014 coup with a history of consolidating as a bloc whenever their interests are perceived as threatened. Despite the people’s proven desire for political change and progress as evidenced by Move Forward’s election win, the political crisis has highlighted the major democratic backsliding Thailand has undergone over the last several years.

US Social & Political Developments

Biden to auction offshore wind rights in Gulf of Mexico

The US government has announced the first auction for offshore wind power in the Gulf of Mexico totaling more than 300,000 acres off the coasts of Louisiana and Texas. The wind energy lease has the potential to generate about 3.7 GW and power almost 1.3 million homes. The auction is set for August 29. The Biden administration’s efforts to boost US wind power is a critical component of the nation’s green energy transition and will increase the amount of renewable energy going to the US electricity grid.

Kerry wraps up climate meeting with China as US notches extreme temperatures

Special Presidential Envoy for Climate John Kerry has finished three-day talks with China in Beijing with no agreement in hand. In fact, Xi Jinping in a speech stated that China, which is responsible for almost a third of all global emissions, would reduce its carbon emissions at its own pace in its own way. Ironically, the talks come as several regions of the US endure extreme heat waves contributing to the world’s two hottest weeks on record in the last few decades.

Corporate/Sector News

TSMC’s Arizona plant hit by skilled labor shortage

Chipmaker Taiwan Semiconductor (TSMC) has announced a delay in the start of production at its factory in Arizona due to a shortage of skilled workers. This comes as a blow to the Biden administration which has focused on semiconductors and chipmaking as an area of strategic competition with China. The firm has announced that production in the US will commence in 2025.

Exxon Mobil announces massive lithium plant in Arkansas

Exxon Mobil has announced plans to build lithium processing facilities in Arkansas, which could produce over 100,000 tons of the metal annually. Lithium, a critical material used for EV batteries, is present in the brine that fills abandoned oil and gas wells in Southern Arkansas. The production capacity of the planned facilities would be around 15% of the world’s total lithium production.

AI reveal pushes Microsoft’s stock to all-time high

Microsoft’s share price hit an all-time high on Tuesday, closing at $359.49, after revealing Microsoft 365 Copilot, an AI-powered version of the platform. The company’s market cap rose to $2.67 trillion, the latest to enjoy the AI boom. The AI tool will join the competition from Google, Salesforce, and other big tech companies.

Recommended Reads

Watch Out for the Fake Tom Cruise

J. Robert Oppenheimer’s Defense of Humanity

Why people struggle to understand climate risk

Wheat prices spike after Russia raises tensions in the Black Sea.

This week from BlackSummit

The Anatomy of Underpinning Upheavals, Part III: Money, Kant, and the Platonic Shadows

John E. Charalambakis

The BlackSummit Team

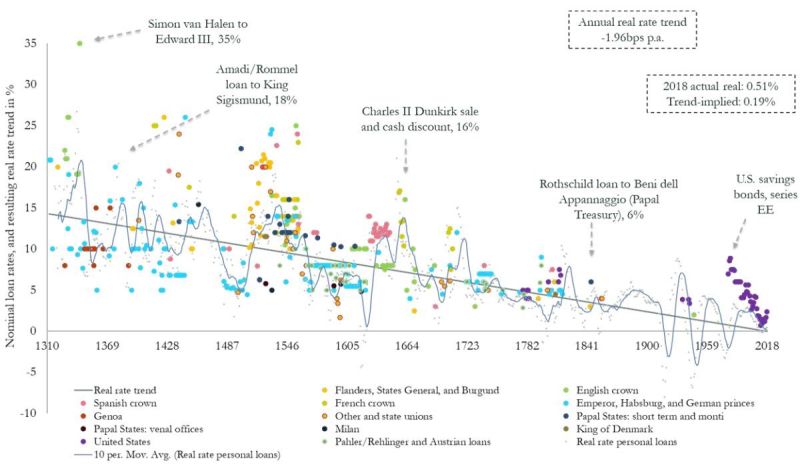

Image of the Week

Video of the Week

Battle under the waves over undersea cables

Source: Financial Times