Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : March 9, 2019

Market Action

Equities declined last week amid reports signifying economies weakening globally. The US 10-year Treasury note declined to 2.62% from 2.76% last week while the price of West Texas Intermediate crude oil declined slightly to $55.26 a barrel. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 17.81 from last Friday’s 13.57.

In response to a global economic slowdown, the European Central Bank (ECB) revealed plans for fresh measures to stimulate the eurozone’s slowing economy. This comes less than three months after the central bank phased out a $2.9 trillion bond-buying program. The ECB announced that in September it will launch a new series of targeted long-term refinancing operations (TLTROs) – cheap long-term loans for banks – and keep interest rates steady through 2019 or beyond if necessary. The ECB has taken a more aggressive stance than expected and is the first major developed-country central bank to ease policy amid a softening global economy. The eurozone’s economy grew 1.1% year over year in Q4 2018, down from 1.6% in Q3.

German factory orders unexpectedly fell in January, adding to the evidence that Europe’s largest economy is continuing to lose momentum. Orders were down 2.6%, the most since June, defying expectations for a 0.5% gain. The Bundesbank’s latest assessment is that Germany is seeing a dent in momentum and that growth this year will be below potential (the economy barely avoided a recession at the end of 2018).

China recorded a sharp decline in exports of 20.7% year over year in February after exports rose 9.1% in January; economists had expected a much smaller drop. In conjunction, imports fell 5.2% following a previous decline of 1.5%. The decline in exports and imports narrowed China’s trade surplus to $4.12 billion, significantly down from $39.16 billion in January. The disappointing trade data are attributed to weaker global demand and distortions from the Lunar New Year holiday. Some economists believe that the weaker outlook is due to China’s economic slowdown rather than the ongoing trade dispute with the United States.

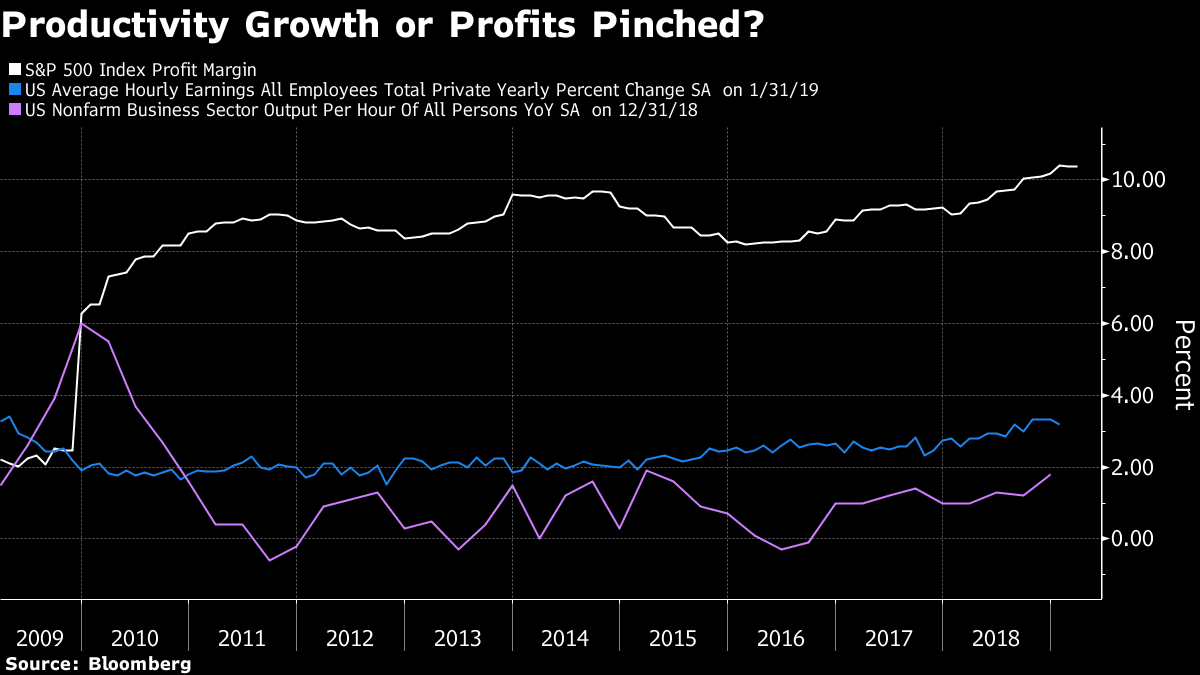

US job growth slowed significantly in February, with nonfarm payrolls rising only 20,000 despite the unemployment rate falling to 3.8%. Economists had expected jobs to grow by 180,000. The payroll report is closely watched by investors because it is one of the most comprehensive estimates produced by the government on how the economy is performing and it is timely, coming just a few days after month-end. Stocks fell on the news. While February’s job growth data were disappointing, the aggregation of January’s and February’s change in nonfarm payrolls averages out at 165,000, close to the business cycle’s average. Meanwhile, average hourly earnings advanced 3.4% year over year versus expectations of 3.2%.

The Organization for Economic Cooperation and Development (OECD) forecasts that the global economy will grow 3.3% in 2019 and 3.4% in 2020, which are down 0.2% and 0.1%, respectively, from November’s forecast. The OECD says that the global economy is suffering more than expected from political uncertainty and ongoing trade tensions, which in particular are contributing to the persistent weakness in Europe and China. Both regions have lowered their growth expectations, with the ECB forecasting 1.1% growth this year – down from its 1.7% forecast in December – and China lowering its economic growth target to between 6% and 6.5%.

In an effort to give the Australian economy a chance to recover from what mounting evidence shows is a weakening economy, the Reserve Bank of Australia decided to hold rates steady this week. The bank also indicated that it is now just as likely to cut rates as it is to raise them, despite its previously stated desire to do the latter. Australia’s economy has been slowing, with Q4 2018 GDP coming in at 2.4%, well below the RBA’s 2.8% expectation.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

On Tuesday, the UK parliament will vote on the Brexit withdrawal agreement that Prime Minister Theresa May has negotiated with the EU. If the measure is defeated, Parliament will vote on whether to take “No Deal” off the table on Wednesday, and a vote to extend the Article 50 period – delaying the United Kingdom’s departure – will follow if Parliament does vote against a “No Deal” Brexit. The House of Lords this week voted in favor of an amendment that would keep the UK in a customs union with the EU. That could be overturned by the House of Commons, but a vote would need to take place for it to occur. The reignition of concerns about a no-deal Brexit outcome will likely also deal a blow to the pound which had rallied in recent weeks as this risk was priced out.

Upcoming data on China’s industrial output, retail sales, housing and credit will come against the backdrop of speculation about what deal US President Donald Trump and his Chinese counterpart Xi Jinping will eventually reach on trade tariffs. The US and China have not yet finalized a date for a summit to resolve their trade dispute, despite the possibility of a late-March summit having been discussed following talks in February. Both sides are reluctant to hold a summit until a deal is close to being finalized.

This Week from BlackSummit

Emerging Markets Developments and the Growth Trajectory

John Charalambakis

Recommended Reads

Trump’s trade war with China scars the global economy – Bloomberg

U.S. Trade Gap Surged to $621 Billion in 2018, Highest in Decade – Bloomberg

NPC: China’s Slowdown Is No Surprise for a Maturing Economy – Bloomberg

Why Authoritarianism Is Collapsing in the Middle East

Video of the Week

Self-Portraits By Women Painters – International Women’s Day

Image of the Week