Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : March 23, 2019

Market Action

The Mueller report was delivered to the US Attorney General early evening hours yesterday. Depending on its findings it could generate market turmoil next week.

Global equities fell this week, undermined in part by concerns over slowing global growth. The yield curve was inverted with the 3-month TB yielding more than the 10-year Note. The yield on the 10-year US Treasury note fell to 2.44%, its lowest level this year and down from last Friday’s 2.58%. The price of a barrel of West Texas Intermediate Crude oil was little changed at $58.50 while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 16.8 from 13 a week ago. The yield inversion signifies fears of economic weakness in the near term.

The flash eurozone manufacturing purchasing managers’ index for March fell deeper into contraction territory on Friday, slipping to 47.6 from 49.3 in February, the lowest level since 2013. The news helped drive the yield on benchmark 10-year German bunds back below zero for the first time since September 2016. Sentiment weakened in the US as well, though not as dramatically, with the flash manufacturing reading falling to 52.5 in March from 53.0 in February.

Kazakhstan’s President Nursultan Nazarbayev, the only man to lead the country since it emerged from the collapse of the Soviet Union in the early 1990s, unexpectedly announced his resignation on Tuesday. He retains much of his influence over the country, as head of the governing party and chairman of the influential security council. The speaker of the upper house of parliament, Kassym-Jomart Tokayev, was sworn in as president some 24 hours after Mr. Nazarbayev’s surprise resignation. He will serve for the remainder of the presidential term which expires in April 2020.

The EU agreed late this week to grant the UK a two-week Brexit extension in order to hold a third vote on the withdrawal agreement next week. If that vote fails, the UK will have to choose among several potential ways to move forward: a long extension of the Article 50 period, which would require UK participation in European parliamentary elections; a revocation of Article 50, meaning the UK would retain its EU membership; and leaving the EU without a deal. Of course the option of a disorderly exit remains on the table and its chances seem to have increased in the past few days. The process kicks off on Monday with an amendable motion on the government’s next steps, which could lead to Parliament formally taking control of the process.

The government of Japanese prime minister Shinzo Abe this week downgraded Japan’s economic outlook for the first time in three years, citing weak exports and industrial production. Ripple effects from the US-China trade battle have been a significant headwind for Japan’s exporters. Recently released figures show that Japanese exports fell for a third straight month in February.

Unemployment in Britain fell to 3.9% in the three months to January, its lowest level since 1975. Analysts have suggested that uncertainty surrounding Brexit could be causing UK employers to delay investment by instead hiring workers who can be let go in the event of a disruptive Brexit.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

Two rounds of trade negotiations between the United States and China are scheduled in the next two weeks, the first in Beijing and the second in Washington, but a finalized deal may not come together until June, the South China Morning Post reported this week. Others see a somewhat faster timeline, with an agreement possible by late April. Among the contentious issues remaining is the proposed enforcement mechanism whereby the US could impose unilateral tariffs on China should the terms of the agreement be breached.

Despite a strong rally across markets this year, European equities remain one of the most disliked regions in the world. February PMI data from Germany and the eurozone sent markets reeling. Next up will be the Ifo business climate survey and consumer confidence figures. Those could indicate whether it is too early to call a bottom in European equities.

Chinese markets aren’t abandoning hopes that authorities may soon relax trading rules for the yuan. As part of the US-China trade negotiations, US President Donald Trump hopes to extract a commitment to yuan stability. The yuan fell more than 5 percent in 2018 but this year it is rising too rapidly for comfort. Rumors are swirling that China’s currency regulator SAFE will rescind requirements for banks to maintain reserves on dollar purchase contracts and also remove the secretive X-factor used to guide the currency’s trading range. Theoretically, those steps would count as efforts to free the yuan – they were imposed last year to curtail speculators betting against the yuan. Detractors might say China is creating conditions for yuan depreciation.

This Week from BlackSummit

Contemplating a Market Reversal: The Importance of Hedging

John E. Charalambakis

Recommended Reads

Traders Are Blindsided Again by Treasuries Paying Same as Cash – Bloomberg

Could Brexit break the Union? | Financial Times

Investors Reawaken to Brexit Risk-But That Spells Opportunity – WSJ

China banks face huge capital hole as stimulus spurs lending | Financial Times

Is the equity bull market too big to fail? | Financial Times

How Worrying Is the Recent Downgrading of German Growth Forecasts? | PIIE

A Future Without Fossil Fuels? | The New York Review of Books

Video of the Week

The impact of smartphones on users’ brains

Image of the Week

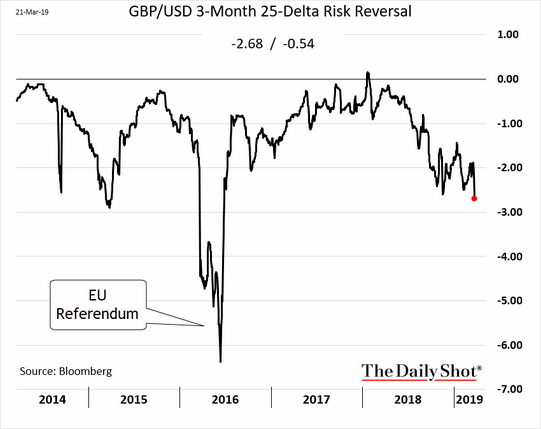

Traders are increasingly nervous about the possibility of a no-deal Brexit. Here is the GBP/USD risk reversal: