Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : December 29, 2018

Market Action

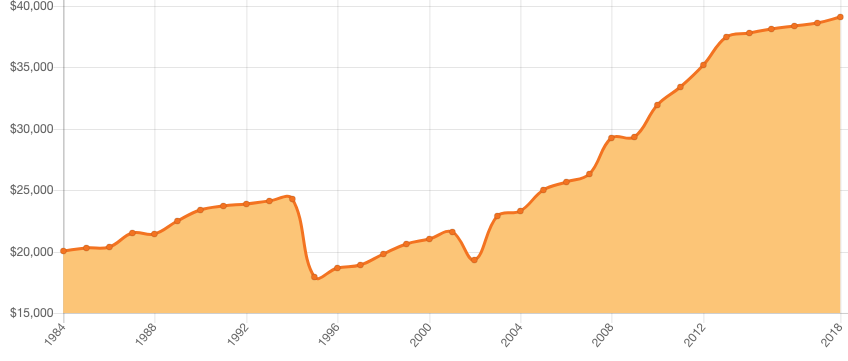

Last week stocks experienced one of their most tumultuous periods of the past decade highlighted by extreme moves in both directions. This included the worst-ever Christmas Eve performance of the Dow Jones Industrial Average, followed by a dramatic comeback on Boxing Day. On the week, the Dow rose 2.8%, the S&P 500 climbed 2.9%, while the Nasdaq registered a weekly gain of 4%, with all three indexes marking their first weekly gains after three straight weekly declines.

Despite some upbeat moves this week, the major equity indexes are all poised for annual losses for the first time since 2008, with the Dow and S&P 500 on pace for their worst December since 1931, according to Dow Jones Market Data. The all-world equity index (market capitalization weighted) is poised for an annual decline of nearly -10% against a backdrop of anxieties about the global economy, Federal Reserve interest-rate increases, earnings repricing, and trade tensions that have created a cocktail of concerns undercutting investors’ confidence. These concerns seem to be making gold and other haven assets more attractive: Bullion rose to a fresh six-month high this week, while silver has reached its best levels since August.

The US government shutdown entered its seventh day on Friday, with President Trump threatening to close the southern border as the budgetary stalemate continues. US House Republicans informed lawmakers that there would be no votes on spending legislation through Monday and thus no relief for the 800,000 federal workers who are either furloughed or working without pay. House Democrats, who assume control of the chamber next Thursday, are weighing three approaches to getting federal funds flowing, but none of them include $5B for a border wall with Mexico.

Japan’s Nikkei fell on its final trading day of the year, cementing its first annual loss in seven years. The benchmark index booked a 12.1% decline in 2018, breaking the longest winning streak since the late 1980s. Japan’s 10-year bond yield also fell overnight below zero for the first time since September 2017, as a recent equity selloff fueled a rally in government debt around the world.

Business leaders’ confidence in the UK economy has sunk to its lowest level in more than 18 months as the risk of a no-deal Brexit grows, according to a survey by the Institute of Directors. Meanwhile, EU budget commissioner Günther Oettinger warned that Germany’s bill would amount to the “mid-three digit range” of hundreds of millions of euros if Britain doesn’t pay into EU coffers under a “hard” Brexit.

Click here for this week’s updated market returns table (including results for 2018 YTD).

What could affect markets in the days ahead?

The US Commerce Department will not publish economic data – including GDP, inflation and other figures – during the ongoing partial government shutdown, an agency spokeswoman told the Wall Street Journal. The closure is set to continue through at least next Thursday as President Trump has said he is prepared to wait as long as it takes to get $5B in border wall funding.

Investors appear to be back in love with Italy, where a budget deal with the EU has put 10-year bond yields on track for their biggest monthly fall since July 2015. But Italy will test the relationship next month, when it sells 27 billion euros’ worth of new bonds. January will be Italy’s heaviest month for bond sales in 2019. Sales are typically heavy at the start of a year, but the difference this time is that the European Central Bank will not be buying. After ending its asset purchase program, it will reinvest the proceeds of maturing debt but has allocated a smaller share of the pie to Rome next year.

In oil and energy, thin trading volumes as a result of the holiday period will likely continue to fuel volatility through next week, and it is expected that crude will continue swinging until inventories in the US and globally dip steadily. Stockpile figures from the US Energy Information Administration showed inventories fell less than expected last week. For the week, WTI finished with a decline of 0.6%, while Brent booked a weekly fall of 3%. Both grades logged their third consecutive weekly losses. Stockpile figures from the US Energy Information Administration have fallen for four consecutive weeks, but stocks still remain elevated after surging in October and November to spark the oil-price rout.

This Week from BlackSummit

Recommended Reads

Investors flee risky US corporate debt | Financial Times

Bruising and unpredictable: the year in markets | Financial Times

The New Arab Order in Today’s Middle East | Foreign Affairs

How China Built a Steel Behemoth and Convulsed World Trade – WSJ

The Remarkable Scale of Turkey’s “Global Purge” | Foreign Affairs

The Year in Pictures 2018 – The New York Times