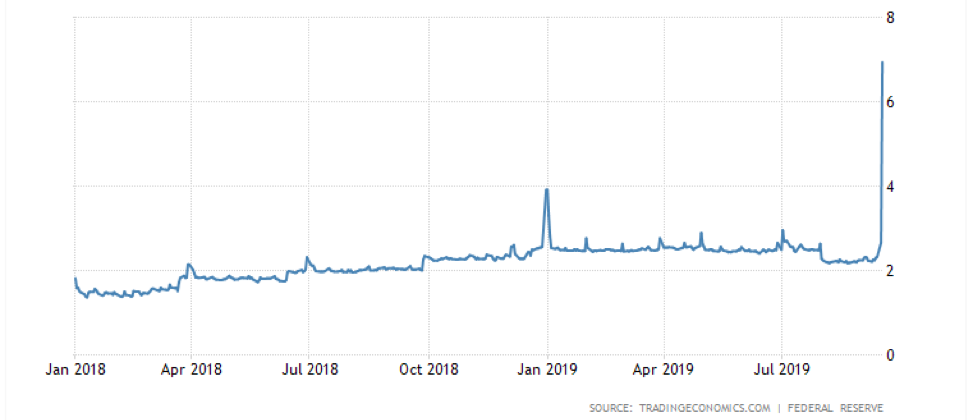

In the course of the last couple of days the Fed has been injecting significant amounts of liquidity (to the tune of $75 billion per day) into the financial system. It should be noted that such intervention has not taken place since the days of the financial crisis and represents an effort to release pressure seen in short-term borrowing. As the graph below shows, the overnight borrowing cost increased substantially on Tuesday, implying a funding shortage.

The overnight market is crucial for the workings of a smooth financial system, especially for fixed income markets. Primary dealers tapped $53 billion on Tuesday, $75 billion on Wednesday and the Fed is planning to repeat the offering for another $75 billion today (Thursday). The explanation given is that corporations pulled cash to pay taxes and investors settled recent bond purchases. Moreover, the decline in bank reserves that has been taking place in the last 2-3 years may be the fundamental reason behind the sudden move.

While the above have all the indications of an aberration – rather than of a fundamental credit quality issue within the financial institutions which in turn could undermine financial stability – we cannot take such a development out of the context of the bond bubble that has been in the works for decades now. The bond-buying frenzy has been exacerbated lately irrespectively of any bond fundamentals and the central banks’ actions keep inflating that bubble (the ECB and its latest announcement last week, as well as the Fed’s rate cut of yesterday are prime examples).

Here is an example of the irrationality that has been prevailing in the bond market: Since the beginning of the year close to $300 billion has been spent in buying negative yielding bonds. Furthermore, the interest rate differentials between a 10-year Treasury (which pays close to 1.8%) and the 10-year German Bund (which pays a negative 0.5%) is significant and thus, foreign exchange hedges and carry trades may infuse an element of instability into the system as cross-border capital flows – independently of production – magnify speculative trends.

If for some reason, the investors decide that they are no longer fools and start withdrawing their funds from the fixed income market (which in turn presupposes that a recession is avoided and/or other significantly major negative events are avoided too), then that market may start deflating (as it has been doing lately) which will have collateral damages for the equity markets as well.

It could be then that a potential market downturn would materialize simply because the economy avoids the worst!

Short-Term Borrowing Crunch: An Aberration or a Signal of Trouble?

Author : John E. Charalambakis

Date : September 19, 2019

In the course of the last couple of days the Fed has been injecting significant amounts of liquidity (to the tune of $75 billion per day) into the financial system. It should be noted that such intervention has not taken place since the days of the financial crisis and represents an effort to release pressure seen in short-term borrowing. As the graph below shows, the overnight borrowing cost increased substantially on Tuesday, implying a funding shortage.

The overnight market is crucial for the workings of a smooth financial system, especially for fixed income markets. Primary dealers tapped $53 billion on Tuesday, $75 billion on Wednesday and the Fed is planning to repeat the offering for another $75 billion today (Thursday). The explanation given is that corporations pulled cash to pay taxes and investors settled recent bond purchases. Moreover, the decline in bank reserves that has been taking place in the last 2-3 years may be the fundamental reason behind the sudden move.

While the above have all the indications of an aberration – rather than of a fundamental credit quality issue within the financial institutions which in turn could undermine financial stability – we cannot take such a development out of the context of the bond bubble that has been in the works for decades now. The bond-buying frenzy has been exacerbated lately irrespectively of any bond fundamentals and the central banks’ actions keep inflating that bubble (the ECB and its latest announcement last week, as well as the Fed’s rate cut of yesterday are prime examples).

Here is an example of the irrationality that has been prevailing in the bond market: Since the beginning of the year close to $300 billion has been spent in buying negative yielding bonds. Furthermore, the interest rate differentials between a 10-year Treasury (which pays close to 1.8%) and the 10-year German Bund (which pays a negative 0.5%) is significant and thus, foreign exchange hedges and carry trades may infuse an element of instability into the system as cross-border capital flows – independently of production – magnify speculative trends.

If for some reason, the investors decide that they are no longer fools and start withdrawing their funds from the fixed income market (which in turn presupposes that a recession is avoided and/or other significantly major negative events are avoided too), then that market may start deflating (as it has been doing lately) which will have collateral damages for the equity markets as well.

It could be then that a potential market downturn would materialize simply because the economy avoids the worst!