Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : August 31, 2019

Market Action

Global equities rose on the week as the rhetoric surrounding the US-China trade battle became less charged. The yield on the US 10-year Treasury note fell to 1.52% from 1.60% a week ago, while the price of a barrel of West Texas Intermediate crude oil rose around $3 to $56.35 as US crude inventories were drawn down this week. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 17.40 from 20. 8 last Friday.

Comments from the Chinese commerce ministry confirming that trade talks remain scheduled for September in Washington helped sooth frayed nerves late in in the week. After a week of escalating tensions last week, this week saw a modest shift in tone from both the United States and China, with China vowing not to immediately retaliate against the latest tariff hike announced by the US last week.

As the yuan weakens, China is tightening capital controls, requiring banks to seek extra documentation before approving foreign remittances, according to Nikkei.

Italy’s anti-establishment Five Star Movement reached agreement with the center-left Democratic Party to form a governing coalition, avoiding a return to the polls for the second time in less than two years. The combination has thwarted, at least temporarily, the League’s Matteo Salvini, who brought down the Five Star-League coalition in hopes that new elections would propel him to the premiership. Markets welcomed the new coalition by driving the yield spread between German and Italian debt to its lowest level since last year’s election, on hopes of a smooth budget negotiation between Italy and the EU. Giuseppe Conte will return as prime minister.

A currency crisis, sparked by a likely shift in philosophy after October’s presidential election, prompted Argentina’s president Mauricio Macri to seek a restructuring of his nation’s outstanding debt. The government is seeking to extend the maturities of outstanding bonds and to renegotiate a bailout package with the International Monetary Fund that requires repayment to begin in 2021. The currency crisis has fueled a surge in inflation, which some estimate will reach as high as 70% this year. At the end of the week, ratings agencies downgraded the country’s debt, ruling Argentina to be in selective default.

The US and France reached a compromise over France’s digital tax. Under the agreement, France’s 3% tax will be removed once an international agreement is reached.

What Could Affect the Markets in the Days Ahead

US Treasury Secretary Steven Mnuchin said his agency is giving very serious consideration to issuing bonds with ultra-long maturities. The comments came amid a decline in US 30-year bond yields to record lows below 2%. The Treasury Department has looked at issuing very long bonds twice in the last decade, but has decided against it each time. The prospect of locking in very low interest rates on Treasury borrowing seems to have revived the notion once again.

Announcing a new legislative agenda, British Prime Minister Boris Johnson has arranged to suspend Parliament for a crucial five-week period leading up to the October 31 Brexit date. Lawmakers will have very little time to take action to block a no-deal Brexit or to pass a motion of no confidence in Johnson. The prime minister hopes to wring concessions on the Irish backstop from the European Union if it is confronted with a no-deal outcome. Members of Parliament return from their summer recess on Monday and have a week to try and shape the course of Brexit or pass a motion of no confidence in the government.

The US and Japan announced a tentative trade agreement at last weekend’s G7 meeting in France. The deal covers agriculture, industrial tariffs and digital trade. The two sides hope to sign the final accord next month at the United Nations General Assembly in New York.

This Week From BlackSummit

Contemplating the Ramifications of a Slowdown

John E. Charalambakis

Recommended Reads

Why Branding China a “Currency Manipulator” Will Only Hurt the United States

How fire shaped humans, and forged the modern economy – BBC News

China’s Long March to Technological Supremacy

A Chinese take on the gold standard | FT Alphaville

Carney Urges Libra-Like Reserve Currency to End Dollar Dominance – Bloomberg

Video of the Week

Image of the Week

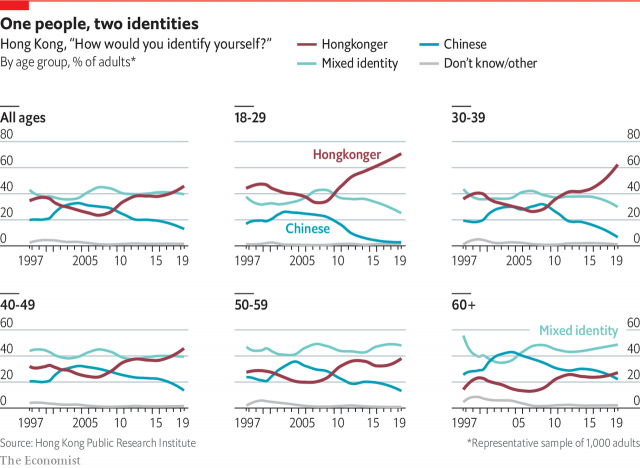

Almost nobody in Hong Kong under 30 identifies as “Chinese”

The territory’s residents increasingly see themselves as distinct from mainlanders

More information