Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : May 18, 2019

Market Action

Global equities recouped some of the ground lost last week amid the breakdown in US-China trade talks. The yield on the US 10-year Treasury note continued to decline, falling to 2.40% from 2.44% a week ago. The price of a barrel of West Texas Intermediate crude oil rose $1 to $63.00 while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 15.8 from 19.8 last Friday.

EU authorities fined Barclays, RBS, Citigroup, JPMorgan and MUFG more than €1bn for participating in cartels to manipulate the foreign exchange spot market for eleven currencies by exchanging sensitive information and trading plans through online chat rooms to gain financially. UBS participated in the cartels but was not fined as it alerted the EU.

A mixed bag of US economic data was released this week showing that retail sales were little changed in April after a big upside surprise in March and that industrial production declined by one-half percent. More forward-looking surveys in two US Federal Reserve districts were more upbeat, however, with New York and Philadelphia Fed surveys both exceeding expectations. Data released by China this week were uniformly weak despite significant economic stimulus in recent months, highlighted by retail sales growing at their slowest pace in 16 years in April. Industrial production and fixed asset investment were also below expectations.

Attacks on four oil tankers in the Persian Gulf and on a Saudi oil pipeline raised tensions just days after the US announced it is moving additional forces to the gulf region. The US blamed Iran for the tanker attacks while Iranian-backed Houthi rebels were blamed for targeting the Saudi pipeline. Despite the tensions, crude prices were largely stable, contained by a cut in the International Energy Agency’s oil demand forecast. On Friday, the Wall Street Journal reported that the US and Iran may have misread each other. The paper reported that US intelligence agencies think that Iran’s leaders believed the US was preparing to strike Iran, which prompted preparations for possible counterstrikes. Those preparations were interpreted by the US as offensive threats against US forces. President Trump reportedly told his acting secretary of defense that he does not want tensions between the US and Iran to lead to war, mitigating concerns somewhat.

The Trump administration intensified pressure on China by signing an executive order banning US purchases of telecommunications equipment from China’s Huawei Technologies. At the same time, the US Department of Commerce restricted US companies from selling or transferring technology to the tech giant. China responded by saying in a front-page commentary in the state-run People’s Daily newspaper that the US must show sincerity if it is to hold meaningful trade talks. China cast the US as a bully and pushed back on US claims of China’s malfeasance on trade. Trump said he has not decided whether to impose a 25% tariff on the balance of China’s exports to the United States after last week hiking levies on exports amounting to $200 billion to which China retaliated by announcing it will hike existing 5% to 10% tariffs to between 10% and 25% on 1 June while exempting commercial aircraft and crude oil.

