Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : January 5, 2019

Market Action

Global equities mostly rose on a volatile week, shaking off recent declines to open 2019. The yield on the US 10-year Treasury note stands at 2.66%, down about 10 basis points from pre-holiday levels. A barrel of WTI crude oil closed at $48 while volatility, as measured by the CBOE Volatility Index (VIX), cooled to 22.5 after spiking into the mid-30s over the holidays.

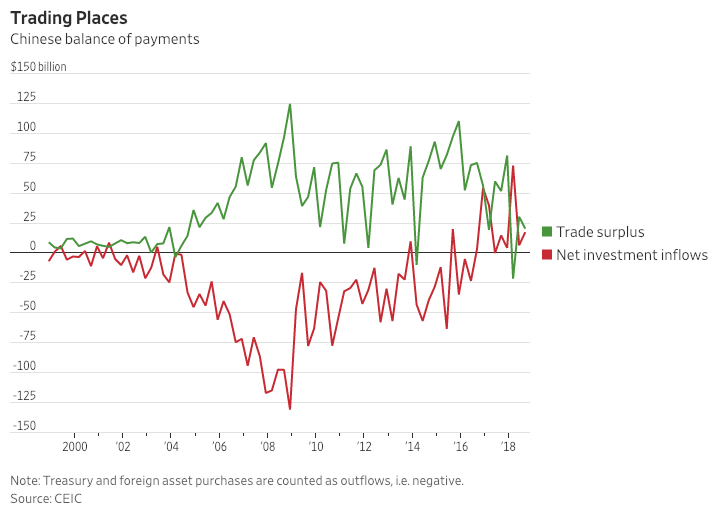

With the brewing China-US trade war biting into global growth already and liquidity tightening around the world, 2019 has been anticipated to be a stressful year in markets. But nobody expected it to start with a currency market “flash crash” that briefly pushed dollar/yen below 105.00. The move was attributed to automatic sell triggers in thin markets, but it would have fully reversed by now if investors saw no fundamental justification to it. Poor manufacturing surveys in Asia, Europe and the United States and a sales warning from Apple might go a long way in explaining the move.

Thursday’s very weak US manufacturing data raised concerns that the US economy is beginning to downshift along with the rest of the global economy (China’s manufacturing PMI fell into contraction territory in December, below 50, while the eurozone PMI slipped to 51.4), but Friday’s employment report calmed those fears at least for the near term: The US economy added 312,000 jobs in December, nearly doubling expectations for a rise of 175,000. Average hourly earnings rose 3.2% year over year. The unemployment rate rose to 3.9% from 3.7% as new entrants were added to the labor force.

On Friday, markets welcomed comments from Fed chair Jerome Powell in which he said that the central bank will be patient as the economy evolves but is fully prepared to shift its policy stance significantly if necessary. Powell also said the Fed would not hesitate to adjust the pace of the balance sheet runoff if necessary, a shift in tone from his December press conference at which he indicated that the balance sheet reduction is likely to remain on autopilot.

Jair Bolsonaro, the first right-of-center president since Brazil ended its military dictatorship in the mid-1980s, was sworn into office this week, vowing to fight corruption, open up markets and carry out structural reforms. He announced on Thursday his government’s intention to privatize 12 airports and 4 seaports. Reform of the state pension plan is also one of Bolsonaro’s top priorities. Investors have been receptive to the new president’s reform message, making Brazilian equities a standout with their 15% return in 2018.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

US-China trade talks at the vice-ministerial level will resume next week, China’s commerce ministry announced Friday.

Also on Friday, China stepped up efforts to boost lending in its flagging economy with the central bank announcing another reduction of the reserve requirement ratio and the country’s premier ordering big banks to lend to cash-starved small businesses. The 1 percentage point reduction of the reserve requirement ratio-to be carried out in two equal cuts on Jan. 15 and Jan. 25-will free up a net 800 billion yuan ($116.6 billion) for lending, according to the central bank. The adjustment is the fifth broad-based cut to required reserve holdings since the start of 2018 and came earlier than many in the financial community expected, signaling Beijing’s concerns about growth.

The start of the year is normally a busy time for sovereign debt issuers, especially developing nations. Emerging market debt has risen steadily in recent years, but it might be different this year as worries over global growth are deepening and sending tremors through world markets, dampening investors’ appetite for riskier assets and making it harder and more expensive for EM issuers to roll over debt and borrow. Analysts at Citi expect EM spreads to continue widening due to “increased anxiety about the end of the economic cycle in the U.S., uncertainty about damage caused by the Fed’s tightening, and a lack of clarity regarding China-U.S. trade disputes”. It’s shaping up to be a quieter start to the year as governments weigh their options and wait on the sidelines for an opportune moment. Yet some are still planning to make an appearance: Israel will start its investor roadshow in Europe on Monday.

Wall Street and Treasury yields slumped after the United States ISM index turned in its largest drop since the financial crisis in 2008, especially as investors now bet that the Fed is more likely to cut rates this year than raise them. However, manufacturing isn’t the big weight in the U.S. economy that it used to be: Services now account for roughly 80 percent of economic activity, and investors will be watching closely on Monday to see if ISM’s barometer of that key sector delivers solace or more pain. It is expected to dip modestly to a reading of 59.7 from 60.7 in November (a reading above 50 indicates activity is growing), but the risk is that it turns in a downside surprise like the manufacturing index.

This Week from BlackSummit

New Year: Factors Shaping Up Markets

John Charalambakis

Recommended Reads

What Happens When Bond Markets Get Weird – WSJ

The future might not belong to China | Financial Times

Energy issues to watch in 2019 | Financial Times

Taking Stock of the World’s Debt – WSJ

Opinion | When the Bubble Bursts, Consider the Anti-Bubble – The New York Times

Video of the Week

Is it normal for cargo ships to lose their load?