Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : August 3, 2019

Market Action

Global equities were lower on the week in reaction to escalating US–China trade tensions. The yield on the 10-year US Treasury note tumbled 21 basis points to 1.87% while the price of a barrel of West Texas Intermediate crude oil fell 60 cents to $55.70. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 18.6 from 12.2.

Frustrated at the slow pace of trade talks and citing China’s failure to purchase large quantities of US agricultural products and halt the shipment of fentanyl to the United States, President Donald Trump announced 10% tariffs, effective 1 September, on the approximately $300 billion in US imports from China not already subject to a 25% levy. The tariffs are expected to impact an array of consumer products that had previously avoided duties.

The US Federal Reserve cut interest rates a quarter of a percentage point on Wednesday, the first reduction in over a decade. One of the reasons the Fed cited for Wednesday’s cut was uncertainty surrounding trade, so Thursday’s tariff announcement may increase the odds of additional cuts. The cut resulted in a surge in the US dollar to its highest level in two years, a potential headwind for US exporters going forward.

Purchasing managers’ indices released this week show that the global manufacturing sectors remains challenged by headwinds associated with the US–China trade battle, Brexit and other factors. The Institute for Supply Management’s measure of US manufacturing sentiment was the only major regional index to hold above 50, coming in at 51.2 in July. PMIs in the eurozone, United Kingdom, Japan and China all remained below 50 last month, suggesting the sector is experiencing a contraction.

With global supply chains in flux owing to the ongoing US–China trade dispute, Vietnam has benefited, and it has become a source of concern for the US Trade Representative, Robert Lighthizer, who warned Vietnam this week that it must take steps to reduce its $40 billion trade surplus with the US by expanding imports of US goods, services, agricultural products and intellectual property. Additionally, The US is on the lookout for US-bound goods from China transshipped through Vietnam in an effort to avoid US tariffs. Spillovers from the US–China trade war are negatively impacting other Asian exporting nations such as South Korea, Taiwan and Japan. For example, South Korean exports fell for an eighth straight month in July, while Taiwanese manufacturing contracted for a 10th straight month and Japanese industrial production slumped 3.7% in June.

Authorities in Moscow detained last weekend more than 1,000 people protesting the exclusion of opposition candidates from city elections, a sign of growing public discontent as trust in President Vladimir Putin declines. Thousands turned out for Saturday’s unauthorized protest, which city officials had warned would be met with a stern response. Protesters are angry at the Moscow electoral commission’s decision to bar opposition candidates it says failed to collect enough signatures to be placed on the Sept. 8 city council ballot—a claim the protesters deny.

Updated market return figures

What Could Affect the Markets in the Days Ahead

Raising a red flag of recession ahead, the inverted US Treasury yield curve between 3 months and 10 years has fallen deeper into negative territory since the latest Trump tariff threat – falling to close to the 12-year lows of minus 26 basis points set earlier this year.

The central banks of Norway, New Zealand, Australia, India, Philippines and Thailand all hold interest rate meetings next week and hot on the heels of the first cut in US rates in over a decade, action is almost guaranteed.

Trade data due out from China next week is likely to reinforce a trend of declining exports and imports, the latter also a function of slowing investment and demand at home. China’s trade surplus with the US has been rising too. The Fed’s interest rate cut this week may help ease the manufacturing pain in the United States, but the dollar has surged against the yuan since and will offset that for US firms. China has done a lot more targeted fiscal and monetary easing, can more easily source US imports from elsewhere and also has the ability to inflict pain on US commodity and farm sectors that back a Trump presidency.

