Market Action

Global equities rallied a bit this week as we had a few days of gains in the markets. However, markets continued to decline on Friday and many experts believe we are still in for major decreases as the COVID-19 crisis rages on. The yield on the 10-year US Treasury note fell to 0.676% and the price of a barrel of West Texas Intermediate crude oil also declined, falling to $21.84. Despite a brief market rebound this week, volatility remains high, rising to 66.25.

The United States has become the epicenter of the coronavirus pandemic. The number of reported cases in the US has surpassed those in every other country. As of Friday afternoon, there were over 100K cases reported and 1,246 deaths in the US. Many states have decided to go on full lockdown, prohibiting unnecessary travel and mandating the closure of non-essential businesses. The number of unemployment claims filed last week topped 3 million, hitting an all-time high, as a result of coronavirus lockdowns.

In an effort to curb the dramatic economic effects of the coronavirus, Congress approved the biggest economic relief package in US history. The $2 trillion dollar deal, which still was signed by President Trump, includes direct payments to many Americans, expanded unemployment insurance, over $350 billion in loans for small businesses, and a $500 billion lending fund for cities, industries, and states. Announcements of the deal could have been partially responsible for the rally in the markets this week.

Central banks across the world increased their efforts to pump liquidity into the markets and keep credit flowing. The US Federal Reserve expanded its support programs by announcing unlimited purchases of Treasuries and mortgage-backed securities along with other measures. The European Central Bank expanded the pool of assets it can buy, abandoned issuer caps for bond purchases related to its €750 billion Pandemic Emergency Purchase Programme, and got rid of its policy of owning no more than 33% of eurozone member’s debt causing bonds in Italy, Greece, and Portugal to rally. The Reserve Bank of India cut its repo rate 0.75% to 4.40% and the Bank of Canada launched two asset purchase programs and cut their overnight rate 0.50%.

US authorities have charged Venezuelan President Nicolás Maduro and other senior Venezuelan government officials with drug trafficking and conspiring with terrorists. The US has offered up a $15 million reward for Maduro’s arrest. The indictment is an escalation in the White House’s efforts to unseat Maduro’s leftist regime and support opposition leader Juan Guaído.

The Summer 2020 Olympics scheduled to be held in Tokyo, Japan has been postponed until the summer of 2021 due to the coronavirus pandemic. The Summer Olympics is the world’s largest sporting event and is a multibillion-dollar affair. Though the Olympic games have been cancelled before, this is the first time in history it has ever been postponed.

What could affect the markets in the weeks ahead?

The G20 held a summit over video conference this week in order to discuss a global response to the coronavirus pandemic. Following the online conference, G20 leaders announced that they are committed to presenting a united front against the pandemic and that they will coordinate policy efforts to tackle the health, social, and economic impacts of the virus. The leaders also pledged to work with multilateral bodies such as the International Monetary Fund and World Health Organization to support developing nations.

There have been no talks between Saudi Arabia and Russia regarding the oil price war that was sparked at the beginning of this month. On Friday, the Saudi kingdom held firm on its position saying they do not have any agreements with Moscow about oil production cuts or enlarging the OPEC+ alliance. Comments from both countries suggest they are prepared for a long price war.

Recommended Readings

How China is Exploiting the Coronavirus to Weaken Democracies

Federal Reserve’s Balance Sheet Tops $5 Trillion for First Time

The Coronavirus Could Reshape Global Order

The People in Charge See an Opportunity

March PMIs presage a precipitous recession in America and Europe

This Time Truly Is Different

‘Nationalisation’ of bond markets helps calm nerves

Coronavirus Will Change the World Permanently. Here’s How.

This Week from BlackSummit

Managing Rising Risks in Times of Uncertainty

John E. Charalambakis

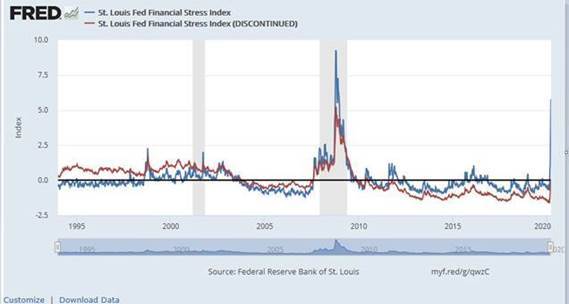

Image of the Week

Video of the Week

No country is free from modern slavery, but would you know it if you saw it?

Source: DW News