Global Market News

Global equities make gains

Global equities were positive on the week despite a turn on Friday. The S&P 500 and Nasdaq rose 1.62% and 3.31% respectively, while the Dow Jones declined 0.15%. The yield on the US 10-year Treasury increased slightly to 3.52%. The price of a barrel of West Texas Intermediate crude oil dropped more than 8% to end the week at $73.24. Volatility, as measured by the CBOE Volatility Index, remained relatively unchanged at 18.33.

Fed raises rates

Aligning with market expectations, the Federal Reserve raised its benchmark interest rates by 0.25%. The Federal Funds Rate was increased within the target range of 4.5%-4.75%, the highest rate since October 2007. In his post-meeting news conference, Fed Chairman Jerome Powell said, “Inflation data received over the past three months show a welcome reduction in the monthly pace of increases… And while recent developments are encouraging, we will need substantially more evidence to be confident that inflation is on a sustained downward path.” Markets were unsteady on the news of continued rate hikes as investors weigh a potential recession.

International Developments

Lebanon devalues currency by 90%

Lebanon is set to adopt an exchange rate of 15,000 pounds per US dollar on February 1st, which represents a 90% devaluation from the old rate of 1,507 per dollar. The move comes in response to a key IMF funding requirement that Lebanon unify its multiple exchange rates in order for it to receive a $3 billion loan. The new rate will nonetheless remain significantly below both the central bank’s Sayrafa exchange platform rate of 38,000 pounds per dollar and the parallel market’s rate at around 57,000 per dollar. While this is the first time in 25 years that the currency has been officially devalued, it has crashed over the last few years due to government mismanagement and decades of corruption.

Indian parliament adjourns following Adani protests

Fallout from Hindenburg Research’s report that the Adani Group – an Indian multinational conglomerate worth tens of billions of dollar – improperly used offshore tax havens and manipulated stocks rocked Indian parliament for a second day coming into Friday, with opposition party lawmakers calling for a broader investigation into the group. India’s ministry of corporate affairs has begun a preliminary review of the Adani Group’s financial statements and other regulatory submissions. In response to the fallout, Indian Finance Minister Nirmala Sitharaman has stated that state insurer LIC and the State Bank of India have shown limited exposure to the stock rout. Since Hindenburg Research’s report, stocks for various Adani companies have fallen between 27% – 59%, with Moody’s credit rating agency warning that the group could find it difficult to raise money. The Adani Group has denied any wrongdoing.

US Social & Political Developments

US expands access to military bases in the Philippines

The Philippines has agreed to provide the US with expanded access to its military bases, broadening US-Filipino cooperation under 2014’s Enhanced Defense Cooperation Agreement (EDCA). The move will expand the US strategic position in the region as tensions with China continue to mount over Taiwan and the South China Sea. The moves come as a reversal of the trend under former president Rodrigo Duterte, who was moving closer to China, and also within the broader context of US-Filipino military cooperation, which had seen the removal of US troops from both Clark Airforce Base and Subic Bay in the 1990s after basing rights expired. China has blasted the move as heightening tensions in the region and threatening regional peace and stability.

Chinese surveillance balloon soars over the US

The US has detected what it calls a Chinese surveillance balloon hovering over the northwestern region of the US. While China says it is a research airship used mainly for meteorological purposes that was blown far from its planned course, suspicions that it may be a spy balloon have caused quite a stir. Coincidentally, the discovery of the balloon comes just days before Secretary of State Antony Blinken’s visit to Beijing, which has now been postponed. The trip was going to be the first time a secretary of state has visited China in 6 years.

Corporate/Sector News

META flies high following earnings beat

META shares increased 18% after it beat fourth-quarter revenue expectations and said first-quarter revenue could reach $28.5 billion. Fourth-quarter revenue of $32.2 billion was higher than expected, but down from a year ago and marked the third consecutive quarter of declining sales. Meta also reduced its forecast for full-year expenses to between $85-$95 billion, down from $94-$100 billion. Meanwhile, earnings reports from other Big Tech companies like Amazon, Alphabet, and Apple this week were disappointing.

Baidu to launch artificial intelligence chatbot service

Chinese search provider Baidu Inc. is planning to launch an AI chatbot service to rival OpenAI’s ChatGPT in March. The company plans to incorporate AI-generated results in addition to links when users make search requests. The Beijing-based firm has invested heavily in AI, including cloud services, chips and autonomous driving, looking to diversify its revenue and now enter the chatbot game.

IMF raises growth outlook

Following the “surprisingly resilient” demand in the US & Europe, easing energy costs, and the end of zero-Covid policies in China, the IMF has increased its global growth projections for the year to 2.9% and says most countries could avoid recession. However, the institution warns that the world could easily fall into recession this year despite the projection increase, due to the effects of ever-tightening monetary policy.

Recommended Reads

What next for Gautam Adani’s embattled empire?

Pope Francis Emphasizes Peace—and Justice—in Congo and South Sudan

Svein Tore Holsether: Europe needs ‘green’ fertiliser as Putin weaponises food

They Poured Their Savings Into Homes That Were Never Built

Great power conflict puts the dollar’s exorbitant privilege under threat

This week from BlackSummit

From Theranos to FTX: How Fraud Teaches Us Proper Trust

Tyler Thompson

The BlackSummit Team

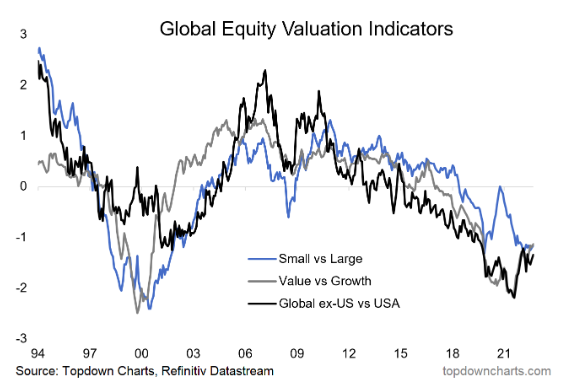

Image of the Week

Video of the Week

No fast-track membership for Ukraine in EU

Source: DW News