Global Market News

Global equities mixed

Global equities were a mixed bag this week. The S&P 500 and Nasdaq closed the week up 0.32% and 1.24%, respectively, while the Dow Jones dropped 1.38%. The yield on the US 10-year Treasury note decreased slightly to 1.54%, and the price of a barrel of West Texas Intermediate crude oil fell more than 5% to $76.10. Volatility, as measured by the CBOE Volatility Index, increased a couple of points to end the week at 18.1.

US economic data reflect uneven economy

US economic data reported over the last week reveals an uneven economy as strong demand collides with labor and goods shortages. 4.4 million Americans quit their jobs in the month of September while the number of job openings remained much above pre-pandemic levels. Consumer confidence hit a 10-year low this month as inflation has had its largest annual increase in 31 years. Over the weekend, President Biden is expected to choose the next US Federal Reserve chair. He will decide between incumbent Jerome Powell and Fed Governor Lael Brainard. The general opinion is that if Brainard is chosen, the Fed will take longer to raise rates or tighten policy than if Powell stays.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 256,000,000 Global Covid-19 deaths: 5,130,000

US Confirmed Covid-19 cases: 47,500,000 US Covid-19 deaths: 767,000

*As of Friday evening

Europe enduring “fourth wave” of Covid-19 pandemic

Covid-19 cases are on the rise again in Europe. Last week alone, nearly 2 million infections and 27,000 deaths were reported in the region. This is the largest number of weekly infections since the pandemic began, prompting several countries to reimpose restrictions and extend state of emergency orders. This “fourth wave”, as many are calling it, has led Austria to declare a nationwide lockdown. Austria is also the first country in Europe to mandate that all citizens are vaccinated against Covid-19 beginning in February. In the US, controversy over vaccine mandates continue. This week, OSHA was told to suspend its vaccine mandate for companies with 100 or more employees after a federal appeals court upheld a stay on the order.

International Developments

COP26 agreement finalized

A final agreement from the twenty-sixth Conference of Parties (COP26) was announced last weekend, bringing an end to the United Nations climate conference. The Glasgow Climate Pact establishes rules for an international carbon market, details the need for countries to reduce coal use and fossil fuel subsidies, and calls for an increase in climate funding for developing countries, among other climate action measures. Dozens of other climate action pledges and agreements were made on the sidelines of the conference, including a US-China agreement to cooperate on decarbonization efforts and an agreement between several wealthy countries to aid in South Africa’s transition away from coal.

India repeals controversial farm laws

Indian Prime Minister Narendra Modi announced the government would repeal all three farming sector reform laws passed last year which have been the source of massive demonstrations in the country. The move is a major win for the hundreds of thousands of India’s farmers who have been demanding the repeal of what they call “black laws” for nearly a year. While Prime Minister Modi maintained his stance that the laws were necessary reforms, he acknowledged they were unfeasible given the farmers’ opposition and is now urging demonstrators to return to their homes: “Let’s make a fresh start and move forward.”

US Social & Political Developments

House passed Build Back Better bill

Friday morning, the House of Representatives passed Biden’s “Build Back Better” bill in a 220-213 vote after nearly 5 months of negotiations. The $1.75 trillion social spending measure includes funding for universal prekindergarten, affordable housing programs, lowering prescription drug costs, and expanding tax credits for reducing carbon emissions, among other issues. The bill now faces an uncertain future in the Senate. Looming over lawmakers in the coming days and weeks is the possibility of a government shutdown if Congress fails to reach an agreement on raising or suspending the debt limit.

Biden and Xi have virtual summit

US President Joe Biden and Chinese leader Xi Jinping held a “respectful and straightforward” three-hour virtual meeting this week. During the call, the two leaders discussed cooperation on issues like climate change and global energy security, and also brought up tensions on issues including trade, Taiwan, and human rights. Both Biden and Xi expressed the desire to move the countries’ relationship forward in a positive direction, avoiding conflict. However, Xi did warn Biden that Beijing would take “resolute measures” if Taiwan pursues independence.

