Global Market News

Global equities slightly lower

Though the market rally continues, global equities were slightly lower on the week. The yield on the US 10-year treasury note changed little, coming to 0.61% at the close of markets on Friday. The price of a barrel of West Texas Intermediate crude oil fell dramatically to $17.18 from $25 a week ago as a result of the oil market crash earlier in the week. Volatility, as measured by the Cboe volatility index (VIX), decreased from 42 to 35 on the week.

Oil crashes into the negatives

In a shocking turn of events, crude oil futures went negative on Monday afternoon. The price of a barrel of West Texas Intermediate crude oil for the May contract settled at -$37.63. This is the first time the commodity has traded at a negative value. The combination of dropping demand due to the coronavirus with excess supply from the Saudi-Russian price war sent the oil markets into a tailspin. Later in the week prices returned to more normal levels, however the Brent crude experienced a significant price drop. Prices of WTI are expected to stay in the teens while Brent in the mid 20s.

PMIs fall to record lows

Flash purchasing managers’ indices (PMIs) fell to record lows this week, indicating the deep economic impact the coronavirus pandemic is having on the world. Taking into consideration the PMI scale which considers 50 as neutral, composite PMIs in the eurozone hit a record low of 13.5 while the United Kingdom’s fell even lower to 12.9. Japan and the US recorded readings of 27.8 and 27.4 respectively. Analysts are increasingly expecting an economic recovery to take many quarters. Businesses are slowly reopening but only as coronavirus cases decline sufficiently. The US, for example, recommends states begin reopening non-essential businesses only after 14 consecutive days of declining new case reports.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 2,790,000 Global Covid-19 deaths: 196,000

US Confirmed Covid-19 cases: 925,000 US Covid-19 deaths: 52,296

*As of Friday evening

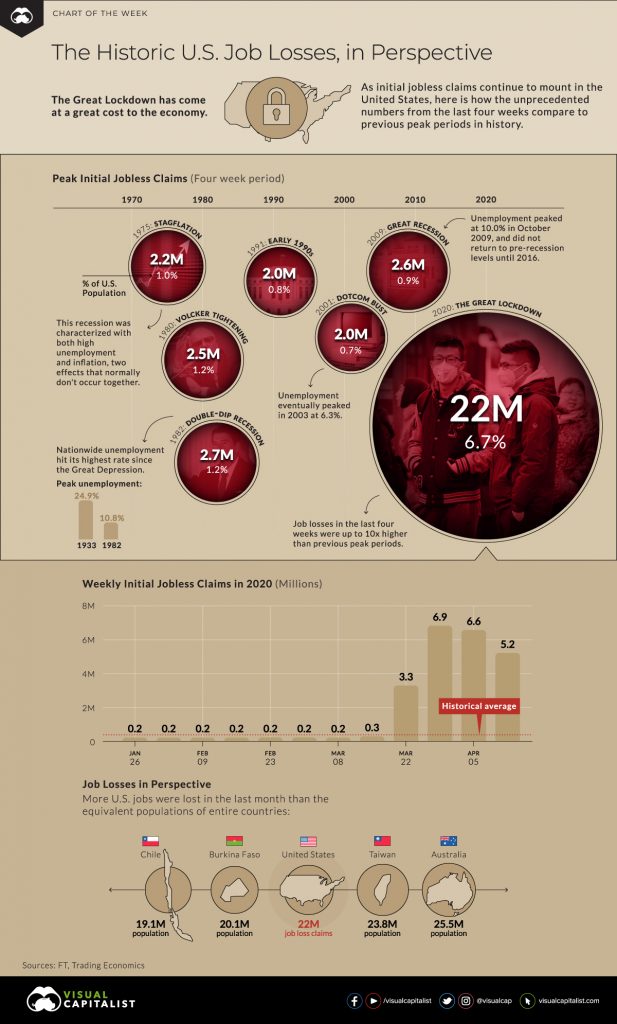

Unemployment rates continue to rise

More than 4.4 million people applied for jobless benefits in the US last week, bringing the 5-week grand total to over 26 million. This amounts to more than 16% of the nation’s labor force. Estimates from McKinsey and Co. suggest 59 million jobs in Europe and the United Kingdom are at risk, equating to 26% of the workforce. Currently, around 18 million Europeans are furloughed, costing governments billions in wage support.

US passes additional relief package

US Congress passed an additional $484 billion relief package just two weeks after the Paycheck Protection program ran out of money. This new package allocates $310 billion worth of funds to reconstitute the program which was designed to fund the payrolls of small to medium-sized enterprises but was taken advantage of by larger corporations. In addition, funding is set aside for hospitals, healthcare workers, and coronavirus testing. Another stimulus package is reportedly in the works but it will likely face a more difficult path to passage due to concerns over a ballooning national debt.

European leaders are close to a proposal

European leaders met on Thursday to finalize a €500 billion package of credit lines, loans, and unemployment support. However, a large rescue fund for the hard-hit countries of Spain, Italy, and Greece has yet to be agreed upon as leaders struggle to resolve long-running political tensions between the Northern and Southern European countries. The European Commission is expected to announce the formal proposal on May 6th.

“Famines of biblical proportions”

The United Nations World Food Programme (WFP) is warning the world that “famines of biblical proportions” could occur within months if action is not taken to secure aid for conflict zones and avoid trade disruptions in developing countries. The WFP estimates the effects of the coronavirus could cause 265 million people to suffer from acute hunger, which is almost double the number in 2019.

Geopolitics Spotlight

Yemen ceasefire extended

The Saudi-led coalition fighting the Houthi rebels in Yemen has extended its ceasefire for an additional month to allow for UN-sponsored negotiations and continued efforts to control the coronavirus outbreak.

Pro-democracy activists arrested in Hong Kong

Hong Kong authorities arrested 15 pro-democracy activists in what has been the largest crackdown on the protest movement since the start of the coronavirus outbreak. The United Nations and several foreign countries, including the US, have condemned the arrests. Not surprisingly, Beijing has denounced the criticism, labeling it inappropriate meddling in domestic affairs.

Recommended Reads

The pandemic adds momentum to the deglobalization trend

Bill Gates on how to fight future pandemics

‘Sadness’ and Disbelief From a World Missing American Leadership

The collapse in oil is a wake-up call for stock markets

U.S. Debt to Surge Past Wartime Record, Deficit to Quadruple

NATO warns allies to block China buying spree

Charlie Munger: ‘The Phone Is Not Ringing Off the Hook’

Coronavirus in Africa: How deadly could COVID-19 become?

Is Persian Gulf heading toward a new confrontation?

This Week from BlackSummit

Alphabet Soup of Recoveries

Joel Charalambakis

Image of the Week

These Charts Put the Historic U.S. Job Losses in Perspective

Video of the Week

The global economy was shattered before the coronavirus

Source: DW News