Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : July 27, 2019

Market Action

The Nasdaq Composite and the S&P 500 closed the week at record highs as strong earnings and healthy growth in gross domestic product buoyed stocks across the board. The yield on the US 10-year Treasury note rose slightly to 2.08% from 2.06% last Friday. The price of a barrel of West Texas Intermediate crude oil rose slightly to $56.31, while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 12.2 from 14.5.

With around 43% of S&P 500 constituents having reported earnings for Q2 2019, blended earnings per share – the combination of reported data and estimates for those who have yet to report – is currently -2.3% year-over-year, while revenue is expected to grow approximately 3.9% compared to the same quarter a year ago, according to FactSet Research.

The dry bulk shipping market has staged an impressive recovery in recent weeks, with capesize earnings in particular rallying well above $20,000 per day and catching many market participants by surprise. Reasons behind the recovery likely include strong demand in China, improving iron ore volumes out of Australia and Brazil, lack of available tonnage in the Atlantic and limited growth in the active fleet.

Boris Johnson won the race to become next prime minister of the UK, and Theresa May officially gave her resignation to the Queen on Wednesday. Johnson has pledged to lead UK out of the European Union by the October 31st deadline, with or without a deal, further intensifying the political and economic uncertainty for the UK. As gridlock within the UK parliament continues, a general election may be increasingly likely.

Germany’s manufacturing PMI fell in July to the lowest level in seven years and well below the 50 level, signaling that Germany’s economy is weakening. The slowdown in the manufacturing sector can be attributed to the ongoing trade disputes and Brexit uncertainty. However, Germany’s labor market and household spending have remained strong, limiting the impact of a deteriorating manufacturing industry on other sectors.

The US economy grew at an annual rate of 2.1% in the second quarter of 2019 – lower than first quarter’s 3.1%, but better than economists’ 2% expectations – despite a cooling global economy. The growth was supported by strong consumer spending (+4.3%), which helped offset the decline in business investment (-0.6%). US initial jobless claims declined by 10,000 to 206,000 last week – versus 220,000 expected – for the third time in the past four weeks, suggesting a stable US labor market.

The IMF stated that real global GDP is expected to slow to 3.2% in 2019 amid deteriorating global trade due to ongoing trade tensions. This forecast is down from the 3.3% global GDP growth forecast by the IMF in April and down from 3.6% last year.

What Could Affect the Markets in the Days Ahead

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are meeting with China’s Vice Premier Liu He and his team next week in Shanghai to resume trade talks. The US signaled that it would like to get back to the same level of dialogue reached with China before the impasse in negotiations in May and hope to return to the working draft of a trade agreement reached in early May. The US is also demanding that China purchase more agricultural products from the US. China has yet to agree to these requests and wants the US to remove tariffs imposed earlier in the year.

Major central banks are moving toward a more dovish tone amid rising headwinds to the global economy. The ECB has indicated that it will cut its short-term interest rate in September and possibly revamp its quantitative easing program in order to stimulate the eurozone economy, which is suffering from the ongoing weakness in global trade due to trade tensions between the US and China. In conjunction, the Fed officially signaled that it will lower interest rates by 0.25% at its meeting next week; a larger rate cut is unlikely as there is currently no sign of imminent economic downturn.

A batch of eurozone data will be released next week: GDP for the second quarter will be much anticipated as the first quarter had come in surprisingly strong but intermediate data has been dismal. Inflation will be released for July, which will show whether subdued growth still translates into weak core inflation growth despite higher wages. Finally, unemployment data will also be regarded with interest. As long as the labor market continues to perform well, service sector growth is likely to maintain a decent pace — which is key since industrial production is still well below its December 2017 peak.

This Week From BlackSummit

Deglobalization and Disruption Meets Deconstruction: Isaiah Berlin and the Crooked Timber of Trading

John E. Charalambakis

Recommended Reads

Why the wheels fell off China’s tech boom | Financial Times

Robert Morgenthau, Manhattan district attorney, 1919-2019 | Financial Times

KOF Globalisation Index: Globalisation Lull Continues – KOF Swiss Economic Institute | ETH Zurich

Small Company Shares Fall Behind in Sign of Economic Worry – WSJ

Chinese Money in the U.S. Dries Up as Trade War Drags On – The New York Times

America’s Indefensible Defense Budget | by Jessica T. Mathews | The New York Review of Books

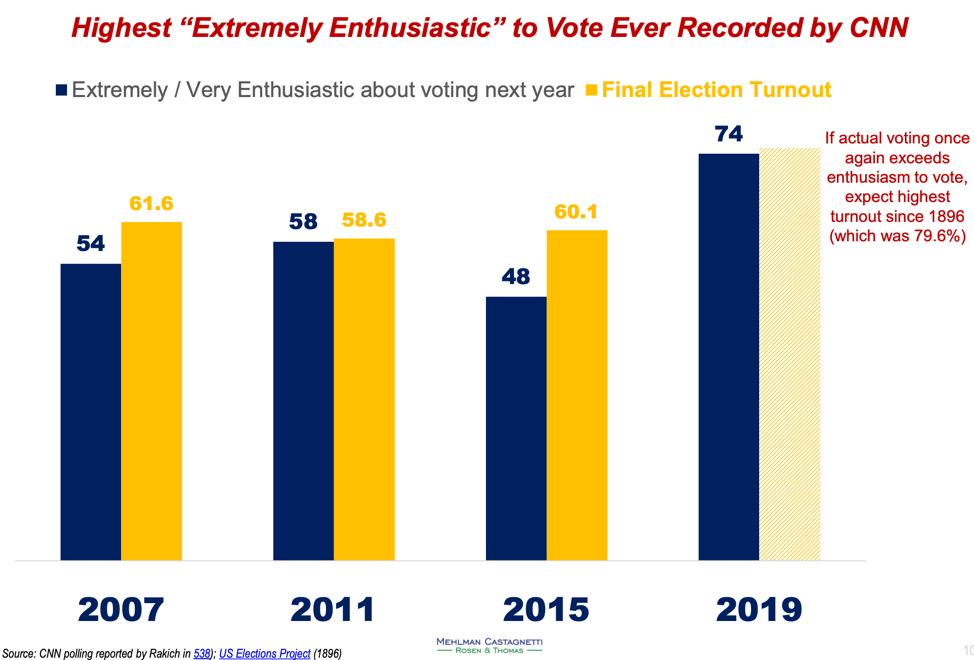

Image of the Week

US enthusiasm for voting:

Source and more info: Mehlman Castagnetti Rosen & Thomas