This Week From BlackSummit

Crossroads: At the Intersection of Geopolitics and Geoeconomics

Rachel Poole

Center for Financial Stability Roundtable Presentation

Philipp Hartmann

Recommended Reads

Putin’s Uncertain Future Shadows a Crackdown on Moscow Protests – The New York Times

How America Can Both Challenge and Coexist With China

JPMorgan Enters China to Take On the World’s Biggest Bank

Opinion | Winston Churchill Would Despise Boris Johnson – The New York Times

Why Central Banks Need to Step Up on Global Warming – Foreign Policy

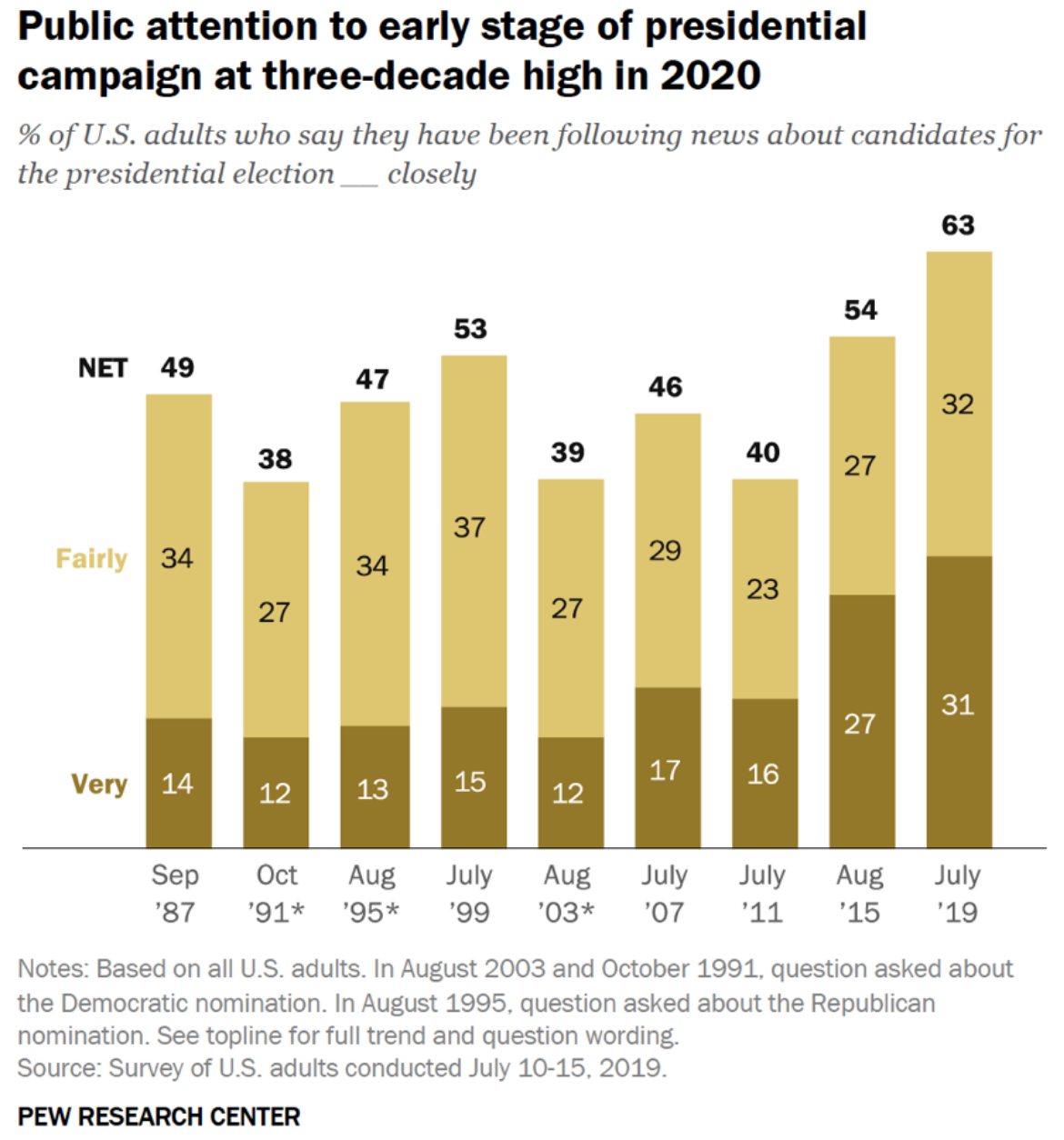

Image of the Week

Source and more info: Pew Research Center