Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : September 21, 2019

Market Action

Global equities closed higher on the week while the yield on the US 10-year Treasury note declined 8 basis points to 1.78% and the price of a barrel of West Texas Intermediate crude oil rose $3.50 after Saudi Arabia’s oil infrastructure was damaged in attacks last weekend. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), was little changed at 13.5.

A number of factors combined to create stress within US money markets this week, prompting the Fed to add liquidity for the first time in more than a decade. The confluence this week of a quarterly corporate tax date and the settlement of several large Treasury auctions at midweek pushed overnight interest rates well above the Fed’s target range, prompting the central bank to add billions of dollars in liquidity to the system on Tuesday, Wednesday and Thursday. The Wall Street Journal reported on Friday that the Federal Open Market Committee may consider modestly expanding the Fed’s balance sheet again in order to provide more liquidity to the system.

An unusually divided Federal Open Market Committee cut its target rate a quarter point to between 1.75% and 2% this week and left the door open to additional cuts. Two members of the committee dissented, arguing rates should be left unchanged. One member voted for a deeper, half-point cut. US Federal Reserve Chairman Jerome Powell offered little clear guidance on future policy moves, though the committee’s statement retained language used to signal openness to additional cuts. Perhaps most notably, Powell dismissed the notion that the Fed might deploy negative interest rates if rates fell to the effective lower bound.

The Fed was not the only central bank to meet this week. The central banks of China, Brazil, Saudi Arabia and Taiwan all cut interest rates, following the Fed. Bucking the trend, Norway’s Norges Bank raised rates sooner than expected but indicated its tightening cycle may have come to an end. The Bank of England, Bank of Japan and Reserve Bank of Australia all held rates steady but were more dovish in their guidance. China cut its new loan prime rate for the second month in a row, but only by 5 basis points, to 4.20%.

Industrial production in China rose at the slowest pace in 17 years, growing 4.4% in August, down from July’s 4.8% pace, while retail sales increased at a slower-than-expected pace as well, rising 7.5% versus 7.6% the month prior. Premier Li Keqiang acknowledged it would be very difficult for China’s economy to continue to grow at 6% or more. Particular weakness in China and Europe prompted the OECD to downgrade its 2019 global growth forecast to 2.9% from an earlier 3.2% estimate, the slowest pace since the global financial crisis, while the Business Roundtable cut its US growth projection to 2.3% this year from its prior 2.6% outlook.

European Commission President Jean-Claude Juncker said that a Brexit deal is possible by October 31 and that if alternative arrangements are agreed to, the Irish backstop — which would tie the United Kingdom to European Union indefinitely while keeping the border between the Republic of Ireland and North Ireland open — would not be needed. Juncker said he didn’t know if the odds of a deal being reached were more than 50-50. A no-deal Brexit would have catastrophic consequences, he said, adding that he was doing everything he could to get a deal.

The end of the Netanyahu era? Israeli voters went to the polls on Tuesday for the second time in five months and as expected, neither Prime Minister Benjamin Netanyahu nor his main rival, the former army chief Benny Gantz, a centrist, won enough votes to claim an outright majority in the Israeli Parliament. Crucially, neither seems to have a straightforward path to forming a governing coalition with at least 61 of the 120 lawmakers in Parliament. That means the contest for prime minister will be decided not by the vote tally but by coalition talks, and Mr. Gantz and his Blue and White party seem likely to be given the first chance to form a government.

What Could Affect the Markets in the Days Ahead

The outlook for a near-term trade deal between the White House and China darkened on Friday, as President Trump dismissed the idea of an interim agreement and Chinese officials cancelled a planned visits with farmers in Montana and Nebraska. The combined news spooked investors, and the Dow Jones Industrial Average quickly lost 100 points, or around 0.4 percent. Negotiations are set to continue, but the twin events on Friday suggested there is not an urgency on either side to complete an agreement.

Spain is headed to polls for the fourth time in four years as the Socialists, the leading vote getters in April’s vote, were unable to form a government. The election is expected to take place on November 10. Markets have been calm given minimal anti-EU sentiment in Spain, but that could change as election day nears.

Saudi Arabia’s oil minister stated crude production will be fully restored by the end of September after major infrastructure was damaged last weekend by missile and drone strikes that the Kingdom blames on Iran.

This Week From BlackSummit

Short-Term Borrowing Crunch: An Aberration or a Signal of Trouble?

John E. Charalambakis

Recommended Reads

Israel Steps Back From Two Brinks – The Atlantic

Whistle-Blower Complaint Is Said to Involve Trump and Ukraine – The New York Times

The economic policy at the heart of Europe is creaking – An unconscious uncoupling

Martin Wolf: why rigged capitalism is damaging liberal democracy | Financial Times

How the global bond rally lost its fizz | Financial Times

What a War With Iran Would Look Like

Video of the Week

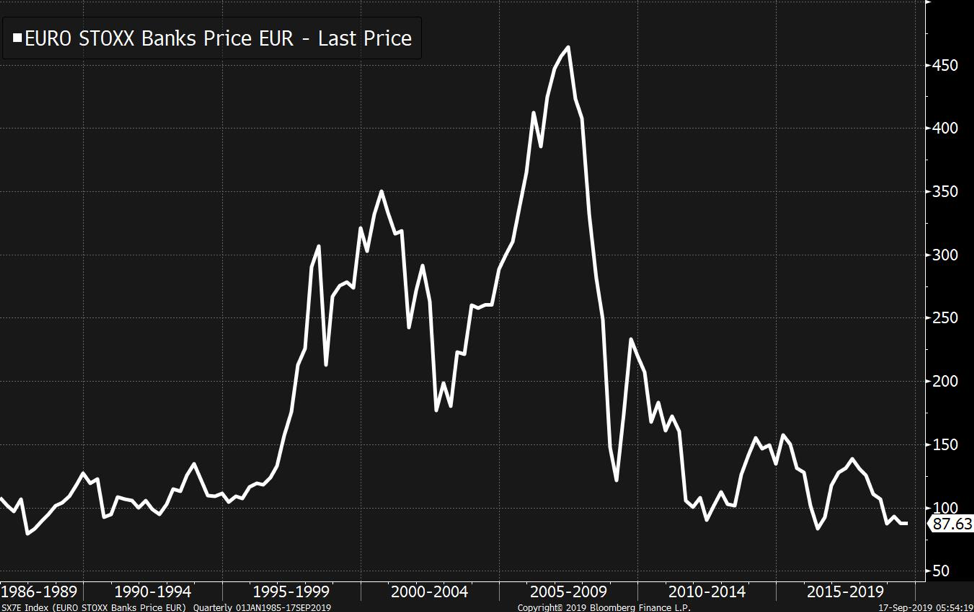

Image of the Week

Source: Bloomberg