Global Market News

Global equities approach record-highs

Global equities approached record-high territory this week on expectations of a fast rollout of several Covid-19 vaccines and the hopes that more fiscal stimulus is on its way soon. The yield on the US 10-year Treasury Note rose to 0.97% while the price of a barrel of West Texas Intermediate crude oil rose $0.80 to hit $46.05. Volatility, as measured by the Cboe Volatility Index (VIX) was little changed, remaining around 21.

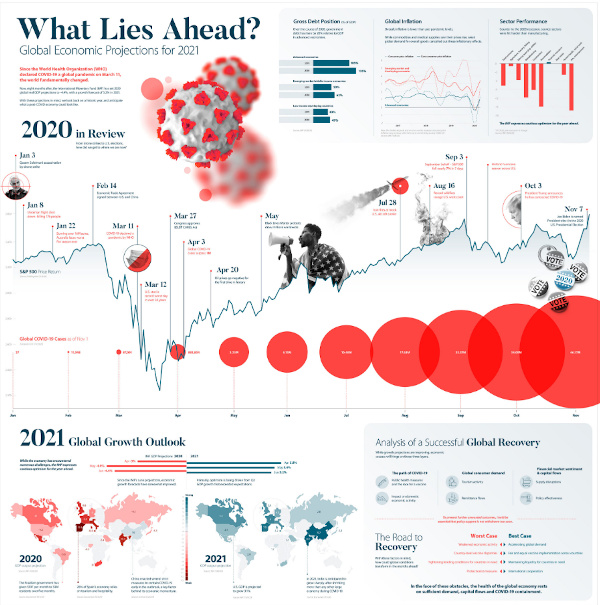

OECD projects 4.2% global growth in 2021

The Organization for Economic Cooperation and Development (OECD) projects global GDP to grow by 4.2% in 2021 after falling 4.1% this year. However, the projected recovery will not be equal across countries. The group predicts China will grow 8% in 2021 while Europe and the US will grow 3.6% and 3.2%, respectively.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 65,400,000 Global Covid-19 deaths: 1,510,000

US Confirmed Covid-19 cases: 14,300,000 US Covid-19 deaths: 276,000

*As of Friday evening

UK approves Pfizer vaccine, US soon to follow

The United Kingdom (UK) has approved Pfizer’s Covid-19 vaccine, becoming the first developed country to approve a vaccine. The first 800,000 doses of the vaccine will be distributed in the UK beginning next week. Emergency use authorization for the Moderna and the Pfizer-BioNTech vaccine in the US is expected in the next few weeks. Frontline medical workers and the elderly will receive vaccine doses first, with the expectation that the general population will be vaccinated by the spring of 2021.

Geopolitics Spotlight

Qatar announces progress in dispute with its Gulf neighbors

Qatar’s foreign minister announced this week that progress has been made with Bahrain, Egypt, Saudi Arabia, and the United Arab Emirates. Qatar’s four Gulf neighbors imposed a trade, diplomatic, and travel boycott on Qatar in 2017 after accusing the country of supporting terrorism and having too close of ties with Iran. Interestingly, the reports of progress came shortly after news broke that Saudi Arabia and Qatar are nearing a US-brokered agreement.

EU prepares for no-deal Brexit scenario

The European Union (EU) is preparing for a no-deal Brexit scenario. The UK has set an informal deadline of Monday to wrap up negotiations. It seemed as though the two sides were close to an agreement, but France’s last-minute claims that the EU was giving away too much seems to have stalled progress.

US Social & Political Developments

Weak payrolls may increase urgency on Capitol Hill

The US reported that only 245,000 new jobs were added in November, which is only half the expected number. The second wave of Covid-19, which has prompted new stay-at-home orders, has clearly taken a toll on hiring over the last month. Many are hoping the weak payroll numbers and worsening virus trends will increase the urgency for a new stimulus package. Early in the week, a group of bipartisan lawmakers proposed a $908 billion package which has now become the basis for talks.

House of Rep. passes bill to decriminalize marijuana

The House of Representatives has passed a bill that would decriminalize marijuana at the federal level. However, the bill has little chances of passing through the Republican-led Senate. Senate Majority Leader Mitch McConnell criticized the House for passing the bill instead of focusing on the Covid-19 stimulus package that both parties have yet to agree on.

Corporate/Sector News

Salesforce buys Slack for $28 billion

Salesforce, the cloud software company, will buy messaging-app Slack for $28 billion in a cash-and-stock deal. The purchase will help Salesforce expand beyond its core product of software which manages customer relationships, to give clients the software tools for day-to-day operations.

US passes bill to delist Chinese companies

Congress has passed a bill that would remove foreign companies from US stock exchanges if they fail to comply with US audits for three years in a row. The bill sets the stage for the removal of several Chinese companies, including Alibaba and YumChina, because China does not typically allow the US to inspect their work. Also this week, the US blacklisted China’s largest chipmaker, SMIC, and national offshore oil and gas producer CNOOC as alleged Chinese military companies.

S&P Global in talks to acquire IHS Market

S&P Global is reportedly in advanced talks to acquire IHS Markit for about $44 billion. The deal would be the biggest corporate acquisition this year and would create a “market data powerhouse”. However, the size of the acquisition raises US and EU regulatory concerns, which could delay the purchase.

Recommended Reads

Will India Choose a Side in the Competition Between the U.S. and China?

Lessons from Japan: coping with low rates and inflation after the pandemic

Bond investors bet on battered companies surviving virus shock

Morgan Stanley’s Wilson Says Stocks Overbought, Risk Correction

The Ticking Debt Bomb in China’s $15 Trillion Bond Market

This week from Black Summit

Crossroads: At the Intersection of Geopolitics and Geoeconomics – Rachel Poole

Portfolio Anchoring & Capital Allocation at the Dawn of Power Shifts – John E. Charalambakis

Covid-19, US Elections, and the Day After – Tyler Thompson and Rachel Poole

Image of the Week