Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : March 2, 2019

Market Action

Global equities rose modestly this week on optimism over progress in US-China trade talks. The yield on the 10-year US Treasury note rose 11 basis points to 2.76% while the price of a barrel of West Texas Intermediate crude oil declined 2.6% to $57.77. Volatility, as measured by the CBOE Volatility Index (VIX), rose slightly to 14.5 from 14 a week ago.

Testifying on Capitol Hill this week, US Trade Representative Robert Lighthizer described several areas in which the US and China have made progress toward a trade agreement, including in particular a tentative agreement on an enforcement mechanism. According to the Wall Street Journal, complaints of violations of the accord would be discussed in a series of consultations between the two countries, occurring every month at the staff level, every quarter at the vice-ministerial level and twice yearly at the ministerial level. Additionally, a tentative framework has been agreed to regarding China’s currency management. Lighthizer said that the US has dropped the threat of a hike to 25% in the tariff rate imposed on China’s exports to the US. Late in the week, US Treasury secretary Steven Mnuchin said the two countries are working on a 150-page document, while White House economic adviser Larry Kudlow said the two countries are on the verge of agreeing on a historic pact.

With 95% of the constituents of the S&P 500 Index having reported for Q4 2018, blended earnings per share (which combines reported data with estimates for those who have yet to report) shows that earnings growth is running at a 13.1% year-over-year pace while revenues are seen rising 5.8% compared with the same quarter a year ago, according to FactSet Research. Estimates for Q1 continue to be lowered, however, with analysts now expecting earnings per share to decline around 3.3% this quarter.

US President Trump walked away from denuclearization negotiations with North Korean leader Kim Jong Un this week in Hanoi. Competing narratives were offered by the two sides, with Trump saying North Korea wanted all sanctions lifted in return for the decommissioning of the Yongbyon nuclear complex and North Korean foreign minister Ri Yong Ho countering that his country would have accepted a partial lifting of sanctions and was willing to halt nuclear and ballistic missile tests. Trump said he is hopeful that talks will continue. Ri said that the North’s position won’t change. Some analysts viewed Trump’s willingness to leave Hanoi without a deal as sending a message to Beijing, with which the US is engaged in trade talks, that in negotiations the US is willing to accept no deal if the only alternative is a bad one.

Asian equities rose overnight after MSCI, the provider of global equity indices, announced that it will increase the weight of Chinese A shares in its indices by increasing the inclusion factor from 5% to 20% in three steps, beginning in May. At the end of the process, China A shares will constitute 3.3% of the MSCI EM Index and 0.4% of the MSCI ACWI Index. The move could potentially draw more than $80B of fresh foreign inflows to the world’s second largest economy, which is showing some signs of bottoming. The Caixin Manufacturing PMI rose to 49.9 in February, recovering from its biggest drop since July 2015, even as factory activity contracted for the third straight month.

Senegal’s President Marky Sall won re-election on Sunday following an unusually violent campaign in one of Africa’s most stable democracies. The West African nation’s election commission announced Mr. Sall garnered 58% of the vote in the first round on Sunday, handing the 57-year-old former geologist a second term in office. The turbulent campaign, marked by sporadic deadly violence between ruling party and opposition supporters, sparked concerns that Senegal could join a growing list of African nations-from Tanzania to Uganda and Zambia-that are backsliding on democracy. EU observers said Tuesday that while the elections were “peaceful and transparent,” they were held “in a climate characterized by a lack of trust and blocked dialogue.”Click here for this week’s updated market returns table.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

British prime minister Theresa May has scheduled a 12 March parliamentary vote on the Brexit withdrawal agreement she has negotiated with the European Union. If that measures fails to pass, a vote to leave the EU without a deal is scheduled for 13 March. If a no-deal Brexit goes down to defeat, a third vote is scheduled for 14 March, which would necessitate a short delay in the termination of the Article 50 period, now scheduled for 29 March. Slowing down the process is made more difficult by the timing of the European Parliamentary elections scheduled for late May, a chamber of which the UK no longer wants to be a member. If the UK is still an EU member at that time, it will be expected to hold elections to that body.

For Chinese markets, the calendar for the coming weeks is looking busy. Trade aside – and a possible meeting between Trump and Chinese counterpart Xi Jinping – China’s parliament kicks off its annual meeting on March 5. Growth-boosting measures such as tax cuts may be rolled out, alongside laws banning forced technology transfer and government “interference” in foreign business practices – a nod to those accusing Beijing of intellectual property theft. Finally, we will get the latest data slice on the state of China’s exports and imports.

