Global Market News

Global equities make gains

Global equities were positive on the week as US growth data gave a boost of confidence to the markets. The S&P 500 and Dow Jones rose 2.47% and 1.81% respectively, while the Nasdaq rose 4.32%. The yield on the US 10-year Treasury increased slightly to 3.51%. The price of a barrel of West Texas Intermediate crude oil swung down about 2% to end the week at $79.43. Volatility, as measured by the CBOE Volatility Index, eas to 18.51.

US economy grew in Q4, but there are signs of weakness

The US economy grew 2.9% on an annualized basis, slightly above the 2.8% consensus estimate. While consumer spending maintained solid growth, retail sales weakened sharply in both November and December, with business spending on equipment contracting. Additionally, demand for long-lasting manufactured goods fell and inventories are rising. As a result, many experts expect a recession at some point in 2023, with JP Morgan considering a mild recession as their baseline case.

International Developments

Israel-Palestine conflict escalates in West Bank raid

Israeli forces killed at least 9 Palestinians, including a 61 year-old woman and 7 militants, and wounded several others on Thursday, in the single deadliest operation in the West Bank in two decades. In retaliation, Palestinian militants fired rockets into Israel, prompting Israel to conduct airstrikes on Gaza early Friday morning. The exchange further heightens concerns that the return to power of Benjamin Netanyahu at the helm of what is widely considered Israel’s most far-right government will trigger further, escalating violence. Expressing alarm, Secretary of State Anthony Blinken is set to visit the region in a bid to reduce tensions.

Germany to send Leopard tanks to Ukraine

After weeks of pressure from its European allies and the US, Germany is set to approve the transfer of 14 of its Leopard 2 tanks from its stockpiles to Ukraine. The goal is to establish two battalions, while providing ammunition and logistics, with Ukrainian troops to begin training in Germany soon. Germany has likewise approved the transfer of Leopard 2 tanks in the possession of allied nations.

US Social & Political Developments

Japan and the Netherlands join US in restricting Chinese semiconductor

Following talks this week, Japan and the Netherlands will join the US in restricting exports of semiconductor manufacturing equipment to China. The purpose of the US-led export controls are to kneecap Beijing’s access to technology that would augment China’s military. The alliance is a major diplomatic win for the US, as American companies would face a competitive disadvantage without cooperation from Japan and the Netherlands.

FDA weighs yearly Covid-19 shot

FDA committee members weighed a proposal on Thursday to turn Covid-19 vaccines into a yearly shot. While discussed, the proposal has not yet been voted on over some outstanding questions over the procedure, including data on who exactly should get annual shots and when they should receive them. The committee nonetheless agrees that Covid vaccination ought to become routine to boost vaccination rates against the disease.

Corporate/Sector News

DoJ files antitrust suit against Google

This week, the Justice Department along with eight states sued Google for abusing a monopoly over advertising tools and engaging in anticompetitive practices online. The lawsuit – the DoJ’s second against the tech giant – describes how Google abused its dominance to the detriment of publishers, advertisers, and consumers. G It also alleges that Google built its monopoly by buying tools that connected advertisers with publishers. The DoJ claims this control of the ad tech market hurts consumers as publishers have fewer resources to create content for visitors of their websites. Google has vowed to fight the lawsuit.

Microsoft announces earnings and layoffs

Microsoft lost $737 billion in market value in 2022, the third-largest decline of any company in the S&P 500. While earnings were better than expected, company leaders highlighted the “cautious” mood of the economy during its earnings call. To deal with the economic pressures, Microsoft announced last week that it would lay off 10,000 employees. On the other hand, confidence in Microsoft was buffeted by the announcement of the company’s multibillion-dollar investment in OpenAI, the company behind ChatGPT.

Brazil and Argentina to develop new currency

As Argentina struggles to rebound from a deep financial crisis, it hopes a joint currency with South America’s biggest economy, Brazil, could create alternative currency reserves and make neighborly trade easier. However, economists have warned that joint currencies are often best suited for countries with similar economies – a missing component of Brazil & Argentina’s relationship. Brazil has announced that the new currency, called “sur”, would be an addition to the two national ones, not a replacement. Brazil’s central bank has also come out against the idea.

Recommended Reads

They Poured Their Savings Into Homes That Were Never Built

When the Stock Market and Jay Powell Are Frenemies

JPMorgan Model Shows Recession Odds Fall Sharply Across Markets

Peak Gasoline Heralds Price Shocks for Drivers, Inflation Headaches

To Fix Its Problems in Ukraine, Russia Turns to the Architect of the War

This week from BlackSummit

Canceling the Noise, Not by Bread Alone: Part XIX

John Charalambakis

Rachel Poole Mustor

The BlackSummit Team

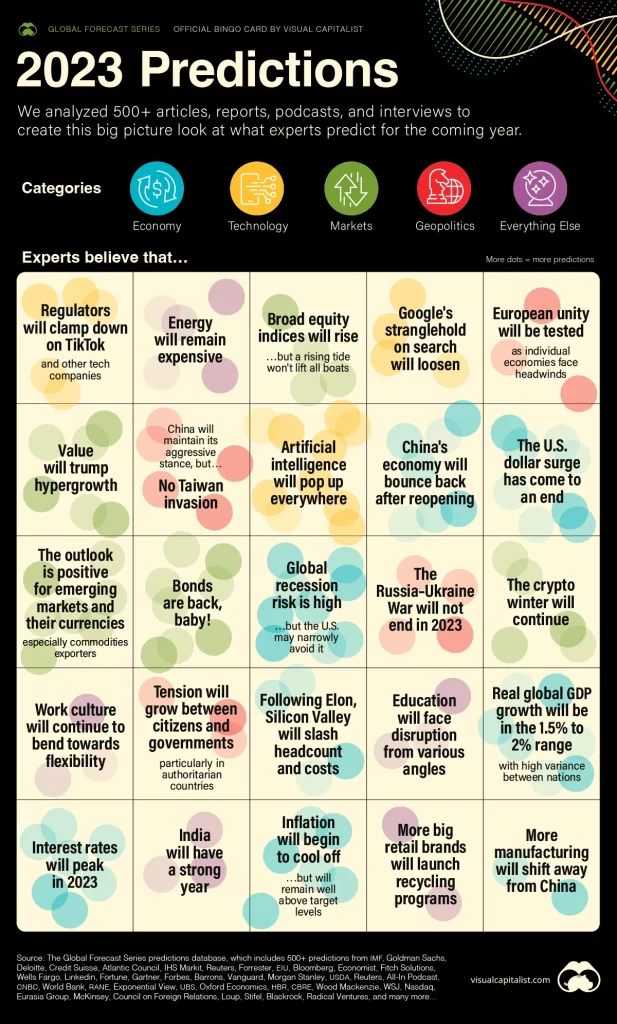

Image of the Week

Video of the Week

These Portable Microgrids Can Restore Power When Disaster Strikes

Source: World Economic Forum