Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : December 22, 2018

Market Action

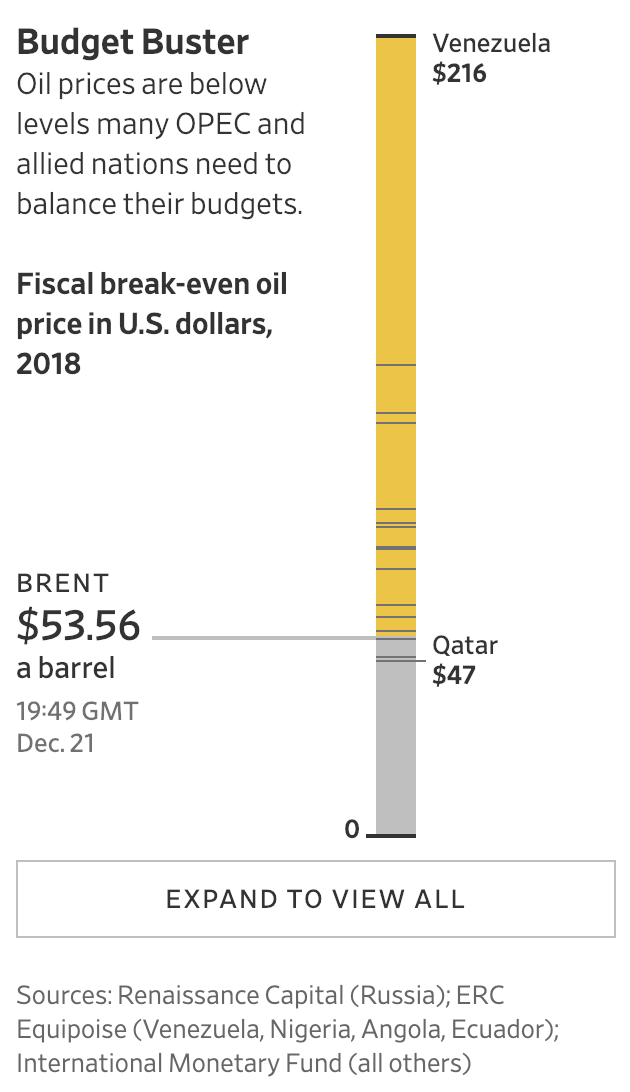

Global equities fell sharply on the week and the Nasdaq Composite Index dropped into bear territory (20% decline from recent highs). In fact, year-to-date performance for the all-world equity index (market capitalization weighted) has dropped to almost -10% amid concerns over slowing global growth and trade disputes. The yield on the 10-year US Treasury note declined 10 basis points this week to 2.79. The price of a barrel of West Texas Intermediate crude oil fell $6.50 to $46, the lowest since the summer of 2017, while volatility, as measured by the CBOE Volatility Index (VIX), rose to 27.6 from 21.3 a week ago.

Stocks fell across the globe after the FOMC lifted interest rates for the fourth time this year, while Fed Chair Jerome Powell downplayed implications of market volatility and said the central bank will continue its balance-sheet runoff. The Fed was not the only central bank to hike rates this week as Sweden’s Riksbank raised short terms interest rates 0.25%, the first hike in seven years. Even after the rate hike, Sweden’s policy rate remains negative, at -0.25%.

Adding to investors’ worries triggered by the Federal Reserve, President Trump refused to sign a stopgate spending bill unless he gets border wall funding, as the impending expiration of seven government spending bills fueled fears of a weekend government shutdown. Defense Secretary James Mattis also resigned overnight, extending political tensions after Trump announced a decision to withdraw US troops from Syria. President Trump also ordered the withdrawal of about half of US forces in Afghanistan, or roughly 7,000 troops.

After weeks of wrangling, the EU approved Italy’s proposed 2019 budget. The blueprint projects a deficit fractionally larger than 2% of GDP – down from earlier proposals which included deficits as high as 2.4% – and is based on a 1% GDP growth assumption, compared to the earlier proposal which assumed a more ambitious 1.5% growth rate.

In France about 66,000 “Gilets Jaunes” protesters turned out for a fifth successive weekend, less than half the number counted a week earlier, following tax relief and minimum wage concessions announced by Emmanuel Macron. Many retailers remained open, as well as attractions including the Eiffel Tower and the Louvre museum. It remains unclear whether such measures will succeed in putting a definitive end to the demonstrations.

After weeks of talks and pressure from the United States, the Mexican government agreed to allow migrants seeking asylum in the United States to wait in Mexico for a court ruling on their cases. Mexican officials did not say where the immigrants would be housed or what resources they would be given, but noted that humanitarian visas and work permits would be made available. The policy shift is the boldest effort yet by the Trump administration to discourage people from seeking refuge in the United States.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

Despite a slowing economy and weak domestic financial markets, China had been employing only targeted stimulus in an effort to keep its deleveraging efforts afloat. However, China’s top policy makers on Friday confirmed that more monetary and fiscal support is on the way. “Significant” cuts to taxes and fees will be enacted in 2019 and while monetary policy will remain “prudent,” officials will strike an “appropriate” balance between tightening and loosening, according to a statement published after the annual Economic Work Conference.

The EU has outlined a series of measures that could come into force should the UK leave the EU without a transition agreement on 29 March. Among the more important precautions are temporary measures to maintain continuity in financial markets by assuring that EU and UK investors can continue to use central counter parties to clear derivatives contracts for up to a year. Other important areas addressed are transport and residency rights for UK citizens residing in the EU. With no consensus on the way forward toward a deal with the EU, odds of the Brexit question being put back before the voters – either in the form of a second referendum or a general election – are rising.

Donald Trump’s US presidency has lurched from crisis to crisis since he took office, but turbulence is reaching new highs just in time for Christmas while Wall Street endures its worst December since 1931 and a flattening bond yield curve signals tough times for the economy. In the upcoming short week investors will be watching several events which could help give a preview into 2019. A bond sale program will test investors’ appetite for US debt while consumer confidence and home sales data will show whether recent yield curve moves are justified – and if they are set to go further.

This Week from BlackSummit

Reflections on the Latest Market Swings: Signals for 2019

John Charalambakis

Recommended Reads

Overbearing: Share of S&P 500 stocks down 20% or more highest since 2008

Fire, Floods and Famine: The Pessimist’s Guide to 2019

What will 2019 have in store for dysfunctional GCC?

US-China trade war: Container shipping freight rates jump

Investors Have Nowhere to Hide as Stocks, Bonds and Commodities All Tumble – The New York Times

That Bear Market Everyone’s Expecting May Turn Out to Be a Bull – Bloomberg

Video of the Week

Austrian village of Oberndorf celebrates ‘Silent Night’