Decision time is coming up at Turkey’s central bank. It’s expected to hold its main interest rate at 24 percent on Wednesday. But the trajectory in coming months hinges to a high degree on inflation; data on Monday is expected to show February price growth at 19.9 percent, down a touch from January’s 20.35 percent. With inflation grinding lower as the economy adjusts after last year’s currency crisis, an interest cut is on the cards sooner rather than later. Adding to the momentum is President Tayyip Erdogan, a vocal supporter of lower interest rates, and especially so given Turkey’s local elections are just a month away and support for Erdogan’s AK Party has been eroded by the economic pressures. Pollsters predict that votes in Ankara and Istanbul will be on a knife edge.

This Week from BlackSummit

Crossroads: At the Intersection of Geopolitics and Geoeconomics

Abe Finley

Recommended Reads

Nations Should Manage Globalization, Not Sabotage It – Bloomberg

How 5G Will Change So Much More Than Your Phone – WSJ

Ukraine: Military-Procurement Scandal Shakes Presidential Race – Bloomberg

Goldman Sees Signs Global Economy Has Bottomed Out Already – Bloomberg

The Dollar Is Still King. How (in the World) Did That Happen? – The New York Times

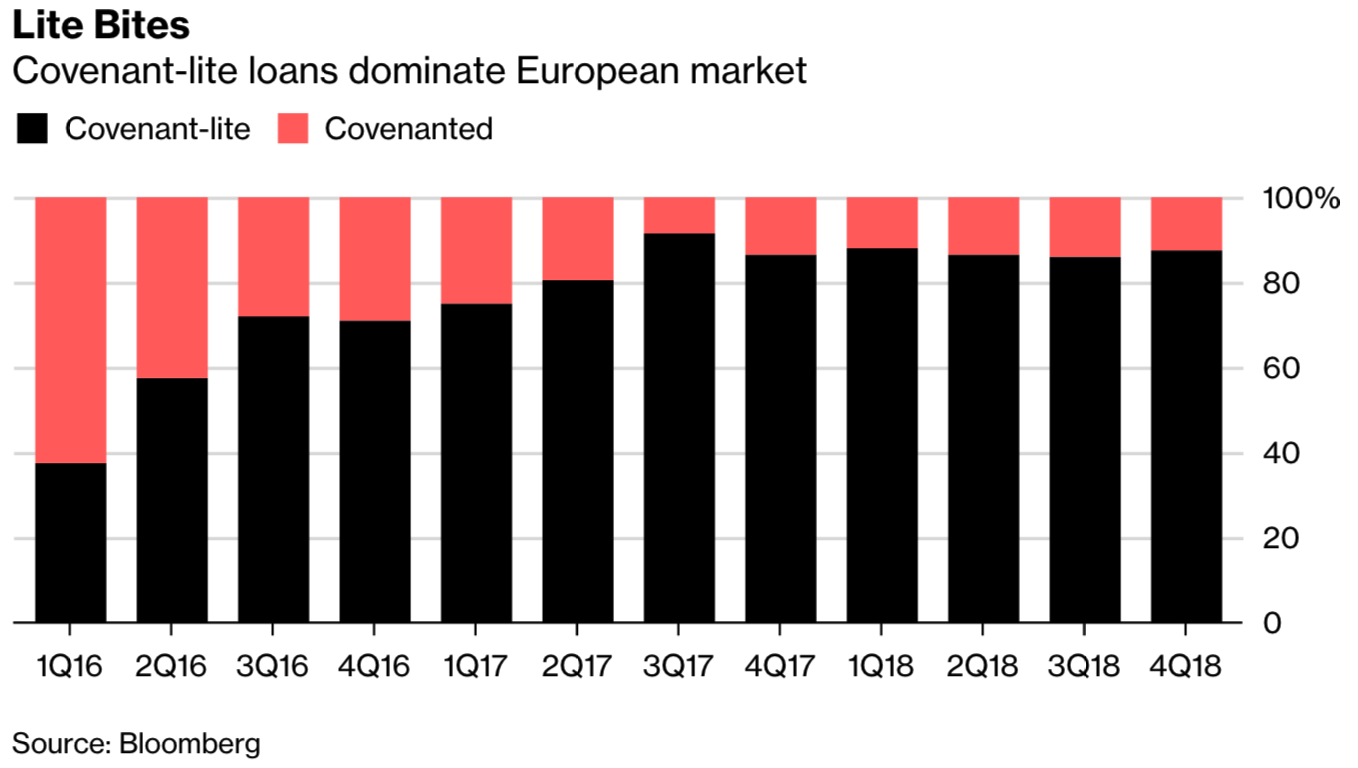

Junk-Debt Market’s 2019 Rebound May Hide a Gathering Storm – Bloomberg

Video of the Week

Doing the rounds with the Safari Doctors