Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : May 4, 2019

Market Action

Global equities were little changed on the week. The same held true for interest rates, with the yield on the 10-year US Treasury note rising two basis points to 2.52%. The price of a barrel of West Texas Intermediate crude oil fell $1.50 to $62.00 while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), was unchanged at 13.2.

Britain’s ruling Conservative Party and its main opposition Labour Party suffered setbacks in English local elections, suggesting widespread frustration over the two parties’ handling of the UK’s withdrawal from the EU. The disappointing outcome for both major parties was signaled by the early returns from the first major ballot since the postponement of Britain’s scheduled departure from the bloc.

The eurozone economy grew more quickly than expected in the first quarter as gross domestic product expanded 1.2% year over year. Spain led the way, growing at a 2.4% pace, while Italy exited recession by eking out year-over-year growth of 0.1%. Additionally, unemployment fell to 7.7%, the lowest level since the global financial crisis.

The unemployment rate in the United States fell to 3.6% in April, the lowest level since December 1969, with the economy adding 263,000 jobs last month, well above the 190,000 consensus estimate. Wage growth held steady, advancing at a 3.2% rate compared with a year ago, the same pace as in March. Another economic bright spot this week was an unexpected jump in productivity, which rose 3.6% in the first quarter, nearly doubling expectations. Higher productivity allows employers to raise wages while maintaining robust profit margins without setting off inflation alarm bells at the US Federal Reserve. However, the Institute for Supply Management’s manufacturing index tumbled to 52.8 in April from 55.3 in May, the lowest level since October 2016. Weak demand for US exports was a factor in the decline.

With 77% of the constituents of the S&P 500 Index having reported for Q1 2019, blended earnings per share, which combines reported data with estimates for those who have yet to report, shows that earnings growth is running at a -1% year-over-year pace while revenues are seen rising 5.2% compared with the same quarter a year ago, according to FactSet Research.

Thousands of Venezuelans clashed in the streets with pro-government forces following an audacious call by opposition leader Juan Guaidó to join him and a small group of military officers in overthrowing President Nicolás Maduro’s government. Venezuela’s central bank has begun using piles of cash rather than electronic transfer to sell foreign exchange to local banks, according to five finance sector sources as reported by Reuters, a sign of how the nation’s economy is becoming increasingly primitive amid the political and economic meltdown.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

US treasury secretary Steven Mnuchin said that just-concluded talks this week in Beijing were the beginning of the final lap of trade negotiations between the US and China. China’s vice premier, Liu He, will travel to Washington next week for further talks amid hopes that negotiations will wrap up by next Friday. Final details to be worked out include the pace at which the US will roll back existing tariffs on Chinese goods and the details of the agreement’s enforcement mechanism.

This month’s Fed meeting saw Chairman Jerome Powell play down recent weakness in U.S. inflation as “transitory” and declare the policy stance “appropriate”. Is Powell right in his view of inflation? Some recent indicators, from first-quarter growth to factory orders to productivity, have been pretty strong; however, manufacturing is growing more slowly and inventories are building. Thus, consumer and producer inflation figures due May 9 and 10 will be watched to confirm the inflation backdrop is indeed transient.

The Reserve Bank of Australia meets on May 7, followed by the Reserve Bank of New Zealand a day later. Both have the same story to tell: low inflation, strong labor markets and limited room to cut interest rates. Both economies have strong links with China, where growth is slowing. Three Asian central banks also meet this week – Malaysia, Thailand and the Philippines. The latter says rate cuts are inevitable; many expect the other two to deliver easing signals as well.

This Week from BlackSummit

Very Short Reflections on Value

John E. Charalambakis

Crossroads: At the Intersection of Geopolitics and Geoeconomics

Abe Finley

Recommended Reads

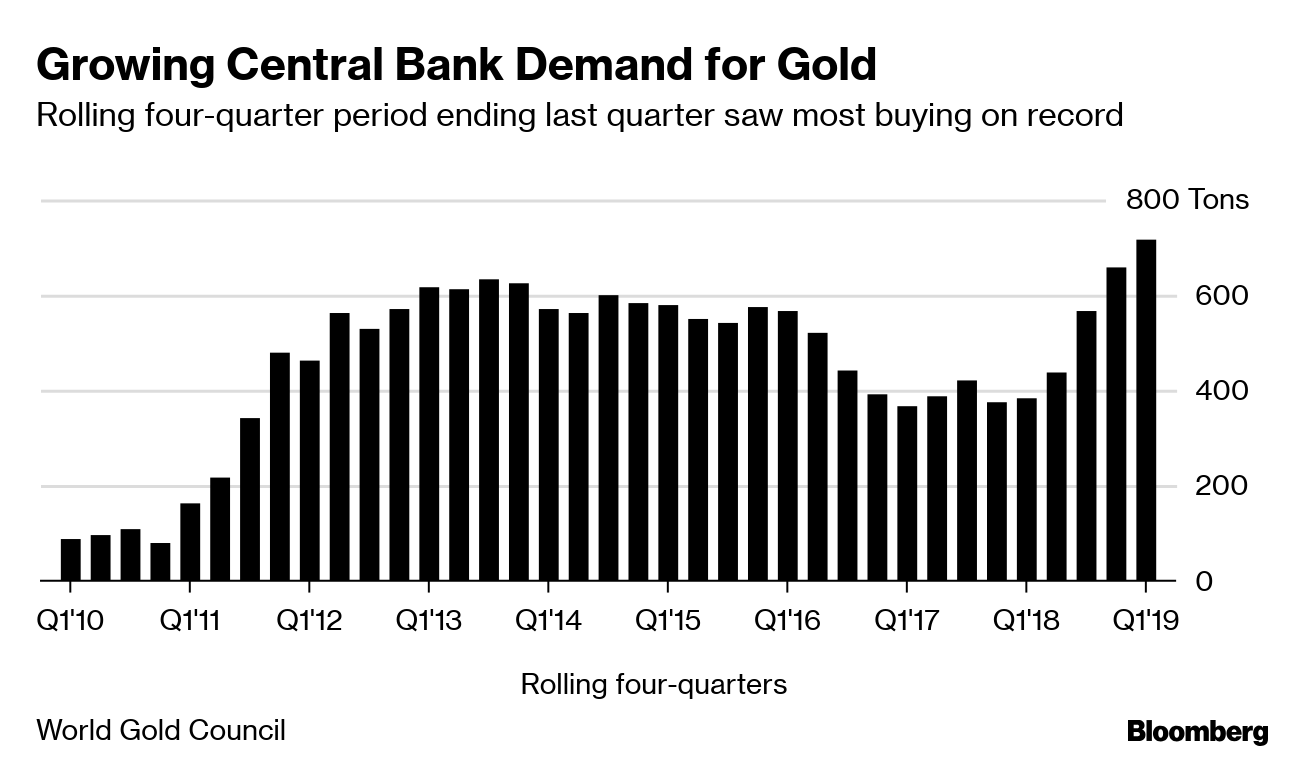

Central Bank First-Quarter Gold Buying at Highest Since 2013 – Bloomberg

Africa will be the new China | Financial Times

Why the Fed changed direction but the dollar did not | Financial Times

Companies in Big Refinance Push While Credit Rally Has Legs – Bloomberg

The Future of the Eastern Mediterranean Tarek Osman

Video of the Week

India hit by Cyclone Fani, strongest storm in decades