Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : August 24, 2019

Market Action

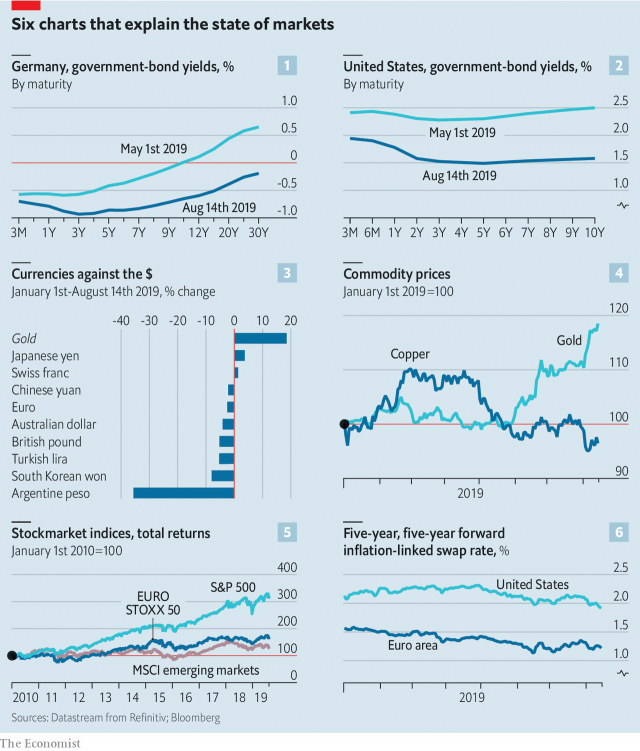

Global equities were little changed on the week while the yield on the US 10-year Treasury note rose 6 basis points to 1.60% from a week ago. The price of a barrel of West Texas Intermediate crude oil declined $1.50 to $53.65 while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 20.8.

The US and China raised tariffs on one another Friday, exchanging salvos in the growing trade war between the world’s two largest economies. Twelve hours after China said it would retaliate against US President Trump’s next round of tariffs by raising taxes on $75 bn of American goods, Trump said he would bolster existing tariffs on $250 bn worth of Chinese goods to 30% from 25 percent on October 1. And he said the US would tax an additional $300 bn worth of Chinese imports at a 15% rate, rather than the 10% he had initially planned. Those levies go into effect on September 1.

Italy’s government collapsed, triggering a power struggle between the country’s right-wing nationalists and rival parties, along with deepening Europe’s political upheaval as the Continent struggles with immigration and slowing economic growth. Prime Minister Giuseppe Conte resigned on Tuesday after Matteo Salvini, a rising force from Europe’s insurgent far-right, withdrew his support for the government. Salvini, whose anti-immigrant League is leading in public-opinion polls, is pushing for snap elections.

Speaking at an annual gathering of global central bankers in Jackson Hole, Wyoming, US Federal Reserve Chairman Jerome Powell said the central bank will act as appropriate to sustain the US economic expansion, adding that policymakers face a challenging environment as there is no precedent for bankers to follow in ameliorating the impacts of uncertainty surrounding the ongoing trade conflict. The Fed is close to achieving both its inflation and full employment mandates and the US economy has continued to perform well overall, though the global economic outlook has been deteriorating, Powell said. Those hoping for a strong dovish signal from the Fed are likely to be disappointed by Powell’s measured remarks.

British Prime Minister Boris Johnson traveled to Berlin and Paris this week is an effort to restart Brexit negotiations. The backstop, which would keep the United Kingdom within the European Union’s customs union, has been the main sticking point preventing the UK from reaching a divorce agreement with the EU. French President Emmanuel Macron said any compromise would need to closely adhere to what was previously agreed to with former British PM Theresa May. The UK press reported that EU officials are beginning to back away from their hard line on the necessity of the backstop and are beginning to seriously consider alternative arrangements.

The flash Markit manufacturing purchasing managers’ index slipped below 50 for the first time in a decade this week. The PMI slipped to 49.9, the lowest level since September 2009, amid headwinds from the trade dispute with China and slower global growth.

With 95% of S&P 500 constituents having reported for Q2 2019, blended earnings per share — the combination of reported data and estimates for those who have yet to report — is currently -0.5% year over year, while revenue is expected to grow approximately 4% compared with the same quarter a year ago, according to FactSet Research. Expectations at the start of the reporting period were for a deeper decline in EPS of around -2.7%. Looking ahead to Q3, analysts are lowering estimates further, forecasting a 3.2% EPS decline. Relatively upbeat reports from retailers have helped ease fears of a slowing US economy.

Updated market return figures

What Could Affect the Markets in the Days Ahead

The yield on the US 10-year Treasury note fell below the 2-year note yield briefly this week, sparking fresh US recession concerns. However, some analysts argue that a yield curve inversion, which almost always precedes US recessions, is not as powerful a signal in the current environment. Negative rates in Europe and Japan, the expected restart of bond buying by the European Central Bank and the massive Fed balance sheet are all distorting the yield curve and muting the traditional signal, they believe.

European Central Bank governing council member Olli Rehn has indicated that an aggressive easing in monetary policy is likely at the bank’s September meeting, and the minutes of the governing council’s July meeting, released Thursday, said the same. More deeply negative policy rates, additional bond buying and stronger forward guidance are expected to be parts of the package.

The 45th annual G7 Summit is set to kick off on August 24 in the seaside town of Biarritz in France. The G7 countries have the largest advanced economies in the world, representing 58% of global net wealth according to the International Monetary Fund.

This Week From BlackSummit

At the Crossroads called Hellespont: Recessionary Fears Meet Unapologetic Optimism

John E. Charalambakis

Recommended Reads

It’s Time to Start Worrying About the National Debt

Federal Deficits to Grow More Than Expected Over Next Decade, CBO Says – WSJ

Germany Regrets Size of Bond That Pays Nothing as Auction Flops – Bloomberg

Collapse in Argentine bonds alerts distressed-debt specialists | Financial Times

No 10 furious at leak of paper predicting shortages after no-deal Brexit | Politics | The Guardian

Trump foolishly thinks gold standard will usher in a golden age | Business | The Guardian

Asian exporters must heed Singapore’s recession warning signs – Nikkei Asian Review