Corporate/Sector News

Baltic Dry Index drops as shipping rates retreat

The Baltic Dry Index, a proxy for dry bulk shipping stocks and indicator of the general shipping market environment, dropped to its lowest level since early June. The plunge comes as shipping rates, which have skyrocketed in the last several months, are beginning to retreat. Concerns over China’s economy and news of production cuts across the globe, including a recent announcement from Brazilian iron ore miner Vale, have put increased pressure on larger shipping vessel segments in particular.

Apple’s self-driving EV expected to launch in 2025

Apple is reportedly planning to launch its fully self-driving electric car in 2025, bumping up the original five- to seven-year timeline reported earlier this year. The design of the car will most likely feature no steering wheel or pedals. Wedbush Securities thinks Apple is looking for manufacturing partners, like Hyundai or Volkswagen, and could announce a strategic alliance next year. Apple’s news comes on the heels of what has been a busy week for the EV sector, with more and more automakers announcing next steps and several EV IPOs. This week, the CEO of Ford said the company plans to produce 600,000 EVs a year globally by the end of 2023. In addition, Ford and General Motors are making plans to get into the semiconductor business.

Sono Group launches IPO

Sono Group, a German solar-powered electric vehicle developer, kicked off its IPO on Wednesday at $20.06 and closed at $38.20, up $23.20 from the offer price. Building off the momentum of Rivian Automotive’s debut last week, Sono raised $150 million as it sold 10 million shares in the IPO. Sono has developed a solar-powered electric car, called “Sion”, that can recharge itself using panels installed on the exterior of the vehicle. As of November 5th, the company has received more than 16,000 reservations on the car.

Recommended Reads

How the Fed Rigs the Bond Market

How Xi Jinping Is Rewriting China’s History to Put Himself at the Center

Risk, Uncertainty and Profit 100 Years Later

Bernard-Henri Lévy’s Journey From Barricades to War Zones

Investors lulled into ‘dreamland’ by central banks, warns Bill Gross

This week from BlackSummit

Disruption and the Second Derivative – Joel Charalambakis

Geopolitical Challenges and Statecraft – Rachel Poole & Tyler Thompson

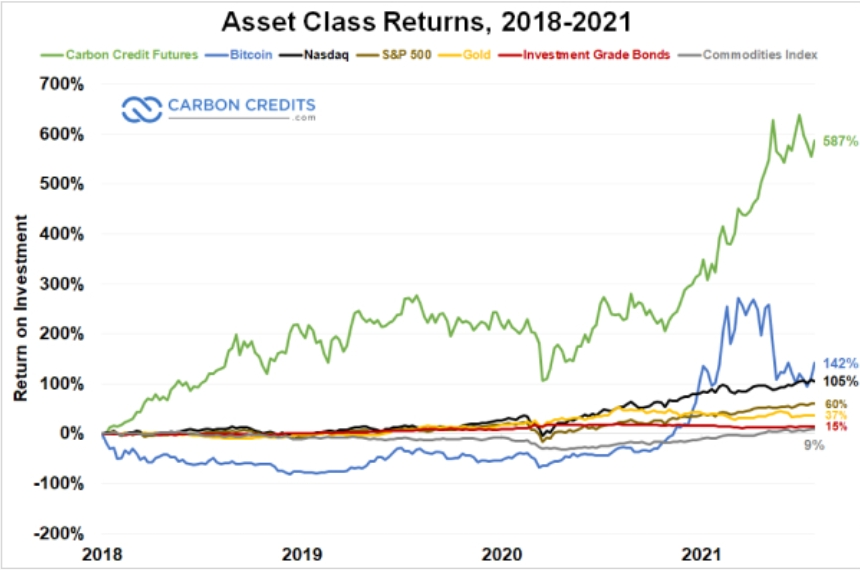

Image of the Week

Video of the Week

The strategically-located seaport in Alexandroupoli, Greece has emerged as a vital and highly-capable transportation hub for U.S. Army forces in Europe.

Source: 598th Transportation Brigade – SDDC