September 4, 2020

Global Market News

Global equities drop

This week, global equities fell as US mega-cap technology stocks came under selling pressure. The yield on the US 10-year Treasury note remained almost unchanged at 0.721%. The price of a barrel of West Texas Intermediate crude oil also dropped this week, closing at $39.51 on Friday. Volatility, as measured by the CBOE Volatility Index (VIX), jumped to 35 from 25.3 last week.

US unemployment rate falls to 8.4% in August

Employers added 1.4 million jobs in August, bringing the official U3 unemployment rate to 8.4%. This figure is more in line with prior recessions, though still significantly higher than February’s low of 3.5%. The economy has recovered about half of the 22 million jobs lost since the pandemic shock in March, though the number of unemployed individuals reporting their layoffs as permanent rose to 3.4 million. Fed Chair Jerome Powell described Friday’s payroll report as good news, though the economy would require low interest rates for years. The U6 unemployment rate settled at 14.2%.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 26,400,000 Global Covid-19 deaths: 870,000

US Confirmed Covid-19 cases: 6,170,000US Covid-19 deaths: 187,000

*As of Friday evening

CDC advises officials to prepare for vaccine candidates

The CDC advised health officials across the US to be prepared for distribution of two potential Covid-19 vaccines by November 1. The CDC also released technical specifications for the two candidates (dubbed “Vaccine A” and “Vaccine B”), with requirements for shipping, mixing, storage, and administration. These details seem to match the vaccine candidates being developed by Pfizer and Moderna.

Geopolitics Spotlight

Belarus strengthens Russian ties amid sanctions

Belarus and Moscow have stepped up diplomatic ties amid protests over the country’s disputed presidential election. Russian Foreign Minister Sergei Lavrov stated Russia would respond “firmly” to interference in Belarusian affairs. This comes as several Baltic states announced travel bans on thirty Belarusian officials, including President Alexander Lukashenko. Belarus stated it would respond in kind.

US-China tensions simmer

The US declassified documents outlining decades-old security assurances to Taiwan, prompting China to call on the US to stop increasing its ties with the island. The Pentagon released an annual report stating China is developing a “world-class military.” Secretary of State Pompeo announced further sanctions on Chinese officials, while China announced stricter measures for technology exports.

US Social & Political Developments

US debt to exceed GDP for first time since WWII

The Congressional Budget Office announced that publicly held federal debt will exceed the size of the economy in the fiscal year beginning October 1. The current budget is already expected to reach 98% of GDP as a result of the coronavirus relief efforts. This is already the highest debt-to-GDP ratio since World War II. The CBO projects that the relief measures will add little to the deficit over the next decade, as they expect low inflation and interest rates to offset the spending.

Presidential polls tighten

In the aftermath of the party conventions, national polls have shown Democratic nominee Joe Biden’s lead has narrowed, especially in battleground states. President Donald Trump trails Biden by 7.2% as of September 4, as opposed to 9.3% in late July; in swing states, Biden’s lead has dropped from 6.3% to 3.3% in the same period. Betting odds show the candidates tied.

Corporate/Sector News

Apple, Tesla complete stock splits

Tesla and Apple completed their planned stock splits on Monday. Despite conventional wisdom that stock splits do not create value, shares of both companies rose in the aftermath. Apple extended its rally an additional 3% Monday following its 4-for-1 split; Tesla shares gained 13% after its 5-for-1 split. By week’s end, both stocks had fallen several points following a contraction Thursday and Friday.

Zoom reports 4x year-over-year revenue increase in Q2 earnings

Shares of Zoom rose as much as 47% on Tuesday following a stellar earnings report after trading hours on Monday. The company reported its second quarter revenue at $663.5M, beating Wall Street expectations by $163M. Management raised its full-year guidance to $2.37B-$2.39B, a year-over-year increase of more than 280%.

FAA approves Amazon drone delivery

The FAA issued Amazon a Part 135 air carrier certificate on Saturday, allowing the e-commerce giant to proceed with its Prime Air drone delivery service. The certification allows Amazon to operate drones beyond the line of sight of the operator, a critical component of drone delivery. An Amazon spokesman stated the certification is the next step to realizing its goal of 30 minute delivery.

