Global Market News

Global equities tumble

Global equities tumbled this week as the Federal Reserve revised its inflation expectations. The S&P 500 closed 1.91% down while the Dow Jones posted its worst week since October, losing 3.45%. The Nasdaq also dropped, closing 0.28% down on the week. The yield on the US 10-year Treasury decreased only slightly to 1.44% and the price of a barrel of West Texas Intermediate crude oil continued increasing, reaching $71.63 Friday afternoon. Volatility, as measured by the CBOE Volatility Index, ramped up several points to 20.2.

Fed raises expectations for inflation

On Wednesday, the Federal Reserve raised expectations for inflation a full percentage higher than it forecasted in March. Though the Fed now expects inflation to reach 3.4%, Chairman Jerome Powell reassured investors that he still believes the price pressures are “transitory”. The central bank also brought forward its timeline on raising interest rates. Back in March, Powell said he saw no increases until at least 2024 but, now, the Fed sees two potential rate hikes in 2023. In response to the earlier-than-expected rate hikes, markets pulled back, and growth stocks outperformed value stocks in the days following the announcement.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 178,000,000 Global Covid-19 deaths: 3,840,000

US Confirmed Covid-19 cases: 33,500,000 US Covid-19 deaths: 601,000

*As of Friday evening

US to invest $3 billion in Covid-19 antiviral drugs

The Biden administration will invest more than $3 billion to develop Covid-19 antiviral drugs. The Antiviral Program for Pandemics will aim to develop oral antiviral drugs that can be taken at home in the early stages of infection. The antivirals would be similar to pills used for treating the flu and could help prevent hospitalizations. Also this week, the Novavax Covid-19 vaccine demonstrated 90% overall efficacy and 100% protection against moderate and severe infection in phase three trials, paving the way for the company to file regulatory authorizations in the third quarter.

Geopolitics Spotlight

Iran holds presidential elections

Conservative judiciary chief Ebrahim Raisi has been declared the winner of Iran’s presidential elections. He will replace moderate President Hassan Rouhani in August. The interior ministry announced Raisi won 61.95% of the vote, however, the elections have been quite controversial. There were many calls to boycott the vote after hundreds of presidential candidates were denied by Iran’s Guardian Council, the body responsible for vetting presidential candidates. Many observers of the election believe the council rigged the election in Raisi’s favor as he is a close friend of Supreme Leader Ali Khamenei. Just days before the election, three presidential candidates dropped out of the race, leaving only four remaining. Raisi is also controversial because of the US sanctions he is under for overseeing the deaths of political prisoners in 1988 and suppressing the Green Movement protests in 2009. The boycott and the pandemic, among other factors, lead to the lowest voter turnout for a presidential election in Iran for decades.

Israel-Hamas ceasefire breaks down

Israel has launched airstrikes on Gaza after Palestinian militant groups flew incendiary balloons over Israel. The groups opted to float the incendiary balloons after 33 Palestinian protesters were injured during a right-wing march in Jerusalem. The engagement has fallen just short of full-scale escalation and no casualties have been immediately reported. Moves on both sides have strained the ceasefire agreement reached between Israel and Hamas just a few weeks ago.

US Social & Political Developments

Biden meets with Putin

US President Biden and Russian President Vladimir Putin met this week at a summit in Geneva. Despite icy relations between the two countries, Biden and Putin committed to holding strategic-stability dialogue which will include arms control and cyber-related issues. At the meeting, Biden warned Putin that the US would use its cyber capabilities to respond to any Russian cyberattacks on critical US infrastructure. Unsurprisingly, Putin denied his country’s involvement in recent cyberattacks in the US. While both sides expression professional respect for each other, no major disagreements were resolved.

Juneteenth becomes a national holiday

President Biden signed a bill this week to officially recognize Juneteenth as a national holiday. The day, celebrated on June 19th every year, commemorates when Union General Gordon Granger arrived with federal troops to Galveston, Texas and issued an order freeing the last of America’s slaves in 1865. The George Floyd protests last year expanded awareness of the holiday, leading several corporations, including Twitter, Nike, Adobe, Uber, and others, to make the day a paid holiday.

Corporate/Sector News

Lina Khan sworn in as chair of the Federal Trade Commission

Lina Khan was sworn in as the chair of the Federal Trade Commission (FTC) this week. As a prominent Big Tech critic, she has argued in favor of blocking mergers and breaking up some of tech’s largest companies. She also believes current anti-corruption laws do not adequately address e-commerce. Khan is the youngest commissioner ever to be confirmed to the FTC. Big Tech firms like Amazon, Facebook, Alphabet, and Apple will be watching closely.

JP Morgan expects higher rates of inflation

JP Morgan is stockpiling cash as it expects higher rates and more inflation. Going against the Fed’s current position, Jamie Dimon, CEO of the bank said “We have a lot of cash and capability and we’re going to be very patient, because I think you have a very good chance inflation will be more than transitory.” He also indicated that JP Morgan believes the pandemic-era trading boom is coming to an end sooner than most people think.

EU and US reach agreement on 17-year aircraft subsidy dispute

Hours before a summit aimed to boost transatlantic cooperation, the US and European Union (EU) reached a truce on a 17-year dispute over aircraft subsidies for manufacturers Boeing and Airbus. The agreement extends the suspension of an estimated $11.5 billion in tariffs for five years, giving the two parties time to hammer out the details of a more official deal. The dispute began in 2004 when the US withdrew from an aircraft subsidy pact after alleging that Airbus had acquired an equal share of the jet market thanks to subsidized government loans. The move comes as President Biden aims to reset relations with the EU.

Recommended Reads

Myanmar: Time running out for NGOs to avoid humanitarian catastrophe

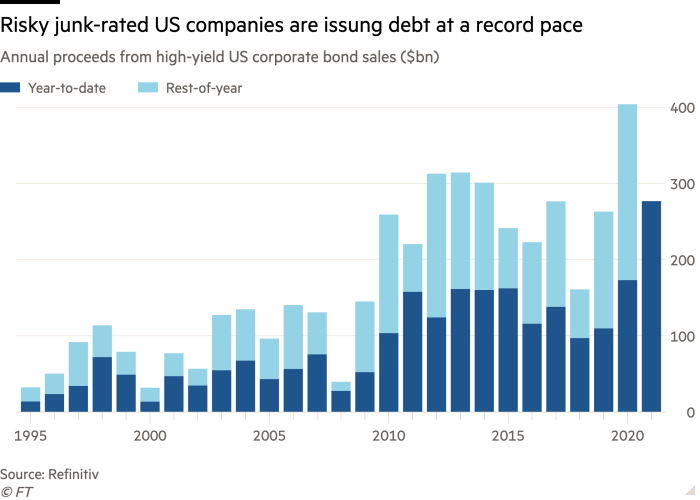

Pandemic Hangover: $11 Trillion in Corporate Debt

The end of privacy? Central banks plan to launch digital coins

Mario Draghi sets tone in cooling EU-China relations

Rising prices in the U.S. could rattle other countries amid uneven global recovery

‘Game over’: Investors hunt for new model after years of broad gains

This week from BlackSummit

Bundling and Unbundling – Joel Charalambakis

The Day After & the Era of Transformation – Rachel Poole & Tyler Thompson

Image of the Week

Video of the Week

NATO declares China a global security threat

Source: DW news