Global Market News

Global equities mostly flat

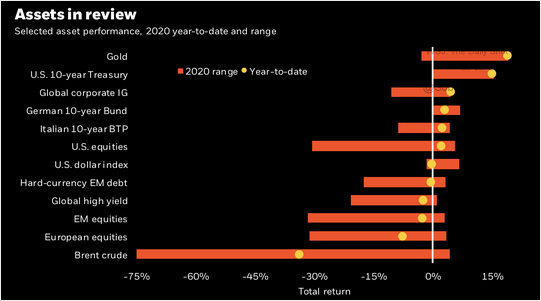

Global equities saw little change on the week. We saw initial signs of turmoil and higher risks associated with market valuations. The yield on the US Treasury dropped to 0.55%, and the price of a barrel of West Texas Intermediate crude oil dropped to $40.39. Volatility, as measured by the Cboe Volatility Index (VIX), declined to 25.6.

Quarterly US GDP falls by 9.5%

Economic data released this week illustrated the continued effects of the pandemic on the US economy. GDP shrank 9.5% from the first quarter to the second for an annualized drop of 32.9%. Initial unemployment claims rose for the second consecutive week, with claims for the week ended July 25 at 1.43 million. Meanwhile, the Fed announced that it would keep interest rates near zero in an effort to mitigate the effects of Covid-19.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 17,300,000

Global Covid-19 deaths: 674,000

US Confirmed Covid-19 cases: 4,590,000

US Covid-19 deaths: 155,000

*As of Friday evening

Resurgence of cases worldwide

Coronavirus infections appear to have risen globally this week even as the US infection rate seems to have plateaued for the moment. In Asia, China, Japan, and Vietnam have reported rising case numbers. Some parts of northern England have been placed under tighter restrictions, while much of Europe has seen a resurgence of cases. In the U.S, parts of the US have seen rising cases while recent hotspots appear to have stabilized some.

Geopolitics Spotlight

Some conflicts slow

The Middle East saw regional tensions rise and fall throughout the week. The Israeli military accused the Iran-back Lebanese Hezbollah of launching a raid across the countries’ shared border, a move Lebanese Prime Minister Hassan Diab called a “dangerous military escalation.” Yemen’s Southern Transitional Council abandoned its claim to self-rule, opening the door to peace through the Riyadh agreement between Yemeni forces and Houthi rebels. Friday marked the first day of the three-day cease-fire between Afghan forces and the Taliban in recognition of the Muslim Eid al-Adha festival; both sides released a substantial number of prisoners in a goodwill gesture. However, the situation between Egypt and Libya highlights rising risks.

Hong Kong democratic process under fire

In Hong Kong, pro-democracy advocates saw additional setbacks on the week. On Thursday, the Hong Kong government blocked twelve pro-democracy candidates (including four incumbents) from running in its upcoming elections. Opposition to the recently passed security law, soliciting international aid, and indiscriminate voting against government proposals were cited as the reasoning for the disqualifications. On Friday, Chief Executive Carrie Lam invoked emergency powers to outrightly delay the election to September next year, citing virus-related safety concerns. The delay comes as a further blow to the pro-democracy movement, who called the delay a “naked attempt to avoid a loss at the polls” (New York Times).

US Social & Political Developments

Coronavirus relief bill negotiations

The debate over the provisions of another stimulus package resurfaced this week as lawmakers failed to reach an agreement on a relief bill. The primary point of contention was the current $600/week enhanced unemployment benefits. Talks are expected to continue through the weekend; Republicans are looking to limit spending to $1 trillion, while the Democrat package has a $3 trillion bottom line.

Corporate/Sector News

Big Tech faces antitrust committee

Wednesday provided some political theater as tech executives from Big Tech were asked to testify before the House antitrust subcommittee. Apple’s Tim Cook, Google’s Sundar Pichai, Amazon’s Jeff Bezos, and Facebook’s Mark Zuckerberg mainly played defense during the 5-hour hearing, emphasizing the myriad competition each company faces. The antitrust committee raised serious concerns over Facebook’s acquisition strategy towards competitors like Instagram, Amazon’s leverage over seller data in creating competing products, Apple’s App Store policies, and Google’s alleged censorship of conservative media. The monopoly power of the Big Tech is an impediment to free markets and competition. The companies also released earnings on Thursday, with all four beating expectations. Apple and Facebook came out especially strong, while Amazon reported profits even after significant pandemic-related expenditures; Google reported narrow margins following a weak quarter for online advertising.

Vaccine developments for Moderna, Sanofi, GlaxoSmithKline

Several companies saw developments relating to their coronavirus vaccines this week. The US government changed its deal with Moderna over the weekend, adding provisions for up to $472 million in funding for the company’s Phase 3 testing of its vaccine candidate. That testing will now include up to 30,000 participants and have a total value of $995 million. Sanofi and partner GlaxoSmithKline confirmed that they would supply the UK with up to 60 million doses of their experimental vaccine. The companies are compressing certain clinical tests to meet their targeted approval deadline in the first half of 2021, having entered talks with the US, the EU, and several other international organizations to sell their vaccine candidates.

Recommended Reads

30 Years After Our “Endless Wars” in the Middle East Began, Still No End in Sight

Unusually, Copper and Gold Prices are Rising in Tandem

Why We Need to Declare a Global Climate Emergency Now

Why There’s More to Gold’s Rally Than Inflation Fears

Congress Pushes for Sanctions on Turkey, Russia Over Libyan War

The End of the Middle East’s Trickle-Down Economy

This week from Black Summit

Money, Debts, Gold and the Greenback: When Yeats Met Orwell – John Charalambakis

Covid-19 and the Day After – Tyler Thompson

Image of the Week

Video of the Week

Former Malaysian Prime Minister Found Guilty of Corruption

Source: DW News