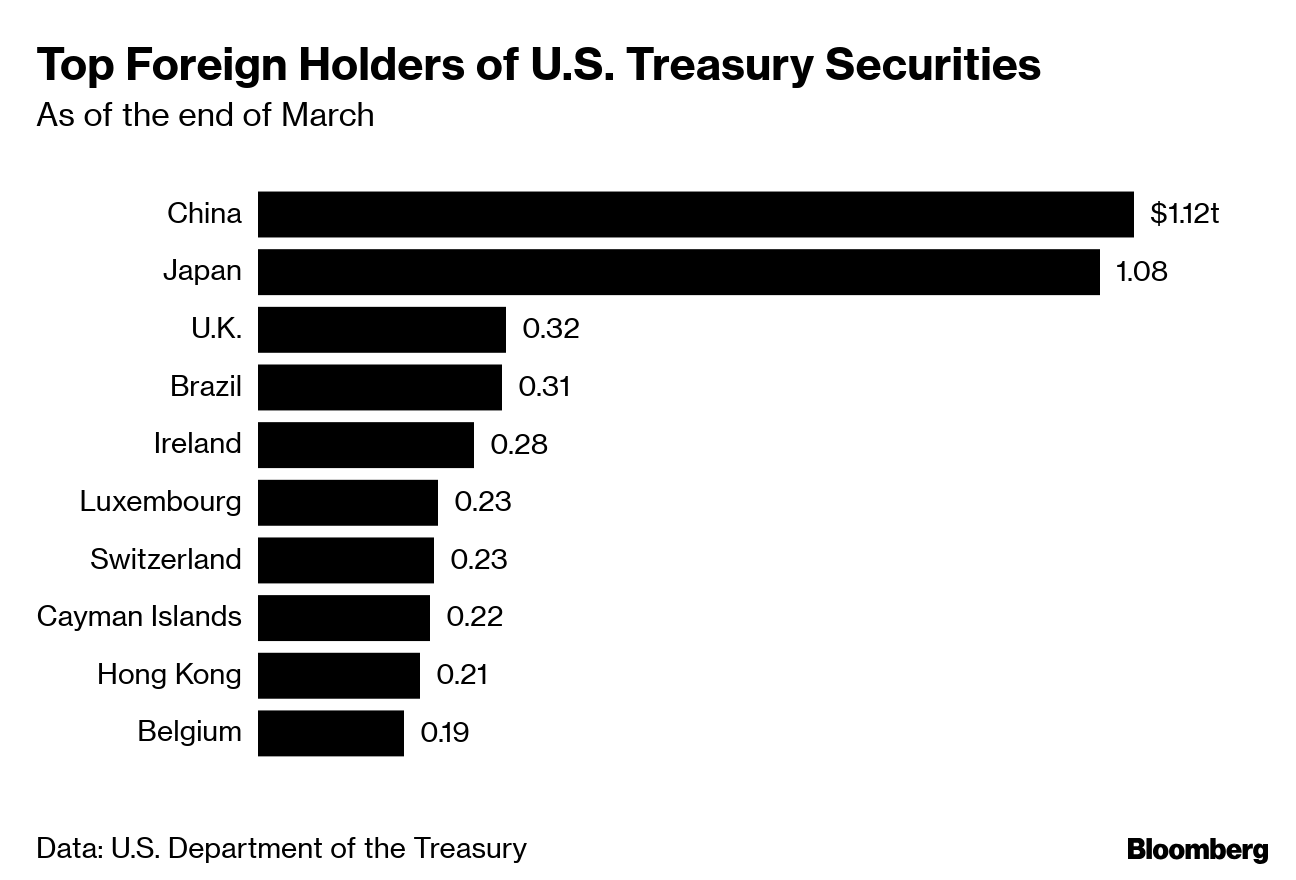

China sold the most Treasuries in more than two years in March, according to data released by the US Treasury, magnifying concerns that the country might weaponize its position as the US government’s largest foreign creditor in the trade dispute between the two countries.

What Could Affect Markets in the Week Ahead?

While populist parties are expected to gain representation in next week’s European parliamentary elections, they are expected to fall well-short of achieving a majority. Additionally, overall support for the European Union remains relatively high. However, the performance of various national political parties could be important in their respective jurisdictions. Meanwhile, Italy’s League, if it performs well in elections next weekend, could be emboldened to dismantle the coalition it has formed with the Five Star Movement in order to form a right-of-center coalition.

Polling in advance of next Thursday’s elections in the UK show Prime Minister Theresa May’s Conservative Party falling to fifth place, according to some polls. The Brexit Party, formed just weeks ago and led by Brexiteer Nigel Farage, leads the polling. Another defeat next Thursday, after a poor showing in local polls earlier this month, will increase the pressure on the prime minister to resign soon. She has previously indicated that she will leave office once the withdrawal agreement with the European Union is passed by Parliament, though it has failed to pass on three tries and cross-party talks with the Labour Party have broken down. After May said she would set a timetable for her departure in early June, former London mayor and UK foreign secretary Boris Johnson indicated this week that he will take part in an upcoming leadership contest.

Markets seem bent on testing the resolve of China’s central bank not to let the yuan fall too fast and breach the 7-per-dollar level. Given some evidence Beijing has been selling US Treasury bonds in favor of gold, many are wondering if China will use a weaker yuan both as a bargaining chip and a means to offset higher tariffs on its exports. But weaponizing the yuan has its downside: Aside from capital flight and the hit to local banks, a yuan plunge will undermine the goal of promoting global yuan use and luring foreign investors to Chinese stocks and bonds.

This Week From BlackSummit

Market Trajectory: Pieter Bruegel Tweeting from Purgatory

John E. Charalambakis

Recommended Reads

How Xi’s Last-Minute Switch on U.S.-China Trade Deal Upended It – The New York Times

Meet the 2019 CNBC Disruptor 50 companies

Trump administration hits China’s Huawei with one-two punch – Reuters

The U.S. Has a Long History of Provoking Wars. Could Iran Be Next? | The New Yorker

Populism and polarisation threaten Latin America – The 40-year itch

A Confrontation from Hell by Amin Saikal – Project Syndicate

The Global Crisis of Democracy – WSJ

Video of the Week

Why Amazon Is Gobbling Up Failed Malls