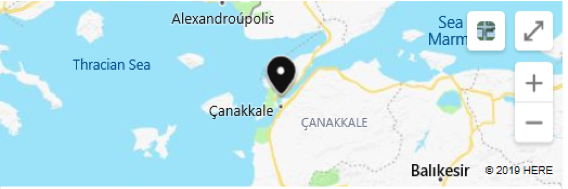

The year was 480 B.C.E. and Xerxes (Persia’s king of kings) had gathered his troops and his fleet in the place known as Abydos, a town on the Asian side of the Hellespont, where two continents (Asia and Europe) meet fours seas at a critical intersection where the Black Sea and the Sea of Marmara meet the Aegean and the Mediterranean Sea).

Xerxes consults his uncle-advisor named Artabanus about a second invasion of Greece (the first one about ten years earlier had resulted in a disaster for Darius – Xerxes’s father – at Marathon). Artabanus – as if another Hamlet – warns the king of possible disasters with Xerxes responding “if you were to take account of everything …, you would never do anything…big things are won by big dangers.”

As Xerxes’s troops and fleet reach the European shore, an awed bystander is wondering why Zeus has disguised himself as a Persian monarch, bringing along “all the people of the world.” Xerxes is of the mentality that nothing can stop him. He flattens the lands, he turns water into solid land by bridging the Hellespont, he makes solid ground liquid by cutting a canal across the Athos peninsula (out of mere arrogance as Herodotus informs us), and he only trusts himself and “his divine destiny”. Artabanus, on the other hand, counts the costs (seen and unseen), the obstacles, the impossibilities, and the complexity of this grand endeavor.

As of about ten days ago, we – like Artabanus – were thinking that the time may be approaching for another trimming and additional portfolio hedging in anticipation of a major downturn as we are approaching the last quarter of the year. The reasoning for such thinking included the abundant signs of a global slowdown in the US, the EU, Asia, as well as South America. Furthermore, trade and geopolitical tensions, along with rising risks (see last week’s commentary) as well as assessments of current vs. fair valuations were creating a sense that we would not be surprised if the S&P 500 ended the year at around 2650 i.e. around 8-10% below current level.

In addition, there is ample evidence in the markets nowadays of a declining trading liquidity. Trading in US Treasuries, as well as corporate bonds has shrunk by more than 50% in the last several years. Equity turnover has also been reduced significantly. When someone looks at this declining liquidity and considers the lack of market makers s/he has wonder if reliance on algorithms can fill-in the gaps. Furthermore, a sense of uneasiness is rising when we also consider the fact that investment funds and algorithmic trading cannot be a source of trading liquidity. On the contrary, both of them may become sources of instability (investing and exacerbating high prices at times when abundance of cash and internal rules – regarding cash positions – necessitate buying, while demand for redemptions could exacerbate a selling panic).

Based on the above our sense was (and still is) that market fragility is rising, especially if volatility moves to a higher plateau. Moreover, the trillions traded through ETFs could enable further destabilization at which point price discovery becomes obsolete. In such a scenario, the absurdity of paying borrowers for lending them money (negative yields) in the midst of soaring debts (according to the latest Congressional Budget Office estimates, US deficits will add more than $12 trillion to the US debt in the next 10 years) could turn markets upside down.

However, we should at the same time question the above scenario, and envision an alternative case where the market unraveling does not materialize and rather the markets continue unapologetically their upward trajectory that they have been enjoying for 10 years now. What could enforce such a scenario? We could identify at least four factors that could uplift the markets even further between now and year’s end, namely: A truce in the trade war; the Feb cutting (wrongly in our humble opinion) rates again in September; the ECB endeavoring into a buying and quantitative easing spree; and corporate earnings/news being better than the downbeat expectations we have nowadays. If two or three out of those four materialize, we would not be surprised to see the market rally continuing through the end of the year.

Xerxes after crossing the Hellespont advanced to the Greek mainland “Even if all the Greeks, and moreover all the men who live in the western countries, were assembled together, they would not be able to fight me.” However, signs of trouble appeared even at Thermopylae where Leonidas with his Spartans delayed Xerxes and showed to the Athenians that Xerxes cannot flatten everything with his intimidation. Arriving in Athens he faced the same dilemma that Napoleon faced in Moscow in 1812: what have you accomplished when you capture your objective only to find it abandoned? (The Athenians at the order of Themistocles has abandoned Athens). The king of kings burned the Acropolis and decided to give the Athenians a final lesson by humiliating them at the battle of Salamis. The problem was that his fleet could not move in the narrow straits of Salamis and Xerxes was forced seeing his fleet burning and sinking. Themistocles hastened the king’s departure by spreading the rumor that the Athenians’ next objective would be the Hellespont bridges. The troops in the haste to return home suffered a humiliating defeat at Plataea (a battle that became a famous play by Aeschylus).

Xerxes was haunted by Darius ghost questioning him if he ever established a connection between his end-goals and the means to accomplish those goals. End-goals can be unapologetically infinite. Means are stubbornly finite. Reality has to connect the two, however they are never interchangeable.

