Global Market News

Global equities slightly positive

Global equities made small gains on the week. The S&P 500 and Dow Jones closed up 0.87% and 0.86%, respectively, while the Nasdaq gained 1.28%. The US 10-year Treasury yield dropped 13 basis points to end the week at 3.44%. The price of a barrel of West Texas Intermediate crude oil dropped slightly to end the week at $76.74. Volatility, as measured by the CBOE Volatility Index, continued to decline, closing Friday at 15.78.

Concern over debt ceiling fuels short-term bond buying

Concerns that the U.S. government may hit its debt ceiling in the upcoming months are leading to investors flocking to short-term, low-risk Treasury bills. As a result, the yield spread between one-month and three-month bills rose as high as 175 bps, its highest level since one-month bills were introduced in 2001. The Treasury has decreased its issuance of short-term debt as it nears the debt limit, but is expected to reverse course once the debt ceiling is raised. This development comes as the May FOMC meeting is coming up, where markets are predicting an 80% probability of a 25 bps Fed Funds rate increase.

International Developments

21 killed in Russian missile strikes

Kyiv experienced its first Russian missile and drone attack in almost two months early Friday. No targets were hit, and Ukraine’s air force reported that it intercepted 11 cruise missiles and two unmanned aerial vehicles over the city. The city of Uman, around 134 miles south of Kyiv, was also struck and 21 people were killed. The majority of the deaths resulted from two missiles hitting an apartment building at night. The missile and drone attacks are part of a continuing Russian tactic to degrade Ukraine’s infrastructure and inflict weariness upon its people.

Conflict rages in Sudan

Fighting has continued in Sudan in contravention of a recent three-day ceasefire extension, with fears of conflict escalation mounting. In response, nations such as China and Turkey have engaged emergency missions to evacuate civilians caught in the country, with the Chinese, for instance, sending warships to assist in evacuation. While the US recently evacuated embassy staff from its mission in Khartoum, the US government has deemed it unsafe to conduct widespread rescue operations of other US citizens still in country, resulting in criticism of Washington’s response to the emergency situation on the ground.

US Social & Political Developments

US House passes debt ceiling bill

The House of Representatives passed a bill to raise the U.S. government’s $31.4 trillion debt ceiling which would include large spending cuts over the next ten years. While the bill isn’t expected to pass in the Senate, it does represent a win for Republican House Speaker McCarthy. The Republicans hope to engage Democrats in negotiations for cutting spending in order to raise the debt limit while Democrats oppose any spending cuts.

Joe Biden announces reelection bid

President Joe Biden on Tuesday announced his run for reelection, framing the announcement as a chance to restore the nation’s character. Biden is expected to secure the Democratic nomination, with no major Democratic challengers expected to emerge. Nonetheless, recent surveys have shown little enthusiasm for a second Biden term, even among Democratic voters. Biden is currently the oldest sitting president at 80 years old.

Corporate/Sector News

Bed Bath and Beyond declares bankruptcy

Bed Bath and Beyond has filed for bankruptcy after recent efforts at turning its business around came up short. The company’s stock fell nearly 40% in Monday’s premarket. The company is in the process of finding buyers for its assets. Bed Bath and Beyond has said it will keep its stores and websites open until it begins to formally wind down its operations, and the company has already started a liquidation sale. The firm owes around $5.2 billion to its creditors but has only $4.4 billion total assets as of its last filing.

UK blocks Microsoft’s attempt to acquire Activision Blizzard

The UK’s antitrust regulator has blocked Microsoft’s purchase of Activision-Blizzard over concerns that the acquisition will reduce competition in the cloud gaming marketplace. The deal, announced last year, is estimated at $69 billion. Activision stock plunged 11% on Wednesday, while Microsoft gained 8%. The ruling by UK regulators is the first decision in a line of inquiries aimed at the acquisition by government agencies, with the US Federal Trade Commission having sued to block the takeover and the European Union currently evaluating the move.

Disney sues DeSantis on First Amendment grounds

Disney has filed a First Amendment lawsuit against Florida Governor DeSantis and a five-member board that oversees Disney’s administrative district in federal court, claiming “a targeted campaign of government retaliation” against it. The lawsuit comes amidst the backdrop of an increasingly aggressive campaign by DeSantis, backed by Florida’s legislature, to target Disney, starting with stripping Disney of its ability to govern its resort as if it were a county. Other more recent measures include, but are not limited to, subjecting Disney to new ride inspection regulations and imposing tolls on roads leading up to Disney.

Recommended Reads

Japan Is Quietly Becoming a Regional Security Power

The Upside of Rivalry: India’s Great-Power Opportunity

Order of Oppression: Africa’s Quest for a New International System

Macron’s vision of a more muscular Europe is coming true

What is really going on between Russia and China

A Corporate Credit Crunch Is Just Getting Started

US Stock Bulls Ignore 100 Years of Recessions at Their Peril

This week from BlackSummit

The BlackSummit Team

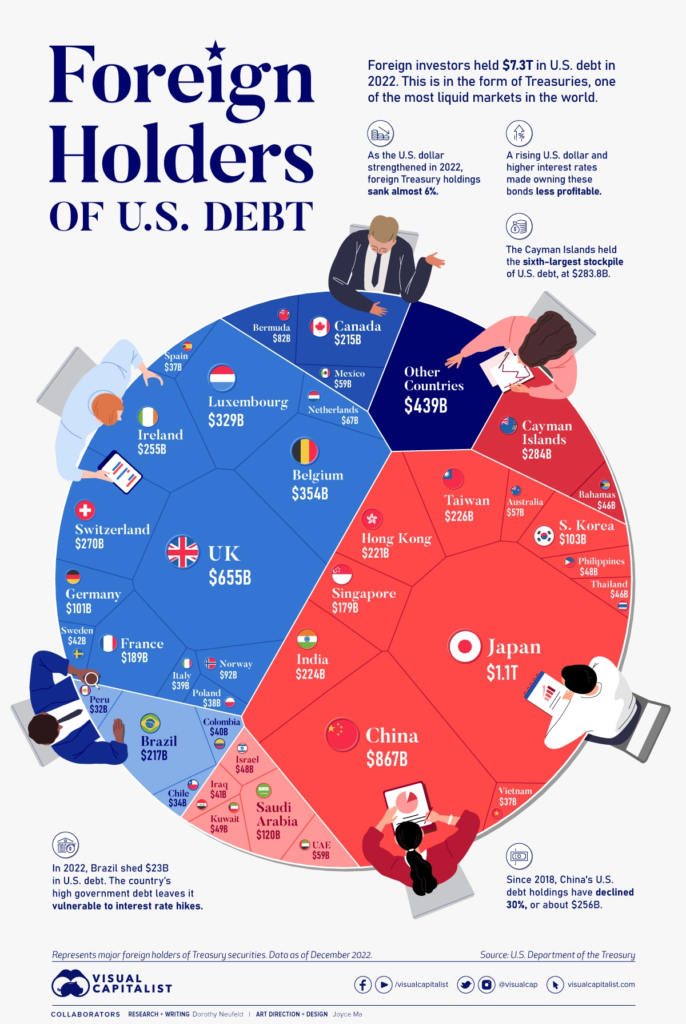

Image of the Week

Video of the Week

Europe’s First $500 Billion Company

Source: DW News