Global Market News

Global equities fall on the week

After entering record-high territory last week, global equities fell this week as global Covid-19 cases continued to rise sharply. The yield on the 10-year US Treasury note dropped to 0.89% from 0.96% last week while the price of a barrel of West Texas Intermediate crude oil rose slightly to $46.58. Volatility, as measured by the Cboe Volatility Index (VIX) rose from 21 to 24.

US household net worth and debt rise

Economic data reported by the Federal Reserve on Thursday revealed US household net worth rose to $123.52 trillion, gaining 3.2% in the third quarter to hit a new record. Meanwhile, household debt rose a startling 5.6%, its fastest pace in two years.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 70,000,000 Global Covid-19 deaths: 1,590,000

US Confirmed Covid-19 cases: 15,700,000 US Covid-19 deaths: 293,000

*As of Friday evening

Great Britain administers the first Covid-19 vaccine in a western nation

This week, Great Britain became the first western nation to administer a Covid-19 vaccine. Canada approved the Pfizer/BioNTech vaccine for distribution a few days ago and the US announced just last night that the FDA has granted emergency use approval for the same vaccine. Within days, millions of doses of the vaccine will be distributed.

Geopolitics Spotlight

Deadline for a post-Brexit trade deal is set for Sunday

Negotiators have set Sunday as the deadline for a post-Brexit trade deal between the United Kingdom (UK) and the European Union (EU). The expectation is for a no-deal outcome. Contingency planning for a no-deal Brexit has ramped up on both sides over the last couple of days and markets are pricing in the consequences of no deal. The pound fell 2.5% compared to the dollar this week and the yield curve has flattened.

EU approves budget and agrees to cut greenhouse gas emissions

After weeks of deadlock following Hungary and Poland’s veto of the budget, the EU approved a historic $2.2 trillion budget agreement which includes Covid-19 recovery funds. The bloc has also agreed to cut greenhouse gas emissions by 55 percent by 2030.

US Social & Political Developments

Covid relief bill negotiations remain at an impasse

Negotiations between Republicans and Democrats on Capitol Hill over a new Covid relief bill remain at an impasse. Hopes were for a bill to pass before the end of the year, but instead, it looks like Congress will pass a stopgap measure that would fund the government through Dec. 18th. Talks on a relief bill will likely continue over the holidays.

The US breaks record for Covid-19 deaths

The US recorded its highest daily Covid-19 death count on Thursday, hitting more than 3,300 deaths in one day alone. The country also hit a record number of hospitalized Covid-19 patients on Thursday, recording a total of 106,688 patients. More than a third of Americans now live in an area where hospitals are facing shortages of intensive care beds.

Corporate/Sector News

DoorDash and Airbnb go public

It was a stellar week for IPOs. Both Airbnb and DoorDash went public this week and far exceeded expectations. On Wednesday, DoorDash shares closed 86% higher than its IPO price, giving the company a value of nearly $60 billion. Thursday, Airbnb’s stock opened at $146, more than doubling its IPO price of $68.

Facebook hit by new lawsuits

Facebook was hit with two lawsuits this week: one from the Federal Trade Commission and another from a group of 46 US states. Both lawsuits accuse Facebook of abusing its monopoly power, paying particular attention to its acquisition of Instagram in 2012 and WhatsApp in 2014. The company has denied any anti-competitive practices, noting that the government approved both of the acquisitions several years ago.

Royal Dutch Shell loses clean energy executives

Several clean energy executives left Royal Dutch Shell this week amid a disagreement over how much the company should shift towards greener fuels. Shell is scheduled to announce a strategy update in February explaining how they will become a net-zero emissions company.

Recommended Reads

The valuation warning signs for stock markets

China Is Both Weak and Dangerous

The Party That Failed

How China Is Buying Up the West’s High-Tech Sector

Europe must take sides with the US over China

Joe Biden Has Problems. The World Has Solutions.

EU proposes fresh alliance with US in face of China challenge

From Airbnb to Tesla, It’s Starting to Feel Like 1999 All Over Again. It May End the Same Way.

This week from BlackSummit

SPACs: Sponsor Revolution or PIPE Dream – Joel Charalambakis

Geopolitical Challenges and Statecraft – Tyler Thompson and Rachel Poole

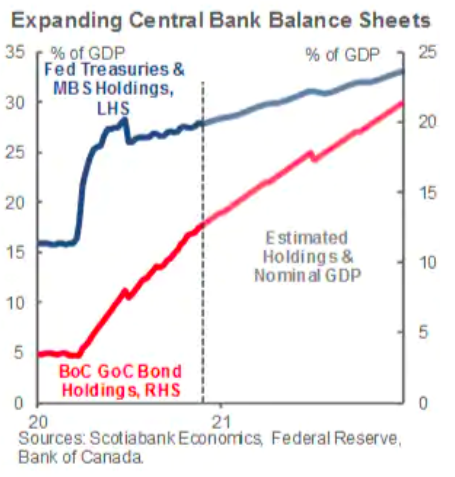

Image of the Week

Video of the Week

COVID-19 pandemic reveals inequalities

Source: DW News