At the crossroads of the Hellespont, Darius’ ghost sits on a throne pondering what if….

At the Crossroads called Hellespont: Recessionary Fears Meet Unapologetic Optimism

Author : John E. Charalambakis

Date : August 22, 2019

The year was 480 B.C.E. and Xerxes (Persia’s king of kings) had gathered his troops and his fleet in the place known as Abydos, a town on the Asian side of the Hellespont, where two continents (Asia and Europe) meet fours seas at a critical intersection where the Black Sea and the Sea of Marmara meet the Aegean and the Mediterranean Sea).

Xerxes consults his uncle-advisor named Artabanus about a second invasion of Greece (the first one about ten years earlier had resulted in a disaster for Darius – Xerxes’s father – at Marathon). Artabanus – as if another Hamlet – warns the king of possible disasters with Xerxes responding “if you were to take account of everything …, you would never do anything…big things are won by big dangers.”

As Xerxes’s troops and fleet reach the European shore, an awed bystander is wondering why Zeus has disguised himself as a Persian monarch, bringing along “all the people of the world.” Xerxes is of the mentality that nothing can stop him. He flattens the lands, he turns water into solid land by bridging the Hellespont, he makes solid ground liquid by cutting a canal across the Athos peninsula (out of mere arrogance as Herodotus informs us), and he only trusts himself and “his divine destiny”. Artabanus, on the other hand, counts the costs (seen and unseen), the obstacles, the impossibilities, and the complexity of this grand endeavor.

As of about ten days ago, we – like Artabanus – were thinking that the time may be approaching for another trimming and additional portfolio hedging in anticipation of a major downturn as we are approaching the last quarter of the year. The reasoning for such thinking included the abundant signs of a global slowdown in the US, the EU, Asia, as well as South America. Furthermore, trade and geopolitical tensions, along with rising risks (see last week’s commentary) as well as assessments of current vs. fair valuations were creating a sense that we would not be surprised if the S&P 500 ended the year at around 2650 i.e. around 8-10% below current level.

In addition, there is ample evidence in the markets nowadays of a declining trading liquidity. Trading in US Treasuries, as well as corporate bonds has shrunk by more than 50% in the last several years. Equity turnover has also been reduced significantly. When someone looks at this declining liquidity and considers the lack of market makers s/he has wonder if reliance on algorithms can fill-in the gaps. Furthermore, a sense of uneasiness is rising when we also consider the fact that investment funds and algorithmic trading cannot be a source of trading liquidity. On the contrary, both of them may become sources of instability (investing and exacerbating high prices at times when abundance of cash and internal rules – regarding cash positions – necessitate buying, while demand for redemptions could exacerbate a selling panic).

Based on the above our sense was (and still is) that market fragility is rising, especially if volatility moves to a higher plateau. Moreover, the trillions traded through ETFs could enable further destabilization at which point price discovery becomes obsolete. In such a scenario, the absurdity of paying borrowers for lending them money (negative yields) in the midst of soaring debts (according to the latest Congressional Budget Office estimates, US deficits will add more than $12 trillion to the US debt in the next 10 years) could turn markets upside down.

However, we should at the same time question the above scenario, and envision an alternative case where the market unraveling does not materialize and rather the markets continue unapologetically their upward trajectory that they have been enjoying for 10 years now. What could enforce such a scenario? We could identify at least four factors that could uplift the markets even further between now and year’s end, namely: A truce in the trade war; the Feb cutting (wrongly in our humble opinion) rates again in September; the ECB endeavoring into a buying and quantitative easing spree; and corporate earnings/news being better than the downbeat expectations we have nowadays. If two or three out of those four materialize, we would not be surprised to see the market rally continuing through the end of the year.

Xerxes after crossing the Hellespont advanced to the Greek mainland “Even if all the Greeks, and moreover all the men who live in the western countries, were assembled together, they would not be able to fight me.” However, signs of trouble appeared even at Thermopylae where Leonidas with his Spartans delayed Xerxes and showed to the Athenians that Xerxes cannot flatten everything with his intimidation. Arriving in Athens he faced the same dilemma that Napoleon faced in Moscow in 1812: what have you accomplished when you capture your objective only to find it abandoned? (The Athenians at the order of Themistocles has abandoned Athens). The king of kings burned the Acropolis and decided to give the Athenians a final lesson by humiliating them at the battle of Salamis. The problem was that his fleet could not move in the narrow straits of Salamis and Xerxes was forced seeing his fleet burning and sinking. Themistocles hastened the king’s departure by spreading the rumor that the Athenians’ next objective would be the Hellespont bridges. The troops in the haste to return home suffered a humiliating defeat at Plataea (a battle that became a famous play by Aeschylus).

Xerxes was haunted by Darius ghost questioning him if he ever established a connection between his end-goals and the means to accomplish those goals. End-goals can be unapologetically infinite. Means are stubbornly finite. Reality has to connect the two, however they are never interchangeable.

At the crossroads of the Hellespont, Darius’ ghost sits on a throne pondering what if….