Market Action

Global equities performed higher on the week as many hope the coronavirus pandemic is reaching its peak. The yield on the US 10-year Treasury note rose to 0.73%. On the other hand, the price of a barrel of West Texas Intermediate crude oil continued to fall, ending the week at $23 a barrel while a barrel of Brent crude oil dropped to $32. Volatility, as measured by the Cboe Volatility Index (VIX), also decreased this week from 49 last week to 43.3 this week.

The declined volatility and positive performance of global equities this week can be partially explained by the decrease in the number of new coronavirus cases reported globally. On April 3rd, the number of new coronavirus cases reached more than 101,000 but since then, it has been declining, hitting only 85,000 on Thursday. In the US, estimates of total deaths attributed to COVID-19 has sharply declined from 240,000 projected a week ago to 60,000. In addition, the number of hospitalizations and the demand for ventilators in New York state has also declined. Officials in Italy believe the virus has peaked in the country and hope to relax lockdown measures by the end of the month. Restrictions in Austria, Denmark, and the Czech Republic have already been loosened.

The eurozone is struggling to coordinate a fiscal response to the pandemic. History seems to be repeating itself as an economic crisis, once again, exposes the economic and political rifts between the wealthier countries of Northern Europe and the less affluent nations of the South. On Friday morning, European Union finance ministers announced a half-trillion-euro coronavirus rescue pact, but it has yet to be approved by EU leaders. The rescue package includes loans, credit lines for health costs, and jobless reinsurance funds but does not specify whether the much-disputed joint European bonds will be issued to pay for relief.

This week an additional 6.6 million people applied for state unemployment benefits in the US, bringing the grand total over the last 3 weeks to 17 million. Surprisingly, markets have not reacted to these staggering numbers. Economists estimate the US unemployment rate is around 13 percent, the highest it’s been since the Great Depression.

Fourteen Latin American and Caribbean countries have requested $4.48 billion dollars of emergency assistance from the International Monetary Fund (IMF) to combat the coronavirus. The region is possibly more exposed to the economic impacts of the virus than others because many of its economies were struggling from weak commodity values before the crisis. Economists are predicting the region will experience its worst recession in 50 years.

What could affect the markets in the weeks ahead?

OPEC and Russia have reached a preliminary deal to cut oil production by 10 million barrels per day, effectively ending the oil price war. This is the equivalent of nearly 10% of global supply. On Friday, the US and Group of 20 (G20) endorsed the agreement, pledging to do “whatever it takes” to bring stability to the oil industry in the midst of the coronavirus pandemic.

Vermont Senator Bernie Sanders dropped out of the presidential race this week, leaving former Vice President Joe Biden the presumptive Democratic nominee. According to recent national polls, Biden has a slight edge over President Donald Trump. However, COVID-19 has paused much of the presidential campaign as states postpone primaries and cancel campaign rallies.

Recommended Reads

This Week from BlackSummit

Is the Covid-19 Awakening Undercurrent Threats and Underwriting a Paradigm Shift? Markets, Statecraft, and the Dollar: Part II, the Oil Dimension

John E. Charalambakis

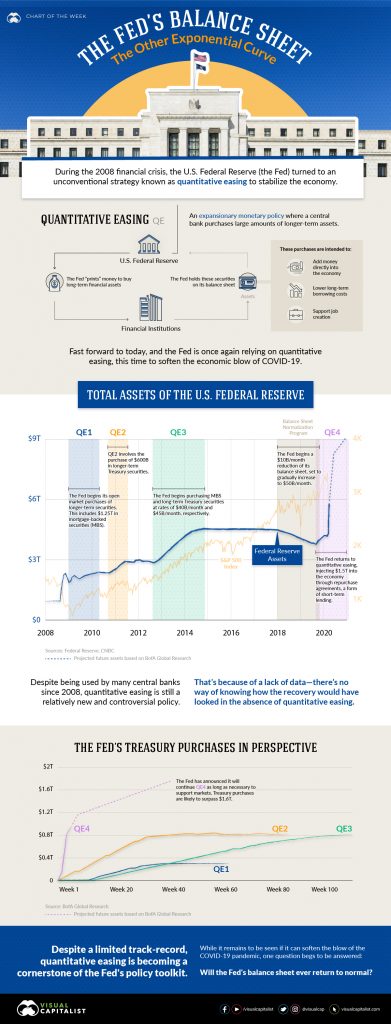

Image of the Week

Video of the Week

Egypt’s Solar Shift

Source: Al-Monitor