Recommended Reads

Industry Warns of Brexit Border Chaos

Southeast Asia is Ground Zero in the New U.S.-China Conflict—and Beijing Is Winning

U.S. Election Priced as Worst Event Risk in VIX Futures History

FT 1000: the Fourth Annual List of Europe’s Fastest-Growing Companies

The Abe Era Ends, Cheering China, Concerning Washington

Covid-19 Pandemic Ravages World’s Largest Developing Economies

‘We Are Witnessing a Major Melt-up.’ Why the Stock Market Gets a Little Scarier Every Day

India’s Economy Shrank Nearly 24 Percent Last Quarter

Belarus’s Struggle to Escape Its Soviet Past Pushes It Into Russia’s Embrace

This Week from BlackSummit

Crossroads: At the Intersection of Geopolitics and Geoeconomics – Rachel Poole

Covid-19 and the Day After – Tyler Thompson and Rachel Poole

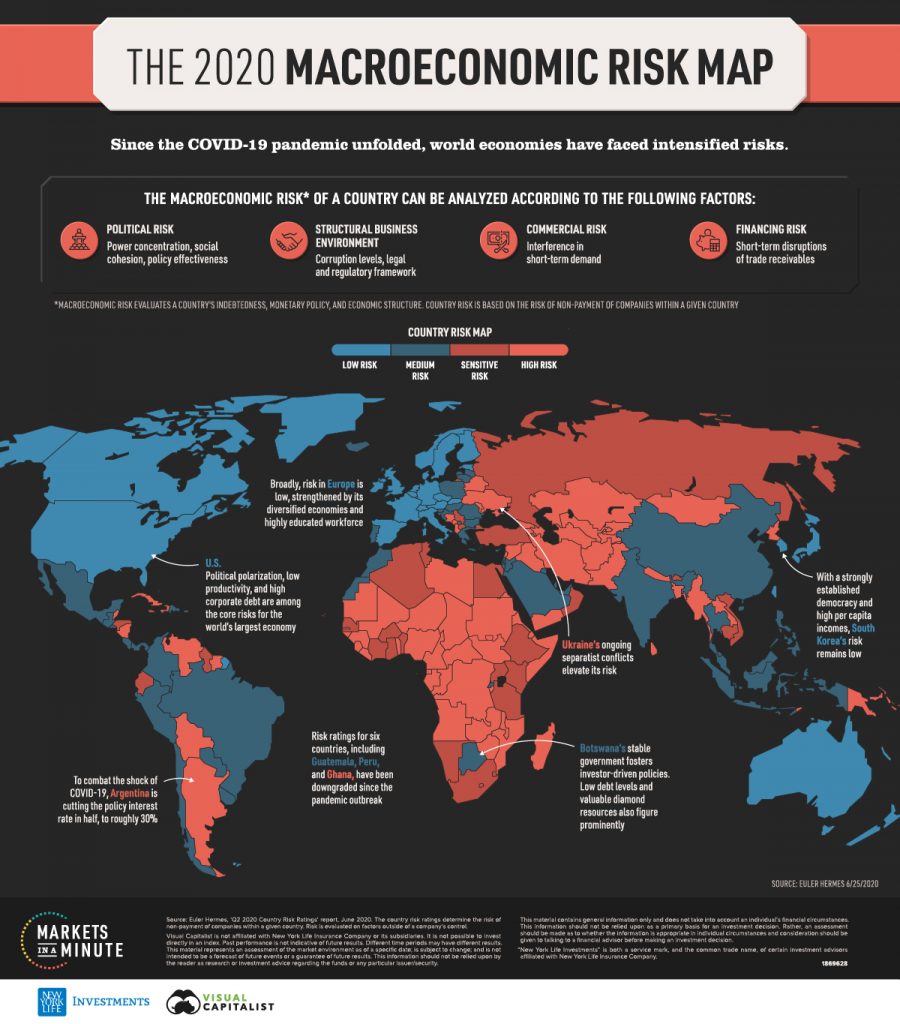

Image of the Week

Video of the Week

Why India is struggling to cope with Covid-19

Source: Financial Times